TFTC - Truth for the Commoner

Bitcoin Brief

|

|

Sup, freaks.

The most critical layer of AI infrastructure isn't controlled by NVIDIA, TSMC, or any company in Silicon Valley. It's controlled by a Japanese toilet maker and a company best known for MSG seasoning. Today's lead story digs into the hidden supply chain chokepoints that the entire AI boom depends on, and why Japan's quiet dominance over semiconductor materials should be on every investor's radar. Plus in the signal section: stealth inflation hiding in your wallet, a generational wealth divide that keeps getting worse, consumer credit cracks widening, the White House pushing banks into stablecoins, why Bitcoin is the only blockchain immune to corruption, and New York City's education spending that defies belief.

Missed yesterday? Catch up here.

|

|

LEAD STORY

|

From Toilets and MSG to Every GPU on Earth: The Hidden Supply Chain of AI

Everyone knows NVIDIA designs the chips powering the AI revolution. Far fewer people know that virtually every one of those chips depends on materials made by a Japanese toilet manufacturer and a company famous for MSG seasoning. Welcome to the real AI supply chain, where the most critical chokepoints are controlled by companies most people have never heard of in this context.

Start with Ajinomoto, the company your grandmother knows for bouillon cubes and umami seasoning. In the 1970s, their amino acid research for MSG production generated chemical byproducts. Instead of discarding them, Ajinomoto's R&D team discovered these substances had exceptional material properties for electronics. In 1996, a major CPU maker approached them about developing a film-type insulator using amino acid technology. By 1999, Ajinomoto Build-up Film (ABF) was in production. Today, ABF is the thin, high-performance insulating layer inside the substrates that connect every advanced chip to the outside world. Ajinomoto controls over 95% of the global market for this material. Without ABF, the most advanced GPUs and AI accelerators are, in the words of industry analysts, "almost impossible to assemble at scale." During the 2021 chip shortage, the bottleneck wasn't silicon. It was Ajinomoto's film.

Then there's Toto, Japan's largest toilet maker, whose Washlet is a household name across Asia. The same ceramic sintering process that creates a non-porous, contamination-free toilet bowl turns out to be exactly what you need to create electrostatic chucks (ESCs), the precision components that hold silicon wafers perfectly flat during the cryogenic etching process used in 3D NAND memory manufacturing. Activist investor Palliser Capital just took a top-20 shareholder position in Toto, calling it "the most undervalued and overlooked AI memory beneficiary." The semiconductor ceramics segment now contributes more than half of Toto's operating profit. The toilet business is the side hustle now. Toto's stock is up nearly 40% in the first two months of 2026.

Zoom out and the picture gets even more striking. Japan holds majority share in 14 critical semiconductor materials: 88% of coater/developers (Tokyo Electron), 53% of silicon wafers (Shin-Etsu, Sumco), 50% of photoresists, 90%+ of high-end EUV photoresists, 95% of ABF insulating film, and 90%+ of ultra-high purity colloidal silica for CMP slurry, made by Fuso Chemical, another food chemicals company. As Gaurab Chakrabarty put it: "The most critical layer of AI infrastructure is controlled by companies that make toilets, MSG, and window glass."

As we covered on Tuesday, the AI boom has already exhausted global semiconductor capacity, pushing everything from gaming consoles to Bitcoin ASICs to the back of the production queue. Now you know where the real leverage sits. It's not in San Francisco or Taipei. It's in Japanese factories that started by making toilet bowls and soup stock.

|

|

|

SIGNAL

|

The $100 Bill Trick: Stealth Debasement in Your Wallet

Why it matters: The Fed is quietly printing for inflation without creating a new denomination.

People would revolt if the U.S. printed a $200 bill. So instead, as @SteveSimple highlighted, the Fed quietly doubled the ratio of $100 bills to $20 bills in circulation. In 2008 the ratio was roughly 1:1. By 2024 it's nearly 2:1. The $100 bill eclipsed the $1 bill to become the most widely distributed U.S. denomination by 2017. The Treasury and the Fed know people need more dollars to buy the same things. Instead of making it obvious with a new denomination, they just flood the system with hundreds. It's shrinkflation for cash itself. Bitcoin's supply schedule, by contrast, doesn't care what you need. 21 million. Forever.

|

|

Boomers Now Control 45% of All Consumer Spending

Why it matters: The K-shaped economy keeps getting more K-shaped.

Americans aged 55 and older now account for 45.3% of all U.S. consumer spending, the highest share in at least 28 years and nearly double the 28% recorded in the early 2000s. They also hold 73.7% of all U.S. wealth, up from 56.2% in 2000. The generational wealth divide isn't closing. It's accelerating. Boomers and older Gen X own the real estate, hold the financial assets, and drive nearly half of all spending. Younger Americans are stuck with student debt, rising rents, and wages that don't keep pace. This is why Bitcoin resonates with the under-40 crowd. When the existing system concentrates wealth at the top of the age pyramid, a neutral, permissionless monetary network is the only credible exit.

|

|

Subprime Auto Delinquency Hits Record 6.9%, Surpassing 2008

Why it matters: Consumer credit cracks are widening where it matters most.

Subprime auto loan delinquency (60+ days) has hit a record 6.9%, more than doubling since 2021 and exceeding even the 2008 financial crisis peak of 5.0%. Total auto debt sits at a record $1.67 trillion. Important nuance from @alphaticaio: prime borrowers are fine at 0.4% delinquency (same as 2018), so this is concentrated in the subprime segment, which represents about 14% of auto loans. But that's exactly the segment that acts as the canary. Subprime borrowers are the first to feel the squeeze from persistent inflation and high rates. Mortgage delinquencies are surging too. The cracks aren't in the foundation yet, but they're spreading.

|

|

White House Tells Banks: Get Into Stablecoins. Now.

Why it matters: Complete reversal from Operation Chokepoint 2.0.

CoinDesk reports that the White House hosted a meeting with banks and crypto groups this week, explicitly favoring stablecoin yield and rewards and telling banks "it's time to move" on digital assets. Two years ago, the same government was systematically debanking crypto companies. Now the administration is in the room pushing banks to engage. The policy whiplash is real, but the direction is clear: stablecoins are being positioned as a strategic tool for dollar dominance abroad. Whether that's ultimately good or bad for Bitcoin depends on your time horizon. Short term, it brings more people onto digital rails. Long term, it reinforces the dollar system Bitcoin was designed to offer an alternative to.

|

|

Bitcoin Is the Only Blockchain Immune to Political Corruption

Why it matters: As Congress builds crypto regulation, the distinction between Bitcoin and everything else has never been more important.

Yael Ossowski at the Bitcoin Policy Institute makes a point that deserves to be drilled into every policymaker's head: Bitcoin launched with no pre-mine, no insider allocation, no venture capital extracting value before anyone else could participate. Its monetary policy is defined in code, 21 million coins, forever. No committee or shareholder vote can change that. Compare this to the parade of politically connected crypto projects, from FTX's political donation machine to Argentina's LIBRA pump-and-dump to the stream of celebrity memecoins designed for insider extraction. The pattern is always the same: centralized and opaque systems concentrate power in the hands of insiders who game them. Bitcoin was explicitly designed as the alternative. As Ossowski told us on the podcast, Washington needs legal clarity that draws a hard line between neutral open-source protocols and company-issued tokens. The CLARITY Act is a step in that direction.

|

|

NYC Spends More on Education Than the Entire Country of Japan

Why it matters: Government education spending is a jobs program, not a learning program.

As Palmer Luckey pointed out, the New York City Department of Education now spends more on education than Japan's Ministry of Education spends on the entire country. Let that sink in. One city versus a nation of 125 million people. Mike Solana's framing is blunt: "Imagine paying $50 billion for public schools. They're about as dangerous as the local juvenile detention center, and half the kids can't read." The late John Taylor Gatto, a former NYC Teacher of the Year who became the system's fiercest critic, argued that American public education was never designed to produce independent thinkers. It was imported from the Prussian model explicitly to produce compliant workers and consumers. Over a century later, we've scaled the budget to absurd heights while outcomes have flatlined or worsened. The answer isn't more money. It's competition. Free market alternatives like the Alpha School model, where students learn in 2 hours what traditional schools spread across 8, prove that the bottleneck is the monopoly, not the funding.

|

|

California Wants to Ban 3D Printers That Don't Block Gun Files

Why it matters: One step closer to outlawing devices that can perform general computation.

A bill filed in California would ban the sale and transfer of 3D printers unless they are listed on a state roster certifying they block firearms from being printed. It would be a misdemeanor to "knowingly disable, deactivate, uninstall, or otherwise circumvent" the blocking technology. The bill also requires printers to only accept jobs from the manufacturer's proprietary software if that software includes the firewall, and mandates the state can force updates to the detection algorithm whenever it sees fit. Read that again slowly. A general-purpose manufacturing tool would be required to run government-mandated content filtering, with criminal penalties for circumvention. This is the template. Today it's 3D printers and gun files. Tomorrow it's general-purpose computers and unapproved software. The principle being established is that the state can require any device capable of creating things to include a government-controlled filter on what it's allowed to create. Bitcoiners should recognize this pattern immediately: it's the same logic behind KYC on self-hosted nodes, restrictions on running your own software, and the push to outlaw encryption. The war on general computation is accelerating.

|

|

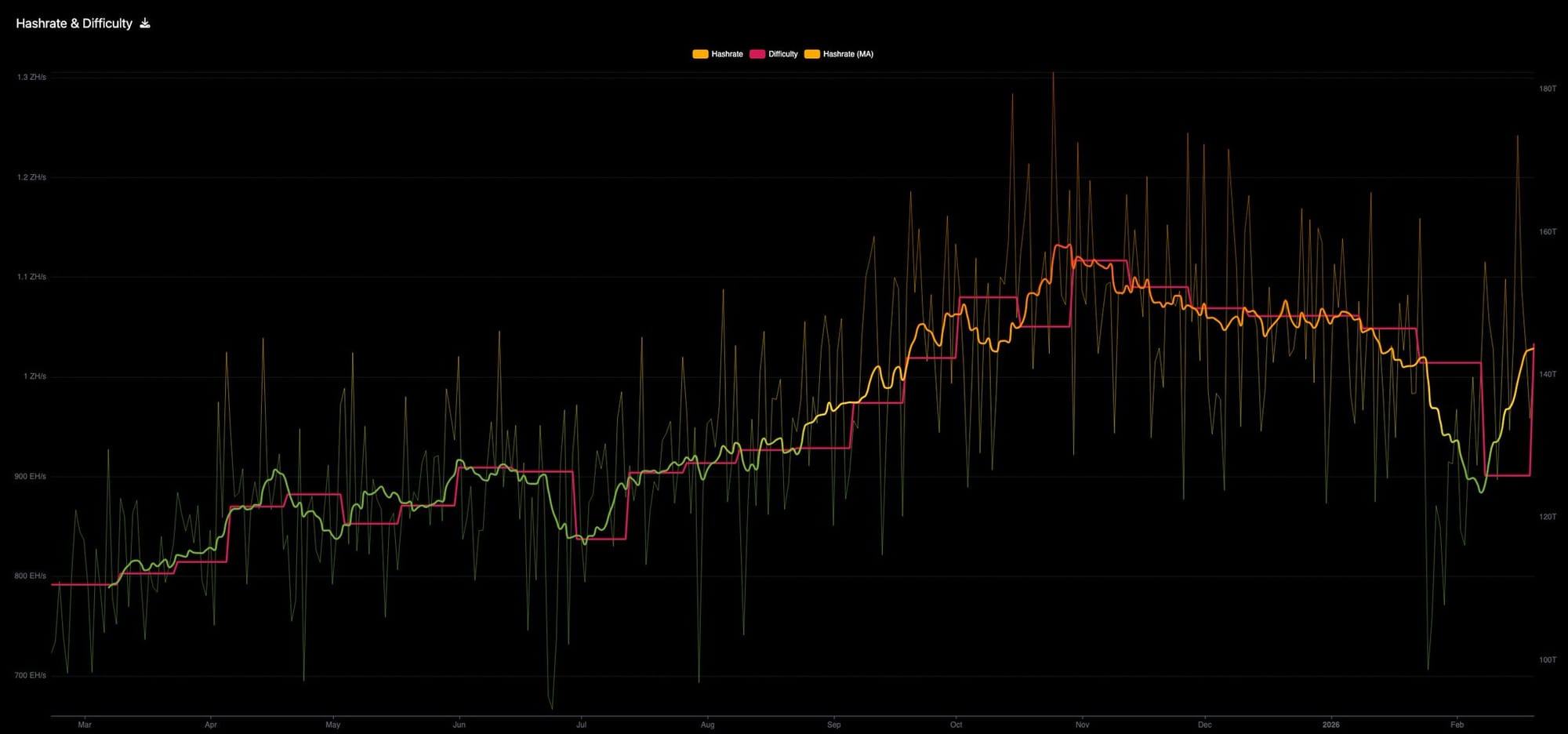

Bitcoin Difficulty Just Jumped 14.7%, Obliterating the Quantum/AI FUD

Why it matters: Miners aren't unplugging. The network is stronger than ever.

Two weeks ago, the narrative machine was running hot: miners are unplugging because of quantum computing risks, miners are diversifying into AI data centers, Bitcoin's hashrate is in trouble. The network just responded with a 14.7% upward difficulty adjustment, pushing difficulty above where it sat before the -11% adjustment two weeks ago. The hashrate dip was caused by miners voluntarily shutting down to participate in demand response programs during harsh winter conditions across the US, redirecting electricity back to the grid when it was needed most, not some structural shift away from Bitcoin mining. This is actually a feature, not a bug: Bitcoin miners are acting as flexible load, strengthening grid reliability while getting paid for it. Some operators may be diversifying into AI HPC, but if they sell their ASICs, someone else plugs them in. That's the beauty of a permissionless network: the hardware finds the most profitable use, and right now, that's still hashing blocks. Be careful who you listen to out there. Most people pushing the "miners are leaving" narrative are either uninformed or actively trying to sell you something.

|

|

|

DATA SNAPSHOT

|

| Bitcoin Price | $67,323 |

| Sats per Dollar | 1,485 |

| Block Height | 937,535 |

| Network Hashrate | 1,026 EH/s |

| Priority Fee | 2 sat/vB |

|

| On-Chain Metrics |

| MVRV Ratio | 1.22 Fair value range, not overheated |

| SOPR | 0.985 Coins moving at a loss on average |

| STH Realized Price | $89,681 Short-term holders deeply underwater |

| NUPL | 0.181 Hope/Fear zone, capitulation fading |

| Realized Cap | $1.10T Aggregate cost basis of all BTC |

| Supply in Profit | 50.5% Half of all supply underwater |

|

|

|

|

If this landed, forward it to someone who could use more signal and less noise. The Bitcoin Brief is free, always will be.

Have a great weekend,

Marty Bent

|

|

|

Follow: @MartyBent · @TFTC21

Nostr: primal.net/marty

YouTube: TFTC · Podcast: tftc.io/podcast

|