In this insightful analysis, we explore the significant rise in gold prices and the subtle shifts in the treasury market, unraveling a complex financial narrative.

Gold prices are reaching record highs, signaling a significant shift in the market that experts are keen to analyze. This rise in gold prices coincides with movements in treasuries and global bonds, suggesting a deeper financial narrative at play. The recent speech by Federal Reserve Governor Christopher Waller has attracted attention, but not necessarily for the right reasons. Understanding the true implications of Waller's words and the current behavior of gold and treasuries is crucial for a comprehensive grasp of the market dynamics.

In his speech titled "Thoughts on Quantitative Tightening," Waller discussed the Federal Reserve's portfolio strategy, particularly the shift toward shorter-dated treasury securities. His statements about the Fed's treasury holdings and potential future quantitative easing (QE) have stirred discussions about the possibility of a reverse operation twist, reminiscent of 2011's Operation Twist. This policy involved buying long-term bonds while allowing short-term bonds to roll off, aiming to stimulate the economy without expanding the Fed's balance sheet significantly.

Contrary to popular belief, gold is not an effective inflation hedge. Historical data suggests that gold's value is more closely tied to broader monetary and financial crises than to inflation rates. The recent upsurge in gold prices is likely reflective of a demand for safety amid uncertainty, rather than a direct response to inflation.

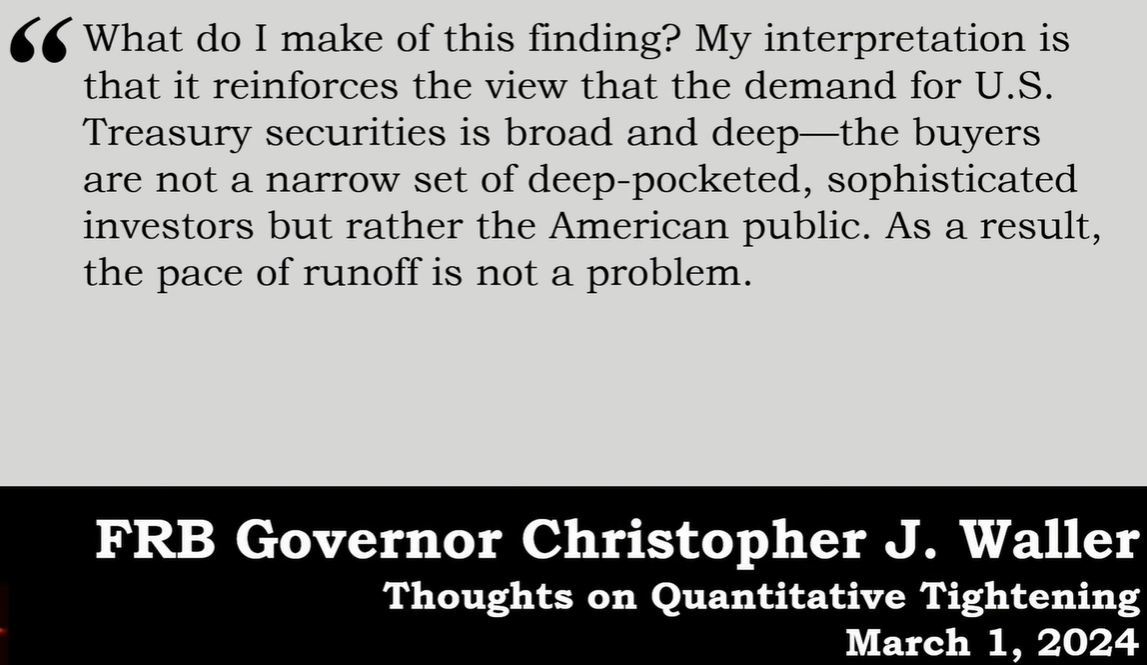

Waller's speech also addressed concerns about the treasury market's stability in light of QT. He indicated that despite the Fed's reduced bond buying, there is a robust demand for treasuries, not just from sophisticated financial entities like hedge funds, but from a broader base including households and nonprofit organizations. This suggests that the treasury market has a deep pool of buyers, which helps maintain its stability.

The current demand for treasuries and the rising price of gold point towards an increased appetite for safety and liquidity in the market. While the Fed projects confidence in the treasury market's resilience, the underlying demand for safe assets indicates that investors may be bracing for potential economic headwinds.

While Waller's comments on the Fed's portfolio strategy do not suggest immediate concern, the broader market dynamics reflect a cautionary stance. The alignment of lower treasury yields and higher gold prices may be foretelling a period of heightened risk aversion, possibly due to factors such as recession risks, global real estate concerns, and other financial uncertainties.

The current financial landscape is marked by a significant rise in gold prices and movements in the treasury market that go beyond the narrative of inflation hedging. Governor Waller's speech, while not the catalyst for these market trends, does shed light on the Fed's outlook and strategy. The real story is the growing demand for safety and liquidity, as reflected in both treasury and gold markets, which could be indicative of deeper economic and financial concerns that are yet to fully surface.