Dissonance has plunged the FOMC into a state of heightened uncertainty, complicating future monetary policy decisions and highlighting the unpredictability of the current economic landscape.

Federal Reserve officials are grappling with a complex economic landscape. Despite implementing a series of aggressive rate hikes, intended to be the most powerful in recent history, the anticipated economic impact has not materialized as predicted. The Federal Open Market Committee (FOMC) has claimed the risks to achieving its employment and inflation goals are becoming more balanced and admits to heightened uncertainty regarding the economic outlook.

The recent FOMC statement reinforces the narrative that the risks to their dual mandate—employment and inflation—are moving towards a state of equilibrium. However, the economic forecast remains uncertain, and there is a particular focus on inflation risks. Federal Reserve officials have communicated their increased uncertainty, which stems from the economy's resilience in the face of the aggressive rate hikes, contrasting with the expected economic suppression.

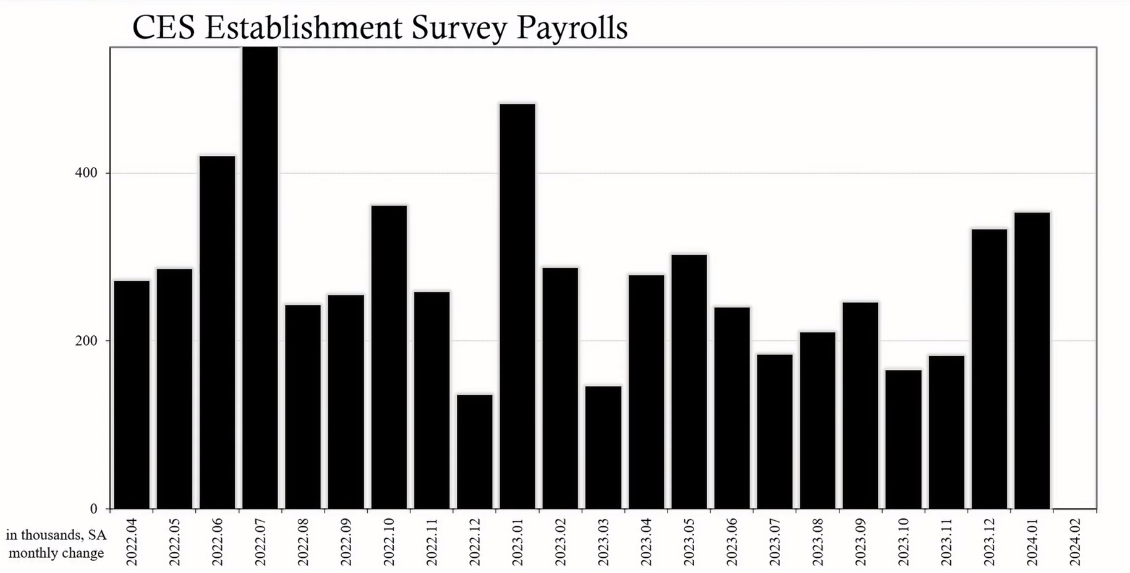

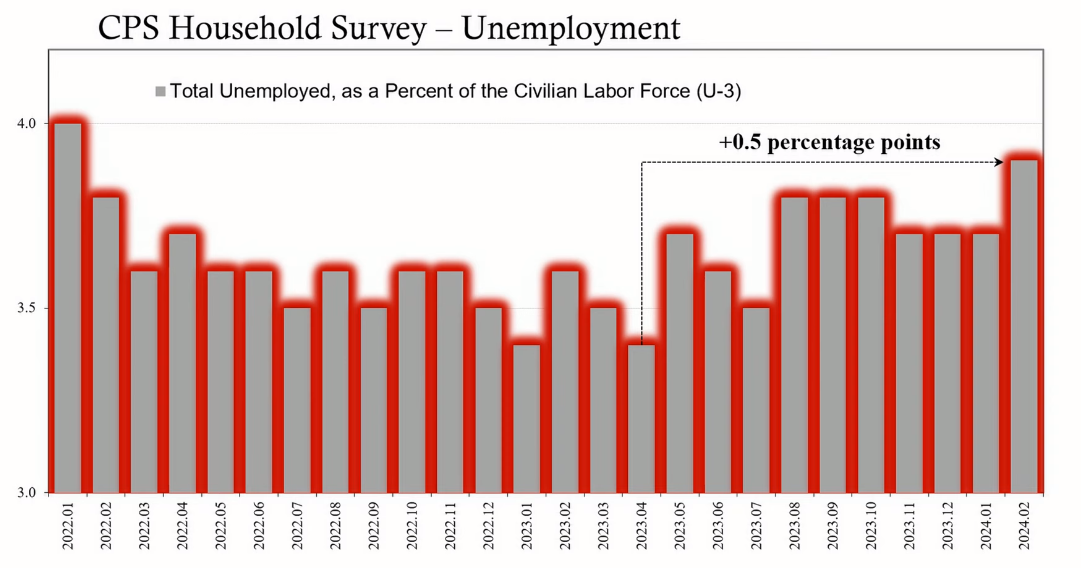

The FOMC expected that the U.S. economy would be significantly impacted by their rate hikes, with a consequent dampening effect on consumer price pressures. Contrary to this, recent data on GDP growth and employment suggest that the economy has remained robust. This disconnect between theory and reality has raised questions about the effectiveness of rate hikes on the general economy and consumer prices.

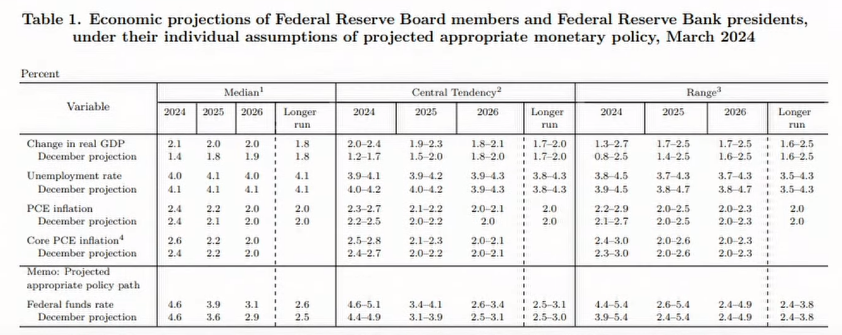

The Summary of Economic Projections reflected the committee's response to the ambiguity. The GDP forecast for 2024 was upgraded from 1.4% to 2.1%, indicating that the economy may not be as adversely affected as previously thought. Despite this, the median projections for interest rates in 2024 remained relatively unchanged, with more participants aligning within the 4.5 to 4.75% range. For 2025 and 2026, however, there was a slight increase in the median projections, reflecting the heightened degree of uncertainty and less confidence in the number of anticipated rate cuts.

International developments are also influencing the Fed's policy considerations. Disinflationary trends in other countries, such as flat Australian consumer prices and the UK's decline in annual inflation rate, contribute to the global economic narrative. Central banks globally are contemplating a shift to more dovish policies, potentially easing their stance on interest rates. The European Central Bank (ECB), for instance, is considering rate cuts in light of worsening economic conditions and a deceleration in wage growth.

Political influences cannot be ignored. Historically, U.S. Presidents have exerted pressure on the Federal Reserve, and the current administration is no exception. There is an expectation, albeit not explicitly endorsed by the Fed, that rates may decline. Market reactions to the FOMC's stance have been volatile, with initial confusion leading to fluctuating yields in short-term and long-term Treasury rates. Eventually, markets have trended towards lower rates, indicating a belief in an inevitable easing of monetary policy despite the Fed's current uncertainty.

In conclusion, the FOMC is facing a period of pronounced uncertainty. The resilience of the U.S. economy, despite aggressive rate hikes, has challenged the conventional understanding of monetary policy's impact. As the Fed weighs various domestic and international factors, including political pressures, it finds itself in a state of confusion, not only about inflation but also about the efficacy of its own policies. This has led to a cautious approach to future rate projections, with a greater emphasis on the need for flexibility in response to evolving economic data. The primary risk for the market and the economy is less about inflation or recession but more about the Fed's ability to navigate this uncertainty effectively in 2024 and beyond.

FOMC March 2024 Policy Statement: https://www.federalreserve.gov/monetarypolicy/files/monetary20240320a1.pdf

FOMC March 2024 Summary of Economic Projections: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240320.pdf