Wall Street is out to lunch.

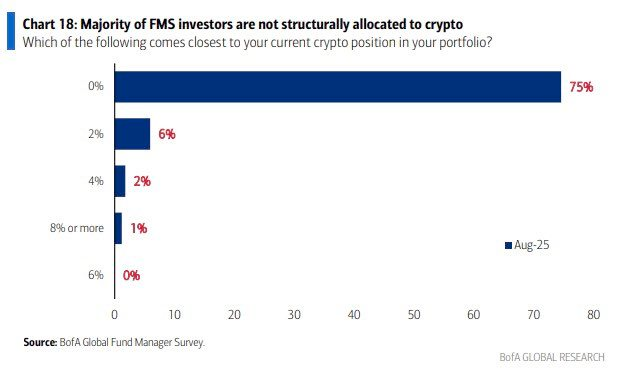

Global fund managers are still woefully underweight bitcoin exposure. A recent Bank of America survey, shared and dissected by Zerohedge over the weekend, found that only 9% of managers that responded have any exposure to bitcoin, with 75% reporting that they have zero exposure to the best performing asset of the last 16 years. The weighted average of exposure across the funds that were surveyed is 0.3% of their total assets. In comparison, 48% of the same cohort has an allocation to gold with a 2.2% weighted average allocation.

Read another way: you are still very early.

For some reason, large asset managers are completely missing the monetary revolution unfolding right before their eyes. I want to point out two things with this fact in mind; despite this, the bitcoin ETFs have had the most successful launch in ETF history by breaking speed to x AUM records with ease, and comping the exposure to bitcoin these managers should have to gold is a mistake.

The first point highlights the fact that much of the price movement over the past year has actually been more retail driven than many expect. This time around it's just retail investors with brokerage accounts that were waiting for the proper vehicles to get exposure. Many ETF analysts have estimated that bitcoin ETF flows have been dominated by this type of investor, with up to 75% of the flows since these ETFs launched coming from this cohort. This makes sense when you consider the fact that many wealth managers still have non-solicitation rules in place, which means they can't actively market bitcoin ETFs to their clients, they can only allocate when a client demands it.

That is changing as we speak and you can bet your ass that a flood of managers will be hitting the pavement hard to sell products that get their clients exposure to the best performing asset of all time. It basically sells itself. The flows from this marketing campaign will likely be material.

On the second point, I think it is important to not anchor to the allocations of their total portfolios that the managers surveyed by Bank of America have to gold, or the fact that it was only 48% of managers surveyed. Since bitcoin is still in its monetization phase, more risk-averse managers will likely have a lower overall allocation because it's easier to make up for a lack of exposure with outsized performance, which bitcoin can provide against gold at this point of its lifecycle. Conversely, there will be managers who like risk and want to clobber their peers with out performance, so they could allocate more than their peers would deem appropriate. Lastly, gold has been around for thousands of years and is analog bitcoin. I think it is important to recognize that bitcoin is a digital beast that comes with different and superior properties to gold that can create a lot more value on top of the network.

Smart contracts, liquid collateral, payments infrastructure, and a tight connection with the energy sector, among many other things.

It will be interesting to see when these managers actually wake up and recognize that they need to begin taking bitcoin seriously. As we said last year, for the first 15-years of bitcoin's existence the associated career risk was with being allocated to it at all. We are now firmly living in a period where that career risk has flipped. If you're not allocated you will be called an idiot. Those who move sooner will be deemed less stupid than the laggards.

Tuur Demeester presents a compelling case for Bitcoin reaching gold parity at 11 kilograms per coin. He highlights how Bitcoin has been consolidating at the 1 kilogram level for nearly five years, following a historical pattern of breaking through psychological gold ratios - first at 1 ounce, then 100 grams, and now approaching the next major milestone. This isn't just about round numbers; it represents a fundamental shift in how markets value digital scarcity versus physical assets.

"Gold parity could be the next magnet. It doesn't mean it's gonna stick there, but at least it'll be the psychological pull for this cycle." - Tuur Demeester

The convergence of the $1 million price target with gold parity creates a powerful narrative. As Tuur emphasizes, Bitcoin's superior properties - instant global transferability, perfect divisibility, and programmable features - position it to eventually surpass gold's $13 trillion market cap. This psychological barrier represents the market's final admission that digital monetary technology has superseded precious metals.

Check out the full podcast here for more on treasury companies as collateral, stagflation's impact on real estate, and Bitcoin's extended cycle dynamics.

Vancouver Proposes Bitcoin Miners to Heat Pool - via X

China Merchants Bank Launches 24/7 Bitcoin Trading - via X

WiseLink Adopts Bitcoin Treasury Strategy - via X

Reborn Coffee Explores Bitcoin Treasury Integration - via X

Volkswagen Singapore Accepts Bitcoin Payments - via X

US Treasury Secretary Praises Stablecoins - via X

Over 10,000 investors downloaded the original report calling for $120k when bitcoin was just $27k. With that price level now achieved, Tuur is back with the 2025 edition—refreshed for the bull run with new data and insights—including Adamant Research’s latest price outlook.

The bull run is heating up—now is the time to take it seriously.

You’ll also get exclusive access to an HD recording of Tuur Demeester’s new 30-minute video presentation, Charting Our Way Through Chaos, breaking down why this boom might be only just beginning—and what forces could push it to the next level.

Read the first-ever mid-cycle report from Adamant Research

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The "screw em" mentality is a good one to have.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: