Despite reports of economic growth, many Americans face declining living standards.

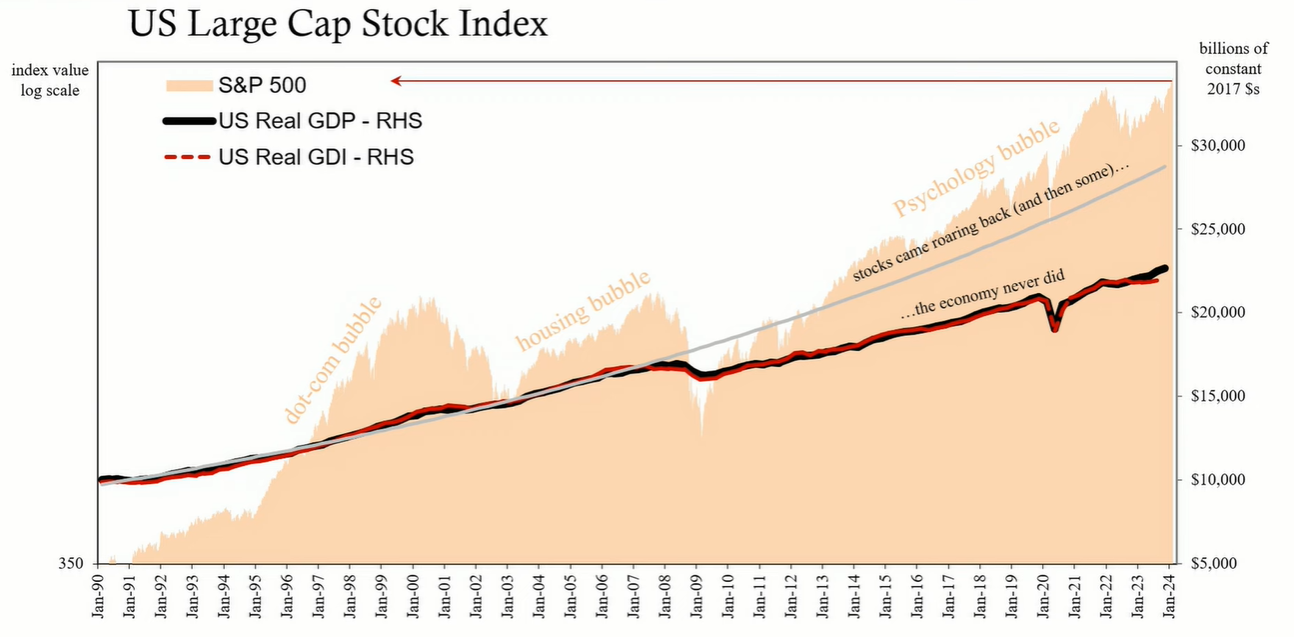

The narrative of a strong economy, particularly the labor market, is often contrasted by the lived experiences of individuals who feel their standard of living is deteriorating. While the stock market and financial assets have seen tremendous growth, the real economy has not mirrored this prosperity, leading to a disconnect between financial success and general living conditions.

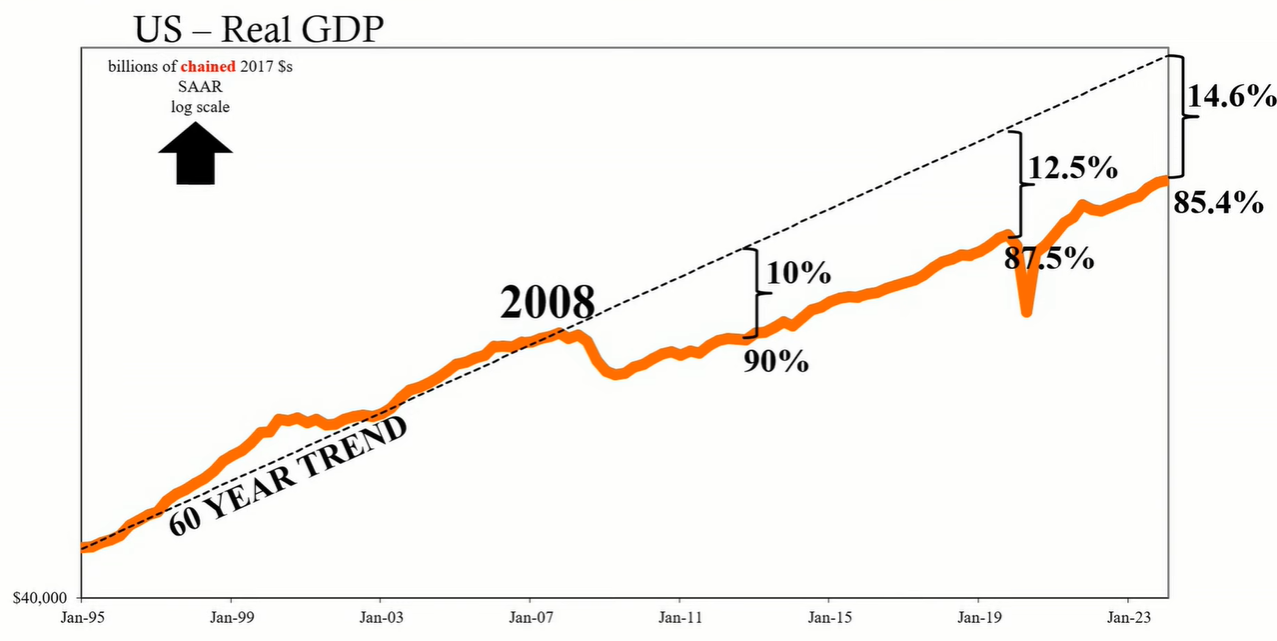

The standard of living is a complex concept, often considered intangible and difficult to quantify. However, the Boston Federal Reserve suggests that one objective measure is the average real gross domestic product (GDP) per capita. This metric takes into account the total value of goods and services produced, adjusted for inflation, and divided by the population. An increase in real GDP per capita is typically associated with the availability of more goods and services and an enhanced capacity for consumers to purchase them.

Despite a rise in real GDP per capita since 2008, the growth rate has significantly slowed, deviating from the historical trend established from 1947 through 2007. By the second quarter of 2011, real GDP per capita in the U.S. was approximately 90% of the expected trend. By the fourth quarter of 2019, this figure had declined further to 87.5% of the trend. With the onset of the pandemic, the first quarter of 2024 saw real GDP per capita drop to just 85.4% of the long-term trend.

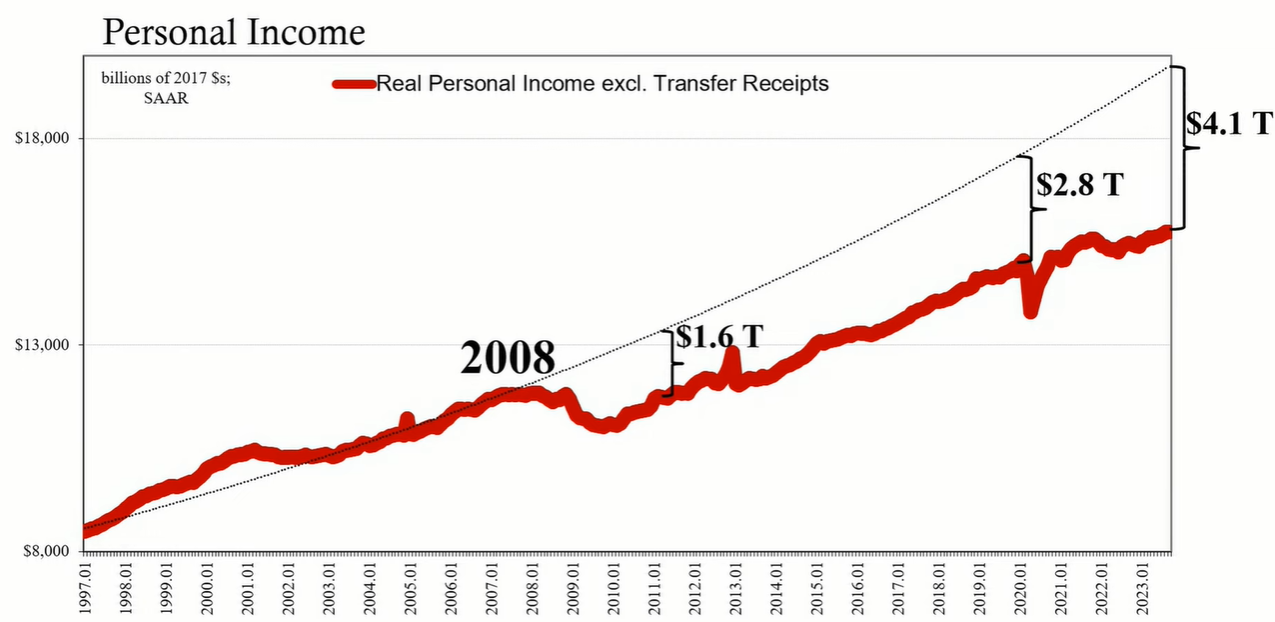

The income trends reflect a similar picture, with real personal income (excluding government transfers) falling behind by $1.6 trillion as of mid-2011 and further trailing by $4.1 trillion by the first quarter of 2024. This decline in income suggests a significant deficit in employment, with fewer workers and reduced earnings compared to historical trends.

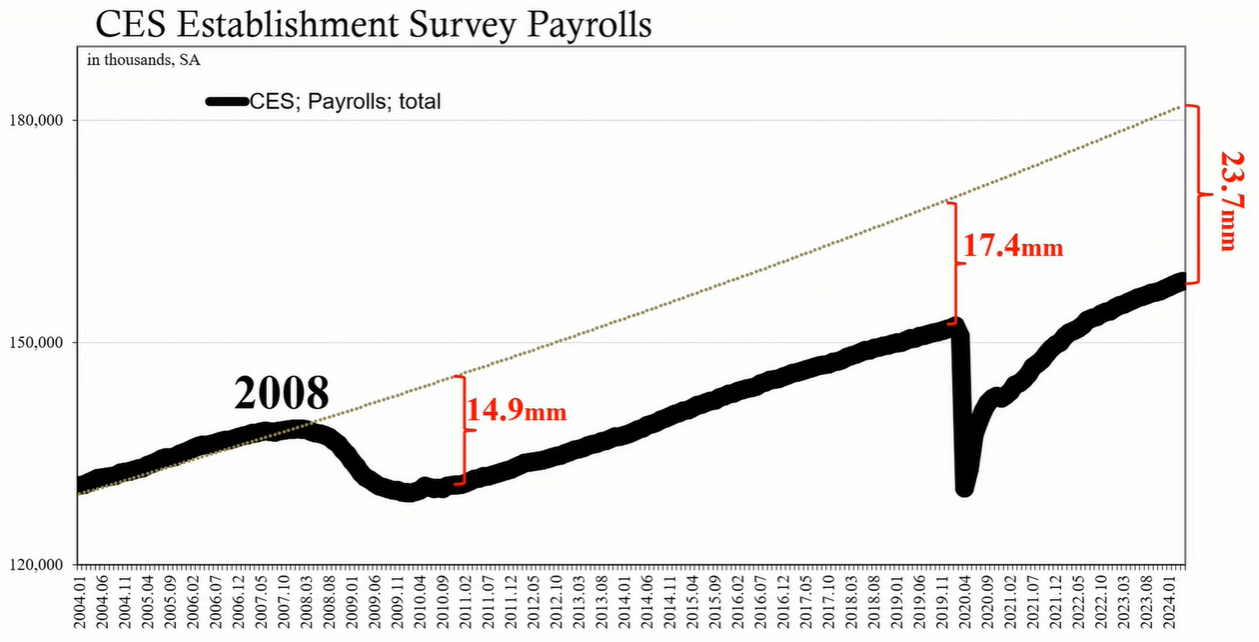

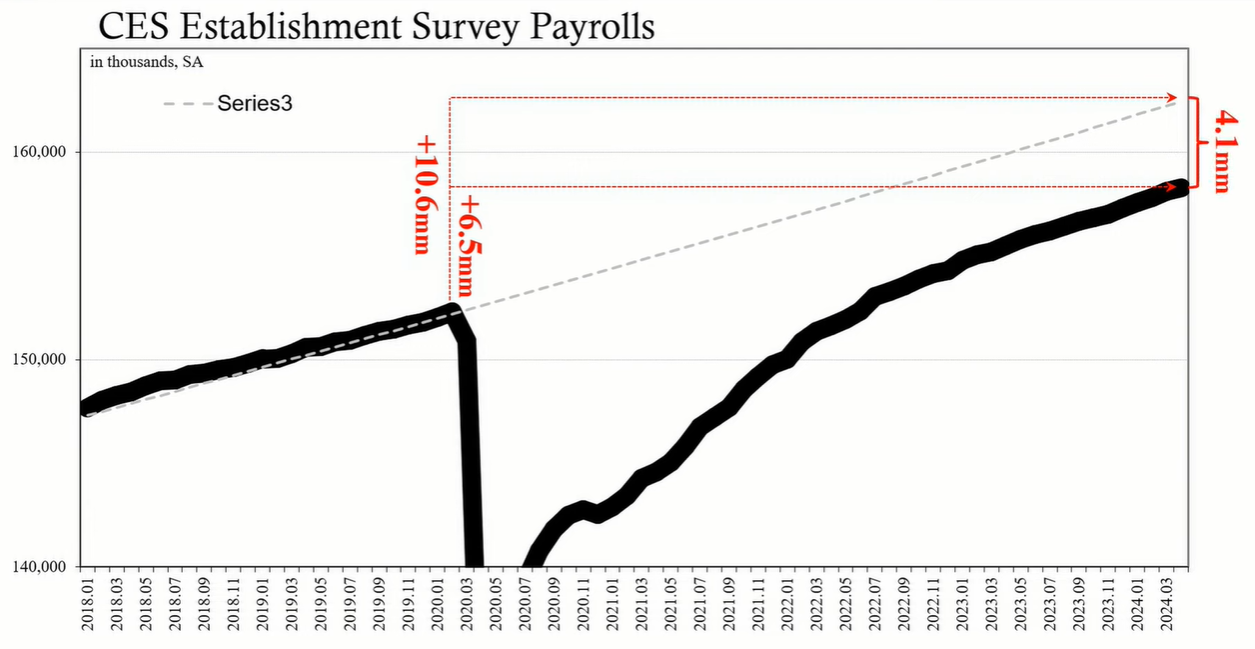

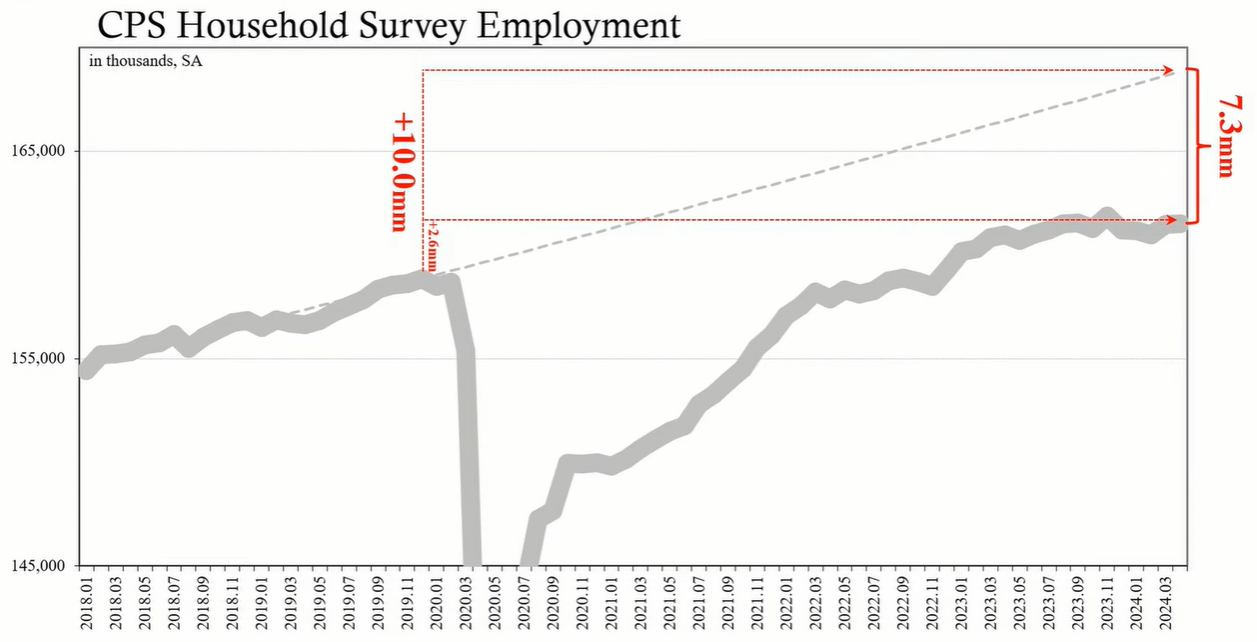

Despite official reports of a strong labor market, the data indicates otherwise. The establishment survey, while optimistic, reveals that the labor market is lagging behind the expected trend. If the trend from the 2010s had continued without the pandemic's impact, an additional 10.6 million jobs would have been expected by the end of 2019. Instead, only 6.5 million jobs were realized, indicating a shortfall of about 4 million jobs. The household survey paints an even grimmer picture, with only 2.6 million jobs added compared to the anticipated 10 million.

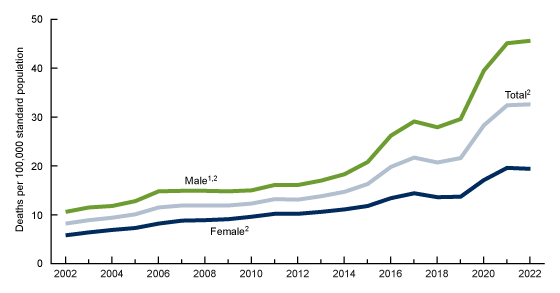

The economic strain is not limited to financial metrics alone but spills over into social consequences. There has been a noticeable increase in drug overdose deaths and a decline in birth rates since 2008, which, while influenced by various factors, may be exacerbated by the economic downturn and diminishing living standards.

The booming stock market starkly contrasts the struggling real economy, highlighting a widening gap between those benefiting from financial speculation and the majority grappling with economic hardships. This disparity feeds into the broader issue of inequality.

Despite the narrative of economic strength, the reality is that living standards for many have been in decline for more than a decade. This disconnect is often obscured by selective reporting that fails to acknowledge the full context of economic data and its deviation from historical trends. While the financial sector flourishes, the real economy and, by extension, the standard of living for the majority, continue to suffer.