Hold on to your butts.

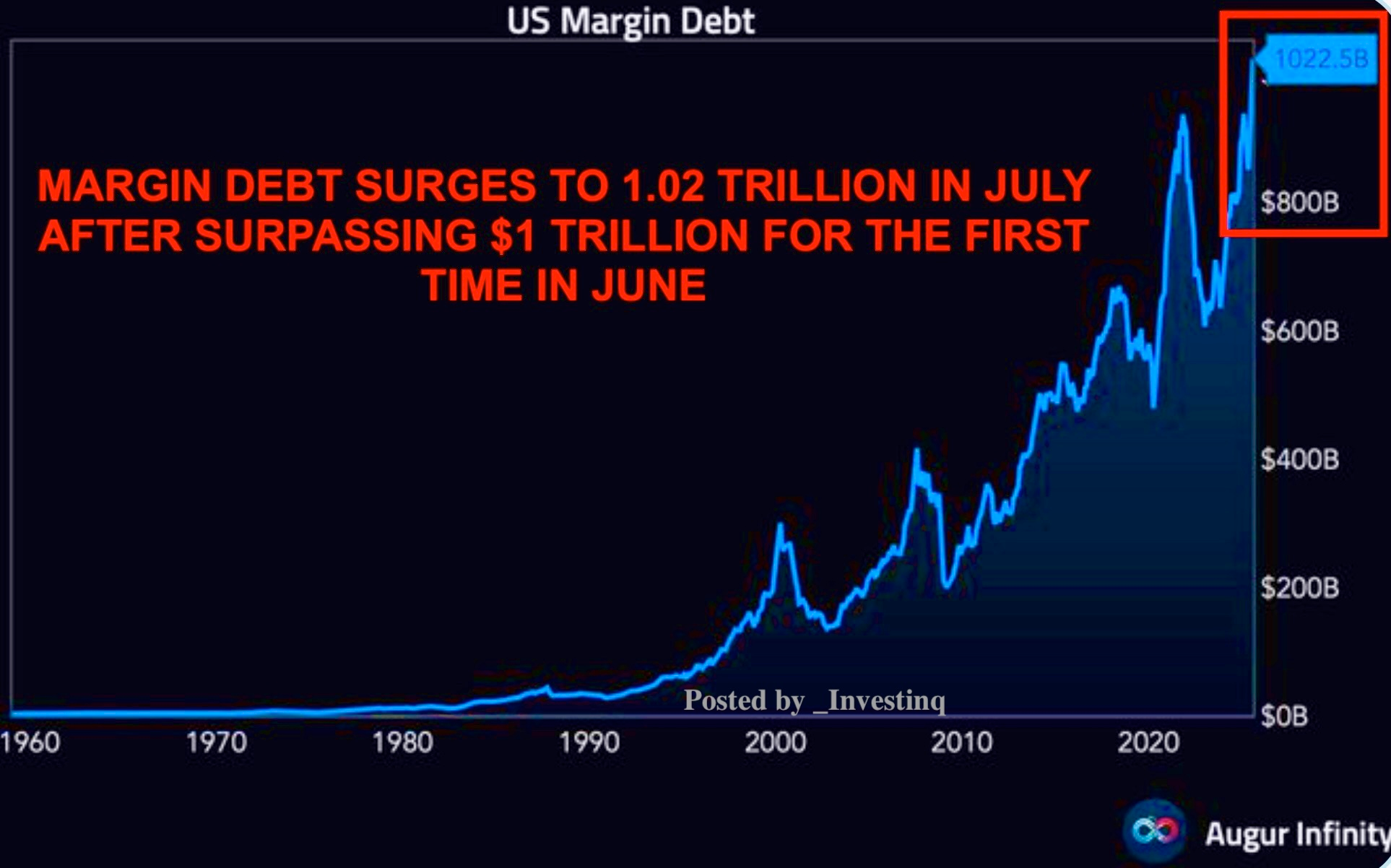

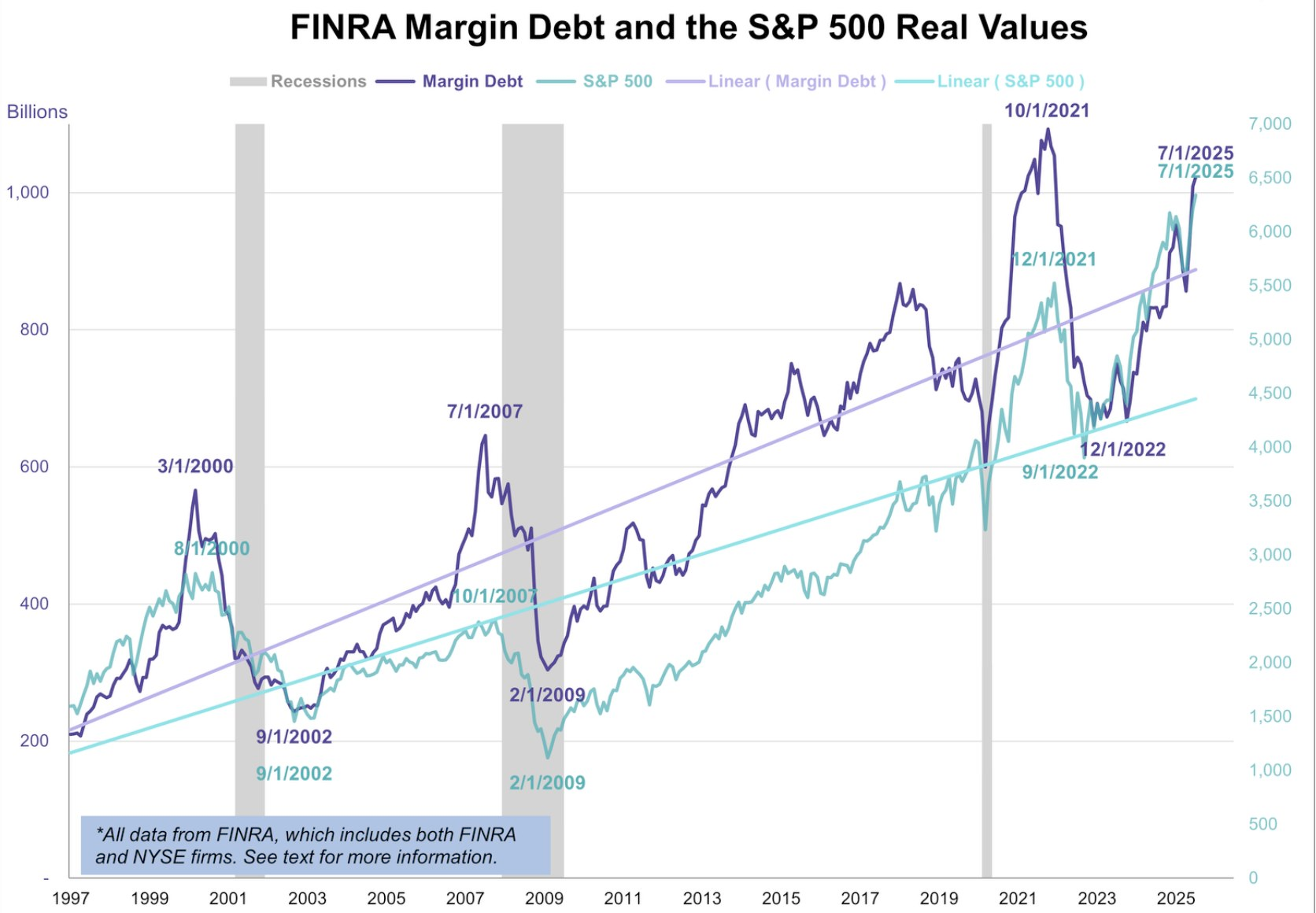

While everyone and their mother is focused on Jackson Hole in anticipation of Federal Reserve Chairman Jerome Powell's speech later this morning I want to draw your attention to the chart above. The financial system is more levered than it has ever been at the same time that the pressure on Jerome Powell and the Fed to lower interest rates and inflation is starting to rear its head again.

If I'm being honest, I'm not sure exactly how to read this. My intuition says that leverage is high because of the stealth stimulus that has been entering the market over the course of the last few years via the Treasury hammering issuance on the short end of the yield curve. Yes, in nominal terms margin debt is at an all time high, but if you look at it in real terms it is still below 2021 levels. Though, it is quickly approaching those levels.

The question lingering in my mind is whether or not we see a melt up in financial assets and leverage alongside with it, or will gravity come into play at some point in the short to medium-term and force a material correction? When you consider the Trump administration's focus on AI - it has been explicitly identified as a national security issue that necessitates a "win at all costs" response, coupled with the strong desire to keep the Republican majority in the House and the Senate in next year's mid-term elections, the prospect of a melt up scenario seems somewhat likely. One thing is certain, the Trump administration is certainly going to try.

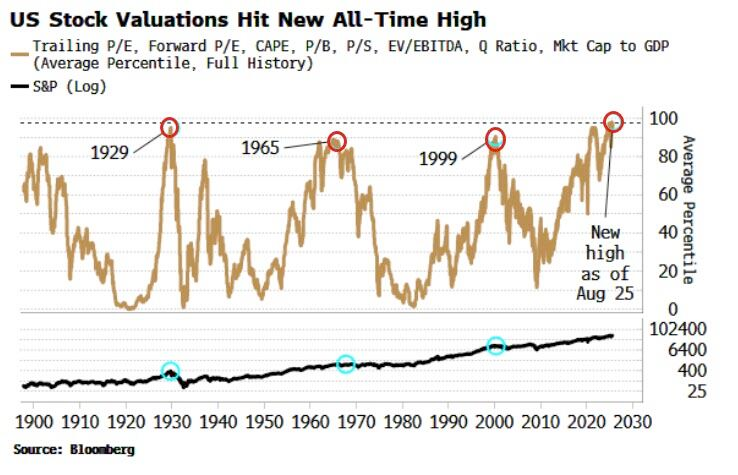

When they do inevitably try, we will see if we are truly moving into new territory because all of the indicators that signal a market top are getting very red and very loud. Just take a look at cyclically-adjusted P/E ratios.

Regardless of what ultimately happens, this is fundamentally bullish for bitcoin in the medium to long-term. If we get the melt up scenario, bitcoin will benefit massively as individuals, investors, institutions and idiots alike seek safe haven in hard assets. If gravity comes into play, bitcoin is likely to correct a bit before the dust settles. At which point, many people will be starkly reminded of the insanity of the incumbent financial and monetary systems yet again and a new wave of bitcoin adopters will enter the market. Joining the steadfast hodlers who understand what they own.

Stay vigilant out there, freaks.

Phil Geiger makes a compelling case on Parker Lewis's Center of Hash that Bitcoin's energy consumption serves a vital purpose - it's the first monetary system to solve the problem of money printing through absolute scarcity. As Phil explains, Bitcoin's 21 million supply cap represents humanity's first truly fixed monetary supply, making it fundamentally different from every other form of money that can be debased. This scarcity only works because it's secured by real-world energy consumption, creating an unbreakable link between the digital and physical realms.

"Money is the most fundamental form of communication that humans have. You can use money to communicate value across different cultures without even speaking the same language." - Phil Geiger

Phil contrasts Bitcoin with other cryptocurrencies, arguing their energy use is wasteful because they don't solve any fundamental problem. Bitcoin's energy consumption directly secures the network against manipulation and enforces the monetary policy that makes it valuable. Parker reinforces this throughout, noting how this direct use of energy for monetary security is unprecedented - unlike gold mining or Federal Reserve operations, Bitcoin creates an explicit, measurable relationship between energy and monetary integrity.

Check out the full podcast here for more on mining pool centralization, fee market dynamics and Bitcoin's self-regulating difficulty adjustment.

DOJ Won't Target Decentralized Crypto Developers - via X

DOJ Demands Fed Fire Governor Lisa Cook - via X

Pennsylvania Introduces Bitcoin Ownership Ban Bill - via X

Buenos Aires Accepts Bitcoin for City Payments - via X

Treasury Proposes Digital IDs for DeFi Transactions - via X

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The hurricane swells are epic on the East Coast right now.

Enjoy your weekend, freaks.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: