Despite bullish sentiments, the hidden costs of homeownership—averaging an additional $18,000 per year—pose significant financial risks.

In a climate of soaring house prices, a prevailing bullish sentiment suggests that the housing market is immune to decline due to homeowners being locked into low fixed-rate mortgages, thus avoiding the pitfalls of the 2006-2007 adjustable-rate mortgage crisis. However, this optimistic outlook fails to account for the rising hidden costs of homeownership which average an additional $18,000 per year.

The argument that housing prices will perpetually rise due to short supply overlooks the reality that even a shift to moderate supply levels—amidst very low demand—could precipitate a price correction. Additionally, an overreliance on home equity borrowing to cover increasing ownership costs is a precarious strategy that may lead individuals into a debt trap, especially if home prices stabilize or drop.

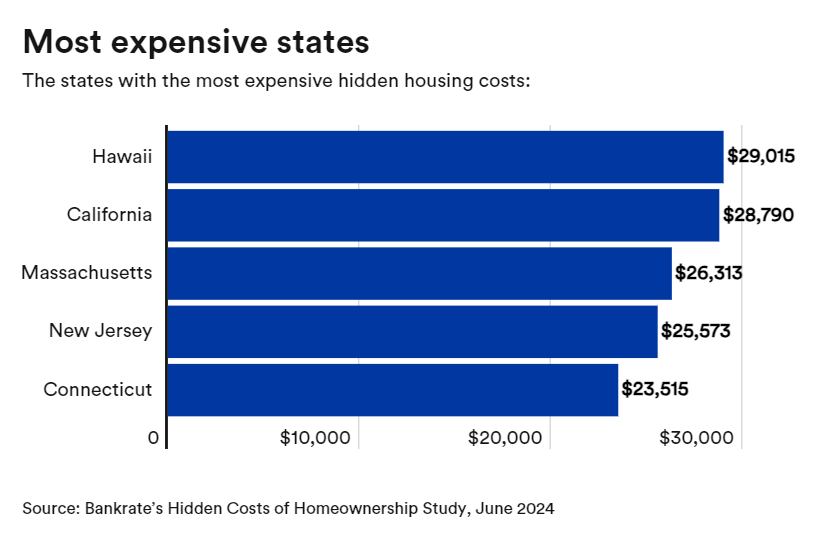

A closer examination reveals that the costs of homeownership extend beyond the mortgage payment. Property taxes, insurance—which in some states like Florida has reportedly surged by 30-40%—and maintenance expenses are significant financial burdens. Labor costs for handymen have skyrocketed, with reports of hourly rates ranging from $50 to $100, a stark increase from the $10-$12 range just a decade ago. The price of materials has also surged, compounding the financial pressure on homeowners.

The rise in these ancillary costs, which have jumped from $14,000 to $18,000 annually since 2020, can be compared to the effect of an adjustable-rate mortgage increasing from 3-4% to 7%. The additional costs, on average, amount to an extra $300 per month, which is significant given that the housing market's collapse in 2007-2008 was catalyzed by a similar magnitude of increased mortgage payments.

The burden of these costs is particularly acute for owners of older homes, which require more frequent and expensive maintenance. First-time buyers are especially vulnerable, often exhausting their savings on down payments and subsequently incurring high-interest debt to cover unforeseen maintenance costs.

Data from 2023 indicates that only 46% of homeowners used savings for home improvements, while 20% resorted to credit cards, and 12% took out loans, suggesting that a substantial proportion of homeowners are accumulating debt to maintain their properties.

The crux of the issue lies not solely in the mortgage payment but in the totality of homeownership expenses. With wages not keeping pace with inflation and purchasing power deteriorating across various sectors—food, energy, transportation, healthcare—homeowners face an "adjustable rate mortgage" on nearly all aspects of their cost of living.

The precariousness of the current housing market, where the hidden costs of homeownership could be as destabilizing, if not more so, than the mortgage crises of the past. Homeowners and potential buyers should be wary of the financial risks associated with the true cost of owning property in today's economy.