The Federal Reserve's decision to keep interest rates unchanged marks a cautious yet hawkish approach to monetary policy.

The Federal Reserve maintained its benchmark interest rate within the target range of 5.25-5.5%, signaling a hawkish stance toward future monetary policy. The latest Federal Open Market Committee (FOMC) meeting concluded with significant attention paid to the dot plot, a chart that records individual committee members' expectations for future rates.

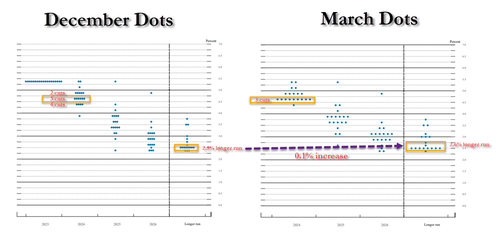

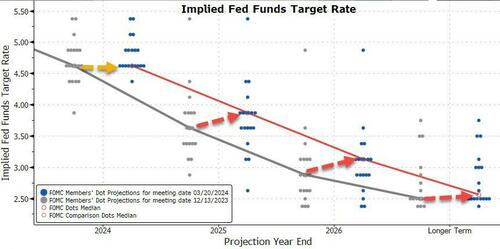

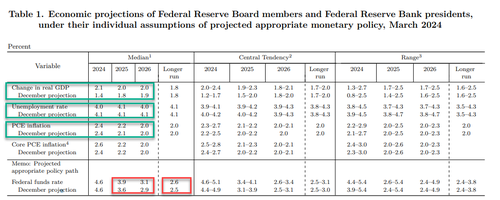

The central bank's projections indicate a median forecast of 75 basis points (bps) of rate cuts in 2024, maintaining the expected rate at 4.6%. However, the forecast for 2025 showed an increase to 3.9% from the previous 3.6%, suggesting a more cautious approach to rate-cutting in the longer term. The adjustments to the dot plot also include an elevated 'neutral' rate, reflecting a shift in perspective among policymakers.

The composition of the dot plot shifted slightly, with more officials now leaning towards fewer cuts. According to the FOMC's median dot, nine officials predict three cuts for 2024, up from six in December, while the number of officials expecting four cuts has decreased. These changes underscore a delicate balance in the committee's views.

Economic growth projections have been upgraded, with policymakers now expecting a 2.1% growth this year, an uptick from the 1.4% forecast in December. The unemployment rate is anticipated to end the year at 4%, a slight decrease from previous estimates. Inflation expectations remain stable, with an end-of-year prediction of 2.4% and a projection that it will not reach the Fed's 2% target until 2026.

Market analysts had been closely monitoring the FOMC's decisions, especially in light of recent macroeconomic data and inflation expectations. "The continued strong performance of the economy even at ‘restrictive’ levels of short rates, the evolution of the economy post-COVID (for example, a high level of fiscal spending), and the fact that several Fed speakers have indicated they are open to the idea that neutral has risen leads me to believe the long-run dot will rise over the next few years starting at today’s meeting," commented Goldman's Josh Schiffrin, Head of Macro Trading Strategy.

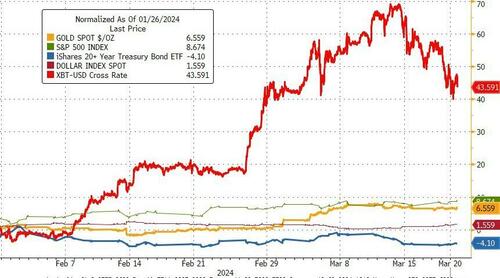

The Federal Reserve's latest policy decision comes amid a backdrop of mixed economic signals, with some data points indicating potential stagflationary tendencies. The stock market has shown resilience, rallying since the last FOMC meeting despite adjustments in rate-cut expectations and a modest rise in the dollar.

As the Fed navigates the complexities of post-pandemic economic recovery, its current stance appears geared towards tempering inflation while cautiously fostering growth. The central bank's future policy moves will be closely watched as investors and analysts seek to understand the implications of the evolving economic landscape.

Originally reported by ZeroHedge