It’s time to come back to reality.

The world has become completely detached from reality and if productive individuals do not take action with a sense of urgency, they could soon wake up in a world in which the luxuries they have taken for granted simply do not exist anymore. The root cause of the collective disconnection from reality is the existence of the debt fueled fiat monetary system that the global economy operates on. When central banks can manifest new monetary units out of the ether with the click of a button, governments can fund spending with the issuance of government bonds, and commercial banks can further expand the monetary base via credit creation; it is easy for the world to become disconnected from reality. Things may seem all well and good for a period of time, but reality, as dictated by the laws of economics, always has the last laugh.

One of the most pernicious aspects of humanity’s collective detachment from reality is the temporary obfuscation of opportunity cost. This illusion persists for a finite but unknowable amount of time as easy money lulls most people into a false sense of security. However, if one squints hard enough they can begin to see opportunity cost peeking its head from beyond the veil. Taunting humanity with a shit eating grin that says, “I cannot believe you actually believed you could escape me.” One sector of the economy that is experiencing the wrath of a neglected opportunity cost, now decades long, is the energy sector. The illusion is beginning to falter - which, if one thinks about it, is not all surprising.

Energy is the base from which everything operates. Life itself would not exist without energy. The most important thing that humans have done as a species is figure out ways to harness energy and leverage it to be more productive. The journey from the age of the hunter and gatherer to the agrarian age to the industrial age to the digital age has been marked by inflection points at which humans discovered novel ways to utilize energy sources to enhance their productive capabilities. This essay you are currently reading was made possible because of the tools I have been afforded by harnessing energy over the course of millennia. Collectively, they provided me with the education, tools, and personal connections necessary to articulate these thoughts and share them with you.

It is truly miraculous that, over the course of time, humanity has accrued the necessary knowledge and skills, resulting in the digital world it enjoys today. Man’s ability to harness nature in the ways he does is something that should be celebrated and marveled at. Unfortunately for today’s generation, the hubris and complacency of man has reached a critical tipping point at which many do not appreciate or understand the importance of energy in our everyday lives. Energy usage is villainized and some men are actively trying to ensure that humanity digresses back to a less advanced stage in hopes to save itself from the weather. The shame that these types of people feel is truly perplexing and if action is not taken with urgency, this generation of virtue signaling dolts will be responsible for setting humanity back generations.

One of the main drivers on our road to self-immolation these last few decades has been the emergence of ESG mandates popularized by capital allocators. ESG stands for Environmental, Social and Governance and serves as an investment framework to determine which companies reap the benefits of large slugs of capital allocations. It is one of the most subversive investment frameworks that has ever been devised, and it completely inverts how businesses should operate in a sane economy. Let me tell you why.

In a well-functioning economy, an entrepreneur identifies an opportunity to bring a good or service to market that currently doesn’t exist but has demand. That entrepreneur spends their time and capital to produce that good or service, bring it to market, and hopefully - if they correctly identified the demand, that it was not being met, and produced the good or service that successfully meets the demand - he makes a profit, allowing him to produce more and serve a larger customer base. One can argue that the most important aspect of this feedback loop is the entrepreneur’s recognition of the market dislocation that provides an opportunity to fulfill needs and bring in more revenue than the amount of money that was spent to fulfill demand. The entrepreneur is able to accomplish this because he is closest to the source of information in the market that signals what is and isn’t needed in the market. Once the signal is received and a business plan is created, the entrepreneur then figures out a way to finance his business with outside capital so that he can service the market with what it needs.

Over the last decade, ESG - largely fueled by fiat money - has completely flipped the script. Instead of the entrepreneur identifying a problem and taking risks to solve it, the large capital allocators of the world have deemed themselves the sole arbiters of what is deemed a “good idea” or what “problems” need to be solved and have made it their jobs to fund “entrepreneurs” to bring their ideas to life. What should be an emergent market phenomena has mutated into top-down diktat controlled by the largest capital allocators on the planet. This has resulted in the largest misallocation of capital in human history, which in turn, has put the global economy in a very precarious situation. While ESG mandates span the domains of environmental issues, social justice and corporate governance, I think it is safe to say that the damage done to the energy sector in an effort to be “environmentally friendly” has been the most pronounced, because it actually carries the burden of all of this misallocation.

Energy is the most important sector of the economy. This is not an opinion or a perspective, but a fact. Every end product that you interact with on a day-to-day basis, and every service you use, was made possible through the utilization of energy at every part of the supply chain. When the energy sector is materially hindered it creates ripple effects on everything else throughout the economy. The first four years of the 2020’s have made this abundantly clear. Decades of poor decision making driven predominately by ESG mandates and subsidies, made possible by the money printer and government debt, have led to over-investment in unreliable energy infrastructure and the deconstruction of reliable infrastructure.

The illogical concept of “net-zero carbon emissions by [insert a date that keeps extending further into the future]” permeated the mainstream consciousness and erected an industry of grift that has displayed a shocking amount of ignorance in regards to how life actually works on this planet. Humans emit carbon dioxide. Plants feed on carbon dioxide. Carbon is one of the fundamental elements of what makes our world inhabitable. And yet, the “experts” and their lapdogs in the mainstream media, together with tone deaf governments around the world, have successfully convinced many people that carbon dioxide is a pollutant that should be eradicated from our hyper-industrialized economy. This surge of collective insanity was an opportunity Wall Street took full advantage of:

“If everyone believes we need to fix the climate, there is a financial product we can sell them.”

Enter ESG; wokeness applied to capital allocation. It combines everything that is wrong with modern society’s rejection of reality with everything that is wrong with the opportunistic and parasitic way in which Wall Street operates.

To be an upstanding corporate citizen in the eyes of the largest capital allocators in the world within an investment landscape dominated by ESG mandates, companies have to prove that they care about the environment, care about diversity, and care about social justice. This has forced companies to allocate time and capital toward endeavors that not only lead nowhere, but are proven to be detrimental to productivity, longevity and profitability, resulting in more negative externalities for the entire global economy.

The “net zero carbon emissions'' goals have corrupted capital in two ways; governments have created trillions of dollars of subsidies that favor particular forms of energy generation (mainly wind and solar) and the BlackRocks and Vanguards of the world have dangled their massive purchasing power as a carrot to force energy companies down the path toward unreliable energy generation and unproductive carbon accounting gimmicks. At the same time, states and countries fully bought into the grift and began dismantling reliable base load generation provided by nuclear, natural gas and coal power plants while investing heavily in wind and solar projects. This has led to unreliable grid infrastructure which has, quite literally, resulted in the loss of human life. One must simply look to Germany to witness the plight of disastrous ESG energy policies.

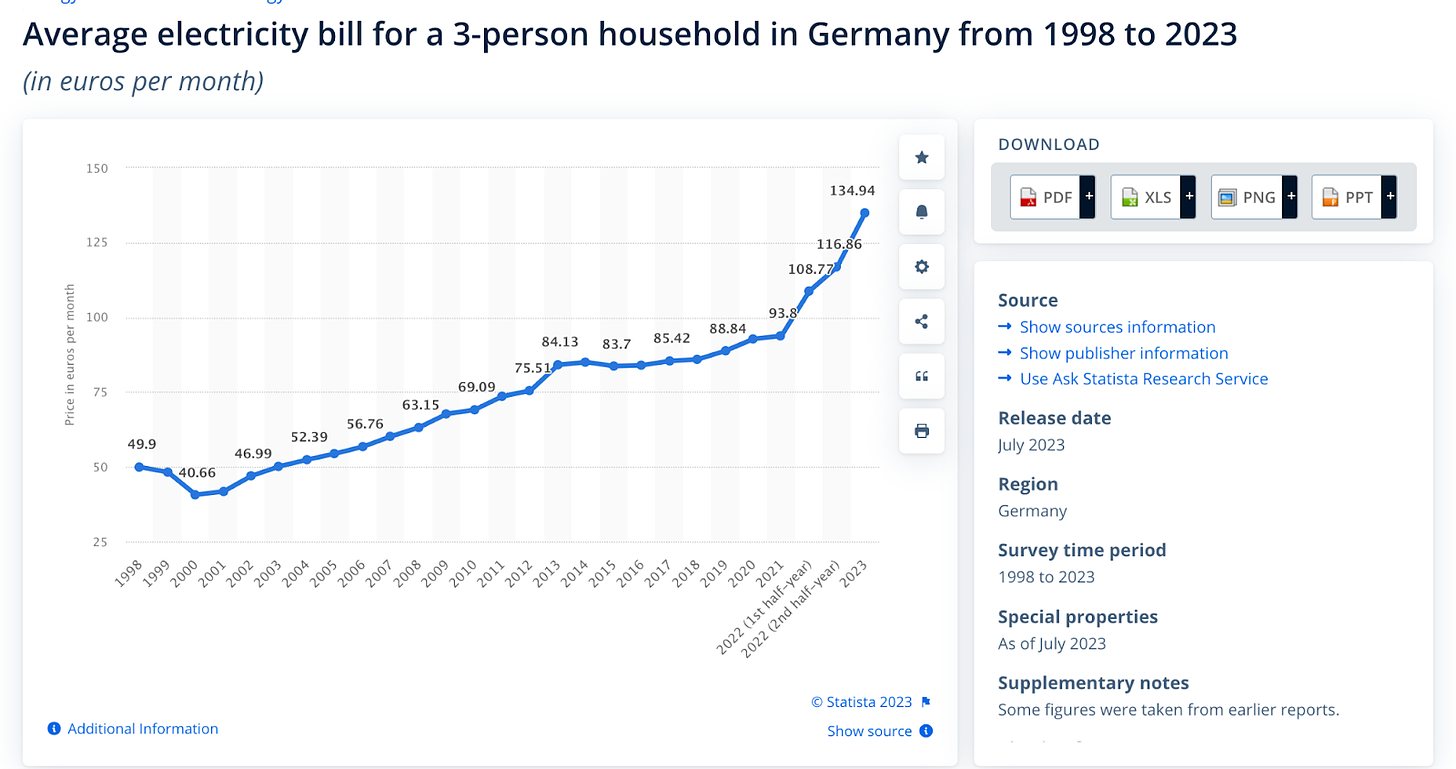

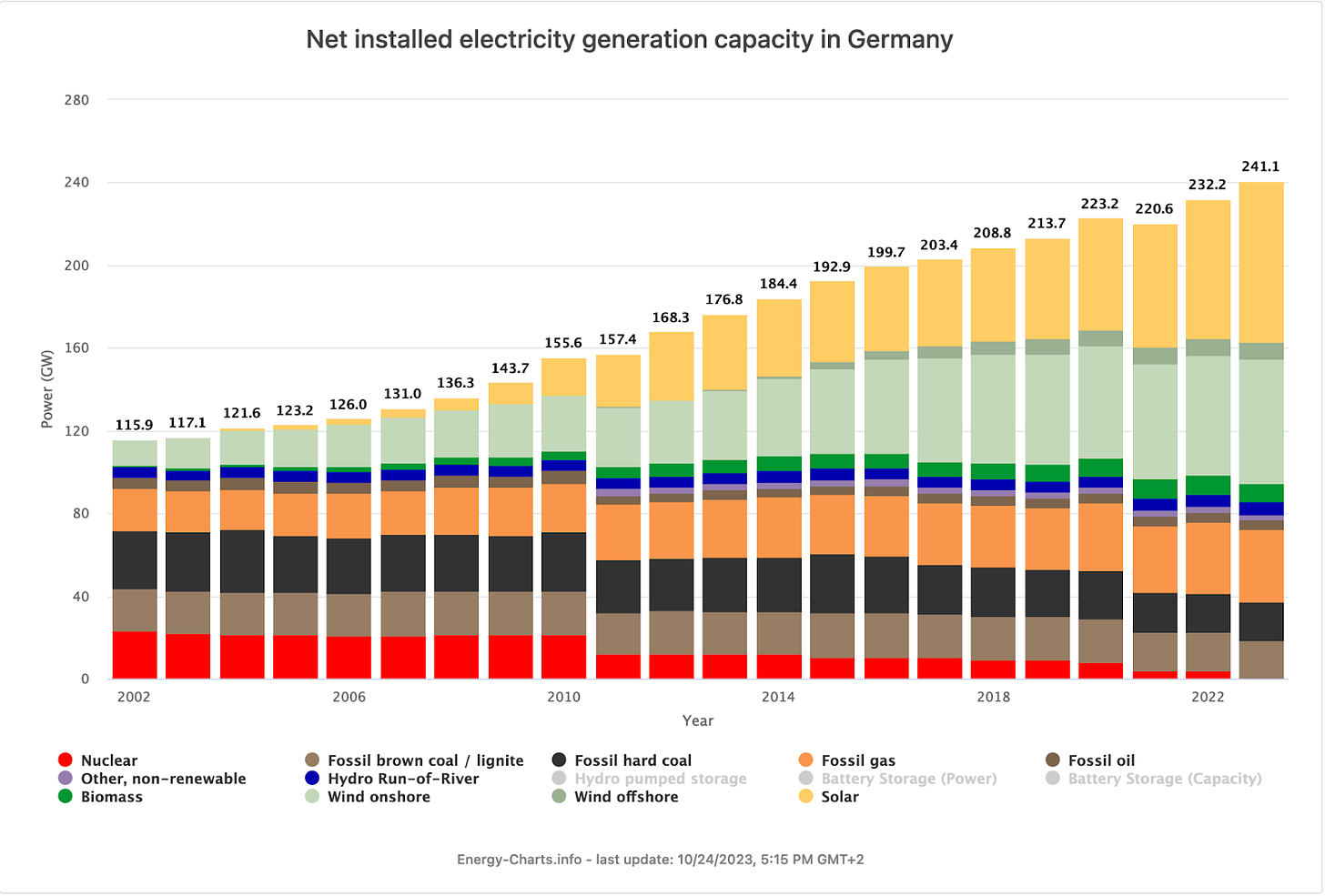

The Germans made a strategic miscalculation at the turn of the century that will be used as a case study for centuries to come. They were the first to embark on a net-zero/“renewable energy” transition and began actively decommissioning reliable energy generation (i.e., nuclear, natural gas and coal) in favor of unreliable generation (i.e., wind and solar). In 2002, Germany had an installed electricity generation capacity of 115.9 gigawatts. Over the next two decades they would expand that installed capacity by more than 108% to 241.1 gigawatts. On paper, this seems like an incredible amount of progress. The type of progress that would lead you to believe that Germans are significantly better off than they were at the turn of the century - especially considering the fact that the German population has grown by only 2.7% over the same period of time.

However, nothing could be further from the truth. While the numbers may look impressive on paper, when overall capacity is marked to market - as determined by the actual generation that is occurring within the German grid system at any given point in time - a very different image is presented. In 2002 the German power industry generated 586.7 terawatt hours of electricity. In 2022, it generated 577.3 terawatt hours. In other words, while capacity has more than doubled on paper, alongside a mild 2.7% population growth, actual generation has declined over a two decade period! The result of all of this? The average German household is paying 187% more for electricity per month than they were in 2002. 187%. And they call this progress?

You might ask - “How the hell is that possible?”

The answer is simple: Being completely disconnected from reality. A nation can build as much generation capacity as their heart desires, but if the generation doesn’t actually materialize, it is all for naught. You’ve built the electricity equivalent of Chinese ghost cities that will never house a single person. No amount of virtue signaling or browbeating can force the sun to shine or the wind to blow, and the Germans are learning this lesson the hard way.

This is a great shame because Germany’s energy infrastructure was considerably robust in 2002 with nuclear, coal and natural gas making up 97.7 gigawatts or ~84% of the overall generation capacity mix. Since the German government made the bold decision to transition their energy system to a predominately “renewable” energy mix, the capacity of nuclear, natural gas and coal has fallen by more than 21% to 77 gigawatts, or ~32% of the overall capacity today.

The effects of this nation-state level virtue signal have been catastrophic for Germany and neighboring countries–especially in the wake of the war between Russia and Ukraine, during which the Nord Stream 2 pipeline was bombed and disrupted the flow of Russian natural gas to Eastern Europe. It has been reported that the EU energy crisis killed more people than “COVID” during the Winter of 2022-2023. Luckily, it was a mild Winter last year. If it had been colder, some were estimating that European deaths caused by the energy crisis would have exceeded 300,000, surpassing the cumulative deaths caused by both “COVID” and the Russia and Ukraine war.

The point being, energy accessibility is not only important for human flourishing, it is essential to survival. Especially in a world where the average human has become completely accustomed to the luxuries of living in a hyper-industrialized and digital economy. The Common Man is too far removed from the era of log-gathering-to-stay-warm, and cannot deal with such an abrupt shock to the system. This is a very scary reality to come to grips with, and it would take another essay to walk through why this simple fact is something that should be properly addressed to ensure the robustness of humanity moving forward, but–for the purposes of this essay–it is a core fact that needs to be recognized and internalized.

The individuals living on this planet today do not have the luxury to virtue signal when it comes to energy production. The stakes are simply too high and any significant deviation from the norm can and will produce deadly consequences. This is why the ESG movement should be met with as much scorn and ridicule as humanly possible. If successful, it will lead to the dismantling of critical energy infrastructure that will end with hundreds of millions of lives lost. The negative consequences would be far graver than any increase in the average temperature of the planet could cause. If urgent action isn’t taken, things could spiral out of control rather quickly.

The German case study is just that, a case study. A microcosm of a larger trend that has evolved into a mind virus encapsulating the world. Texas, one of the energy capitals of the world, has fallen prey to the mind virus and elected to forgo the construction of reliable nuclear, natural gas and coal generation in favor of wind and solar. So far, the consequences have not been as deadly as they have been in Europe, but if the tide doesn’t turn soon, they may certainly prove to be more deadly.

The last few years have brought with them major tests for a grid system that has favored unreliable capacity at a time when demand on the grid has exploded due to population growth and the weather during the middle of Summer and Winter has become extreme. During the Winter storm of 2021, 246 people lost their lives because they were unable to keep themselves warm. Rolling blackouts literally prevented them from accessing proper heating systems. It got extremely cold out because a polar vortex crept down into the Southern part of the United States. This resulted in the clouds covering the sky - rendering solar panels useless - and wind turbines freezing - making it impossible to generate electricity from massive wind farms. In fairness, natural gas lines froze, and temperature sensors at nuclear power plants malfunctioned, causing those generation sources to be rendered moot as well. But one can make a very strong case that the reliable generation sources wouldn’t have fared so poorly if capital wasn’t diverted to wind and solar projects and was instead dedicated to weatherizing pipelines and temperature sensors. Those are things that are completely controllable. Clouds covering the sky and temperatures falling to the point where water freezes and locks up wind turbines are not.

This is the reality of the situation. Unfortunately, the combination of government subsidies and ESG mandates that favor unreliable wind and solar generation over the reliable generation found with nuclear, natural gas and coal has introduced an unnatural market force that is putting humanity in harm’s way. The easy money enabled by the fiat system has incentivized entrepreneurs to take the easy way out and cater to the capital allocators and subsidy distributors centrally mandating wind and solar. It is much easier, and even economically rational in the short to medium-term, to cater to the BlackRocks, Vanguards, and governments of the world pushing the “energy transition” on everyone, and the fat sacks of cash they control, than it is to go against the grain by building reliable generation infrastructure. While things may be good in the short to medium-term for those spinning up unreliable infrastructure, it is a one way trip to destruction, impoverishment and death.

We must see through the mirage! The energy transition being pushed by every major government and capital allocator in the world is not sustainable or desirable. It will lead to the destruction of our modern economy.

Easy money has enabled society’s detachment from reality to persist for a considerable amount of time. Recognize that the “considerable amount of time” is part of the unknowable, yet finite amount of time that opportunity cost hides in the shadows waiting to pounce. ESG and government subsidies are mechanisms to help that opportunity cost find a better hiding spot until it is ready to pounce. And if those pushing these policies get their way, the opportunity costs will pounce at the most inopportune time.

Originally published in the Bitcoin Times