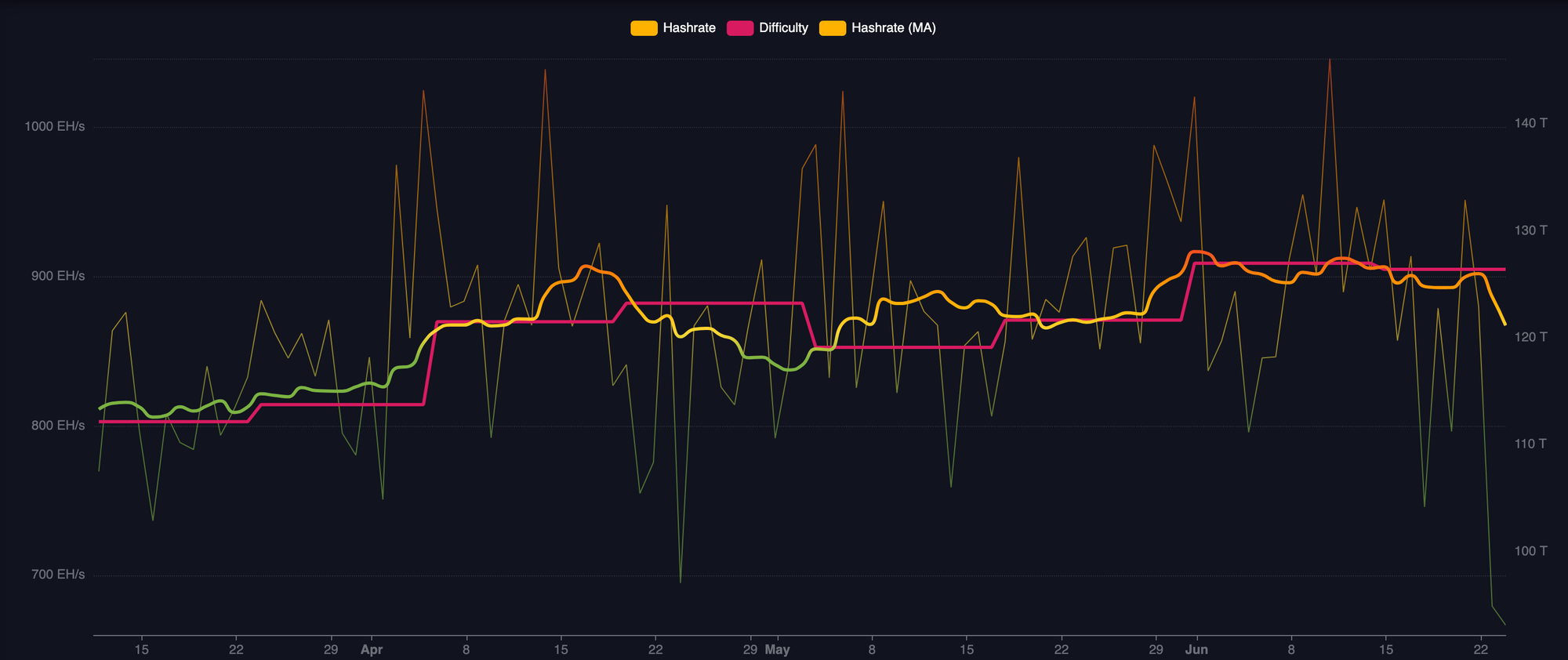

Let's look at the data.

Did American bombs dropping in Iran cause bitcoin's hashrate to fall over the weekend? It's certainly not out of the realm of possibility, but I don't think that's what happened. At least, it's certainly not the main driver. The recent attacks on Iran may have had a marginal effect on hash rate. It is a very poorly kept secret that there is a material amount of hash rate operating within the borders of Iran, but my guess is that the weather in Texas has been a bigger driver of the hashrate decline than a disruption to operational hashrate in Iran.

Here's some empirical data:

I'm not sure if you've checked, but it's very hot in Texas right now. This weekend brought with it not only the attack on Iran by the United States, but also the summer equinox. We've entered the part of the year where in the Northern Hemisphere it gets quite hot as we roll into the Summer months. In Texas, it gets particularly hot. Over the last week, temperatures have hovered just below 100 degrees Fahrenheit in Austin, Texas the city that has a very special place in my heart.

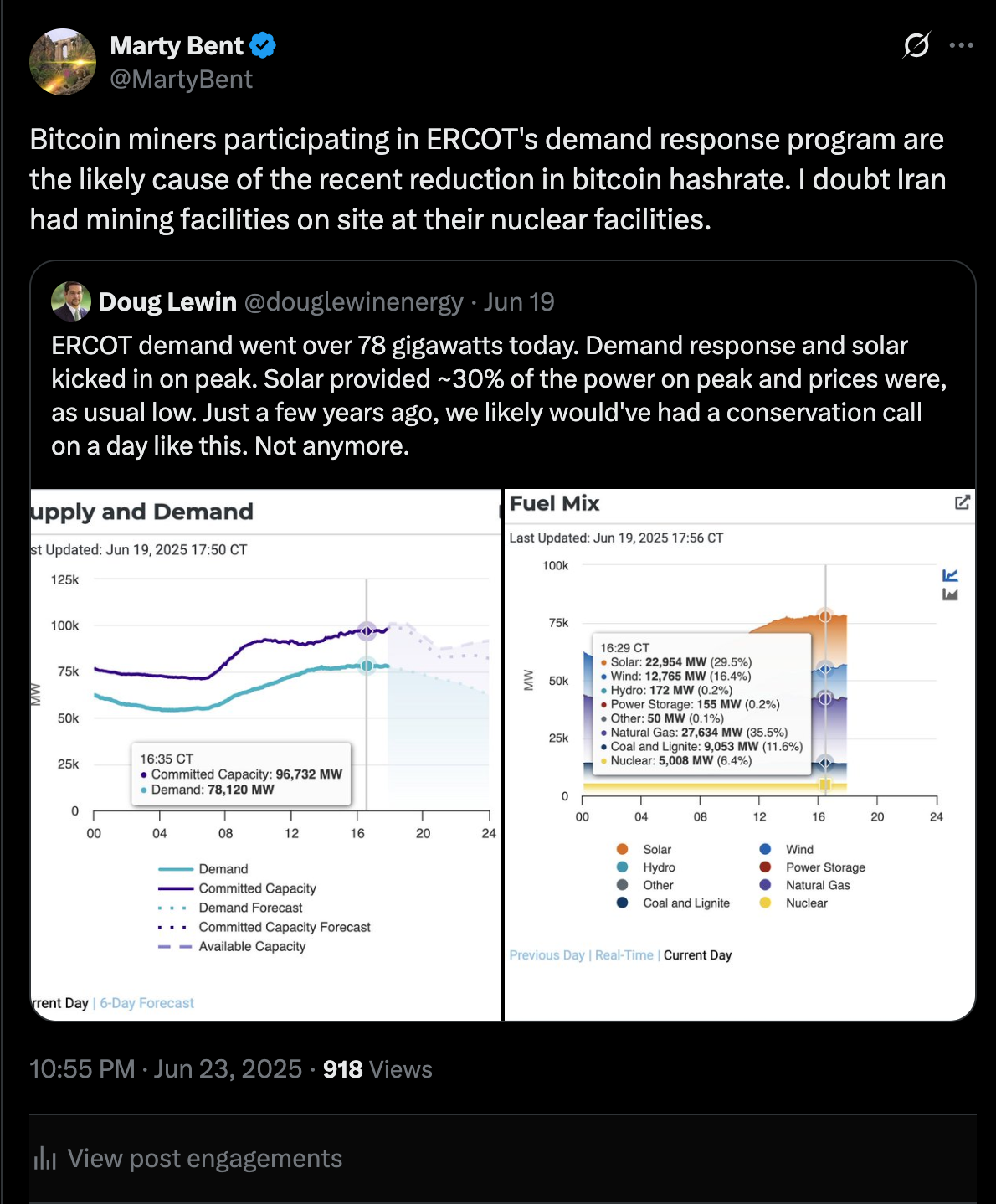

Across the rest of the state, temperatures are ranging in that area or, in the extreme parts of the state, they're well above 100 degrees Fahrenheit. As you may well know, there has been an influx of new citizens to Texas and new businesses to the state over the last five year as individuals around the country have recognized the need for a state that deeply respects private property rights and the ability to experiment from a free market perspective. This has introduced an immense amount of new demand within ERCOT, which controls the electricity generation distribution within the state, and that new demand is putting an immense amount of stress on the grid despite the amount of new generation that has been brought online over the same time period.

Luckily, Bitcoin mining has become an integral part of Texas's grid and those miners are actively participating in ERCOT's demand response program and have elected to shut down there operations when demand spikes, and get paid for doing so, when demand on the grid spikes. This has created a massive buffer that ensures that the Texas grid is stable at any given point in time because there is a material amount of supply that can be diverted to residential consumers when they come home and turn on their air conditioners in the Summer heat.

After China banned mining in 2021, there was the great hash rate migration from China across the world, during which up to 30% of Bitcoin's hash rate settled within Texas's borders. The overall percentage of the Bitcoin network hash rate that is in Texas today may not be at 30%, but I think it's safe to say that it's between 20% and 27% as it stands today. And the miners who have the most scale within Texas are participating in ERCOT's demand response program. If we look at the chart at the top of this letter and look at the weather in Texas and the activation of demand response within ERCOT, it isn't farfetched to believe that miners participating in ERCOT's ancillary services (demand response) are the major driver of the decrease in hashrate over the last week. They certainly do not make up all of the decrease, but it's safe to assume that they're having the largest effect.

This doesn't even take into consideration miners participating in demand response programs in other grid systems throughout the country, particularly Tennessee Valley Authority. It hit 95 degrees in Southern New Jersey today, so I think it's safe to assume that (without even checking the charts) it's pretty hot in Northern Tennessee, Southern Kentucky, Georgia, and North Carolina as well.

The idea that the attack on Iran has materially affected Bitcoin's network hashrate is certainly alluring, but if we're looking at the data and thinking from first principles by applying some common sense, it is more likely that hashrate domiciled in the United States is having a more material effect on the network right now. We've said it before in this rag, but it's crazy to think that the amount of computing power dedicated to the Bitcoin network can be affected by the weather. Since 2021, this is the new normal and I would highly caution anybody trying to make proclamations about what's driving hashrate to pay attention to weather patterns across the United States before jumping to conclusions based off of the military excursions of the United States' military.

For any miners who are not participating in demand response and have the luxury of keeping their operations up and running continuously right now, make sure you keep everything plugged in, relatively cool and connected to your internet because we have a pretty large difficulty adjustment coming in a little less than a week.

Tom Luongo presented a compelling thesis that Iran's nuclear program serves as a deliberately maintained "forever war" mechanism. He argues this perpetual conflict keeps Israel and the US locked in constant tension, draining both nations' resources and energy while serving the interests of what he calls the Davos/City of London power structure. According to Luongo, the JCPOA wasn't designed to actually stop uranium enrichment but rather to create the appearance of progress while allowing Iran to continue building capabilities. This creates an endless negotiation cycle that prevents real resolution.

"The Iranians pursuing a nuclear weapon is the forever war." - Tom Luongo

Luongo suggests this manufactured crisis benefits those who profit from Middle Eastern chaos by keeping the region destabilized and preventing the economic cooperation that Trump promoted during his recent Middle East tour. The nuclear threat provides justification for continued military presence, weapons sales, and diplomatic maneuvering that diverts attention and resources from productive endeavors that could actually benefit the people of these nations.

Check out the full podcast here for more on capital flows, the Fed's strategy and Israel-British relations.

Texas First State to Fund $10M Bitcoin Reserve - via X

ECD Automotive Gets $500M to Build Bitcoin Treasury - via X

Fed Drops Reputational Risk Rules for Bank Supervision - via X

Get our new STACK SATS hat - via tftcmerch.io

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Sunset boat rides are good for the soul.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: