Not ideal.

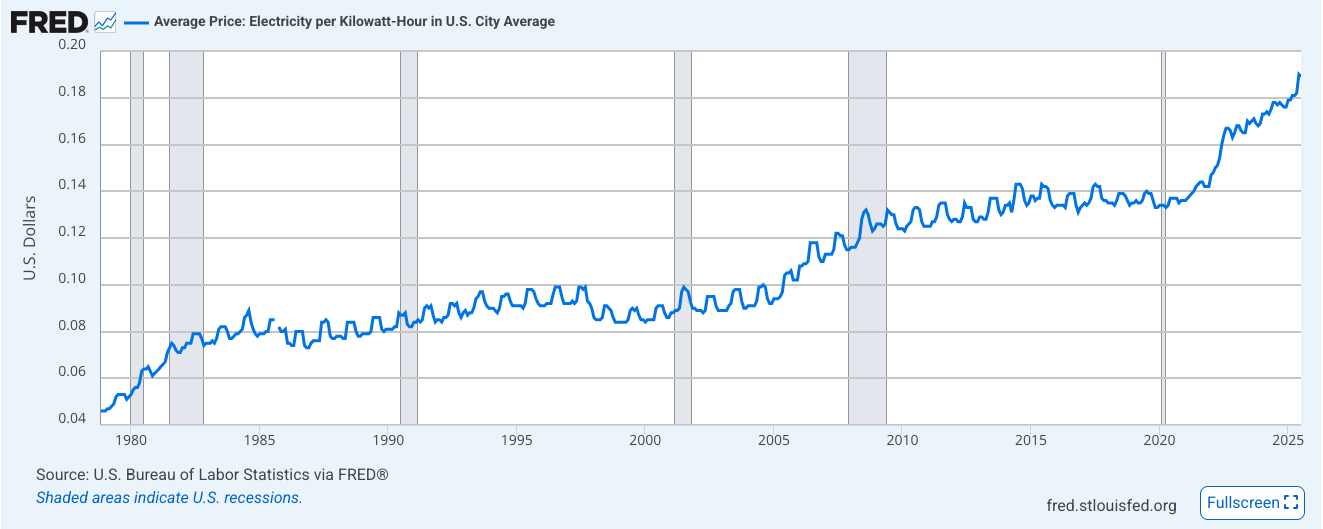

Above is a chart of the average price of electricity per kWh in U.S. cities dating back to 1980. It is arguably one of the most important charts in the world and it isn't getting enough attention. Sure there are many talking about the need for a massive expansion of grid systems throughout the country, but from what I can tell all of those conversations are happening at a surface layer with an implicit assumption that energy prices will skyrocket as a result of rapidly increasing demand. Very are explicitly acknowledging that energy prices took a massive leap up between 2022 and today.

I'm not going to lie, I was a bit shocked when I went to take a look at this chart tonight after someone sent me a screenshot in DMs earlier tonight, but only going back to 2018. I wanted to check to see if the run up was an anomaly or just the product of a long term cyclical trend. Lo and behold, it seems to be a sharp break up through a 40-year trend line. I knew electricity was getting more expensive, but I didn't realize it was THIS bad.

This is yet another data point that highlights how bad the governments and central banks broke things in 2020. There are multiple factors that have contributed to this explosion in electricity prices; decommissioning reliable nuclear power and coal plants, surging demand from data centers housing AI training and inference clusters, increasing demand from bitcoin miners (though, bitcoin miners are extremely price sensitive), increasing demand from millions of people crossing a porous boarder, and a lack of supply growth in the form of generation expansion, at least outside of ERCOT. The demand from AI data centers is certainly one of the more material contributing factors, but the biggest contributor to this chart is the money printing. Creating trillions of dollars out of thin air has consequences.

The urgency with which this problem needs to be solved cannot be overstated. Energy is the fundamental raw input of everything that is produced in the economy. Runaway energy prices are not a good sign. We need to expand generation capacity and transmission as aggressively as possible, yesterday.

And this is also a non-intuitive reminder that we desperately need to fix the money. The fact that energy prices were able to increase at this pace and seem to be inflecting upwards again despite the fact that we've had relatively elevated interest rates is a signal that rate cuts probably aren't the right move for the private sector. I'll still contend that interest rates should stay flat or even move a bit higher. Clearly there hasn't been enough culling of wasteful capital allocation throughout the economy.

One last thought, I find it hard to believe that the AI boom we've witnessed over the last three years isn't in for a major correction at some point in the near to medium-term. I've said it many times, AI is an incredible tool that has certainly made me and this business more efficient, but I think it's becoming clear that a ton of these firms are simply burning cash at an unprecedented rate. Yes the headlines may consistently flash high revenue prints. However, it also seems clear that the cost of that revenue is extremely high. Especially when you consider the fact that electricity and expensive hardware are the main inputs.

Keep your eye on this chart.

Pierre laid out a critical insight on Parker's pod that cuts to the heart of Bitcoin's antifragility. He explained how Bitcoin's security doesn't rely on keeping miners honest through goodwill, but through an unstoppable competitive mechanism. Even if one entity controlled 99% of the network's hashrate, Pierre argued, they couldn't prevent new miners from entering when economic incentives arise. When transaction fees accumulate from censorship attempts, Pierre noted that market forces create irresistible opportunities for defectors or new entrants to claim those rewards.

"Physical hashing cannot be prevented through network control." - Pierre Rochard

Pierre laid out a critical insight on Parker's pod that cuts to the heart of Bitcoin's antifragility. He explained how Bitcoin's security doesn't rely on keeping miners honest through goodwill, but through an unstoppable competitive mechanism. Even if one entity controlled 99% of the network's hashrate, Pierre argued, they couldn't prevent new miners from entering when economic incentives arise. When transaction fees accumulate from censorship attempts, Pierre noted that market forces create irresistible opportunities for defectors or new entrants to claim those rewards.

Check out the full podcast here for more on difficulty adjustments, transaction finality, and why security budgets are misunderstood.

Rumble Begins Testing Bitcoin Wallet - via X

Gold Hits New All-Time High - via X

SEC and CFTC Clarify Spot Crypto ETF Trading - via X

Bitcoin Shows Increased Spot Buying Pressure - via X

Tom Honzik has helped 1,000+ people secure more than 5,000 BTC. Now, TFTC and Unchained are teaming up for a live online session on bitcoin custody.What you’ll learn:

Stick around for the AMA to ask Tom Honzik and Marty Bent anything—from privacy considerations to the tradeoffs of different multisig quorums.

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I need to get better at small talk at soccer practice.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: