Recent CPI data indicates a surprising economic slowdown, highlighted by disinflation and weakening consumer spending.

The release of the Consumer Price Index (CPI) is a closely watched event, providing key insights into inflation and the health of the economy. The latest release of CPI data was anticipated with great interest against a backdrop of economic uncertainty, inflationary concerns, and debate over the policies of the Federal Reserve.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

The most recent CPI data showed lower numbers than expected, marking the first 'miss' in several months. The month-over-month increase for the headline CPI was 0.31%, a decline from 0.38% in March and 0.44% in February. The year-over-year rate also decreased to 3.36% from 3.48%, indicating a move in the direction of disinflation.

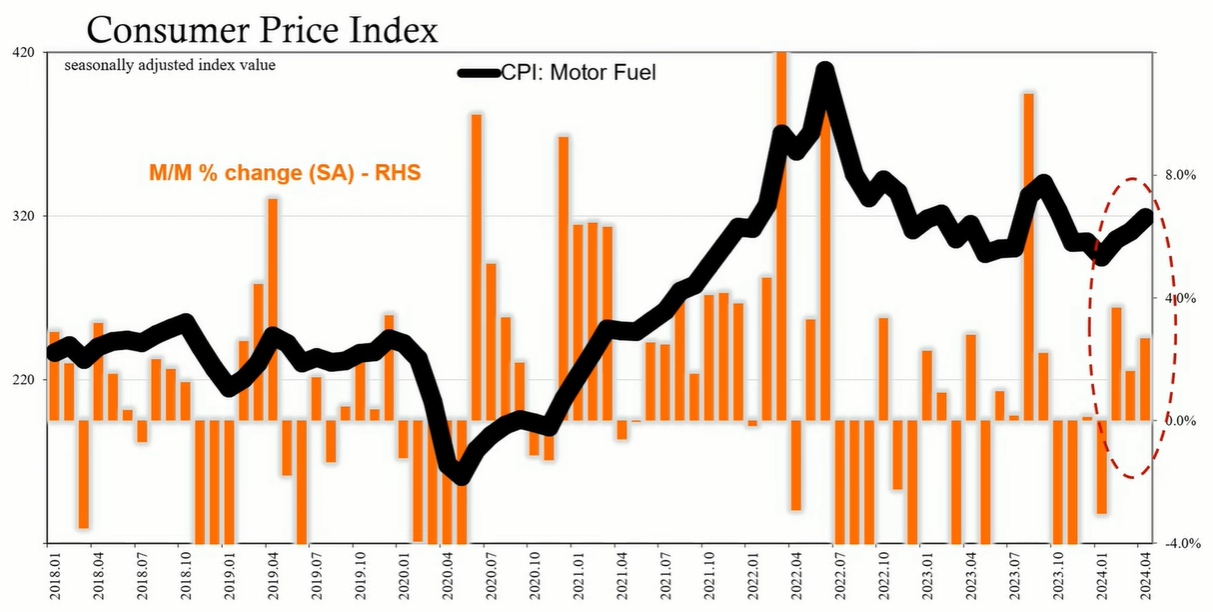

Despite the overall slowdown in inflation, the motor fuel index, a component of the CPI, rose by 2.69% in April alone. Over the last three months, the motor fuel component of the CPI has increased by 8.2%. However, the headline rate is slowing down regardless of these increases, suggesting a positive trend.

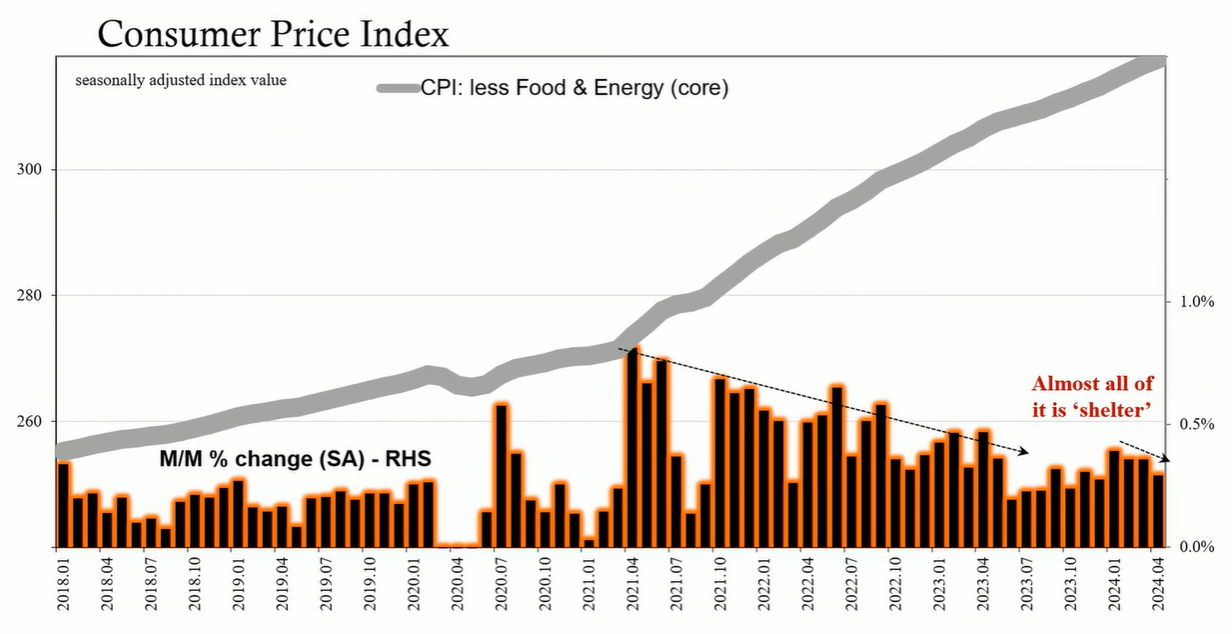

The core CPI, which excludes volatile food and energy prices, is often given more attention as it represents a more stable view of inflation. In April, the core CPI rose by just 0.29% month-over-month, compared to 0.36% in both March and February. This brought the annual rate of the core CPI down to 3.60%.

The index for shelter continued to rise in April, contributing significantly to the monthly increase in both the headline and core CPI rates. The Bureau of Labor Statistics (BLS) relies on the imputation of owner's equivalent rent (OER) to gauge shelter costs, which has continued to rise, albeit at a modestly slowing rate.

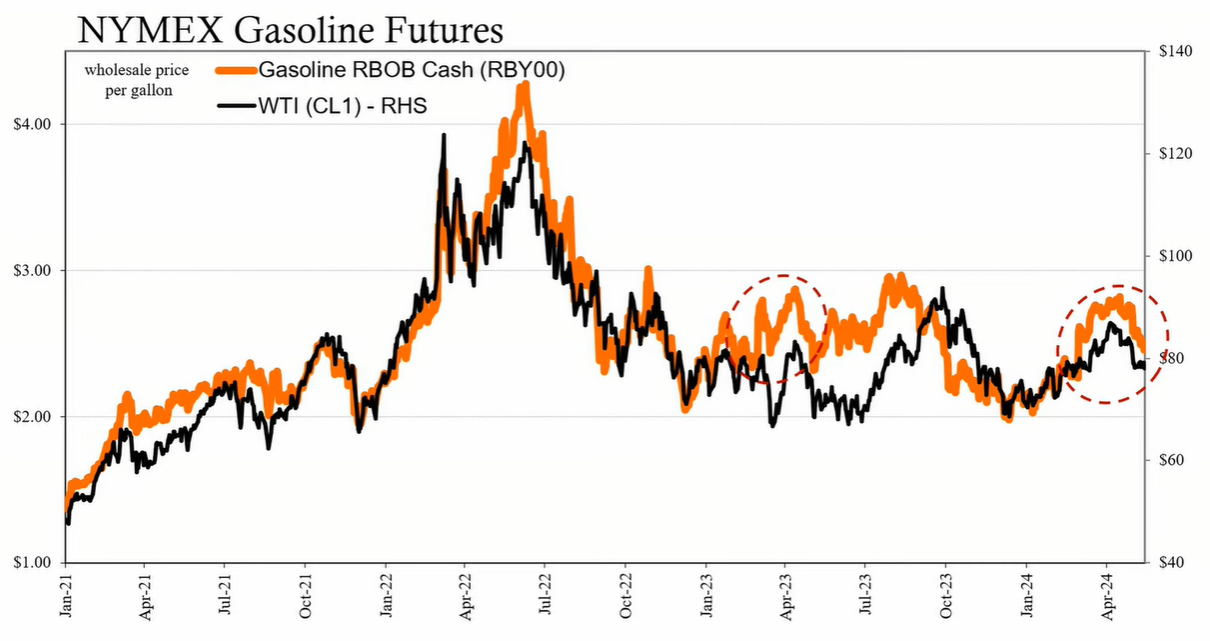

Oil and gasoline prices, which have an outsized impact on inflation measures, are influenced by non-economic factors such as geopolitical tensions and supply restrictions. With energy prices, including gasoline, moving lower, the inflation narrative may shift as these prices normalize.

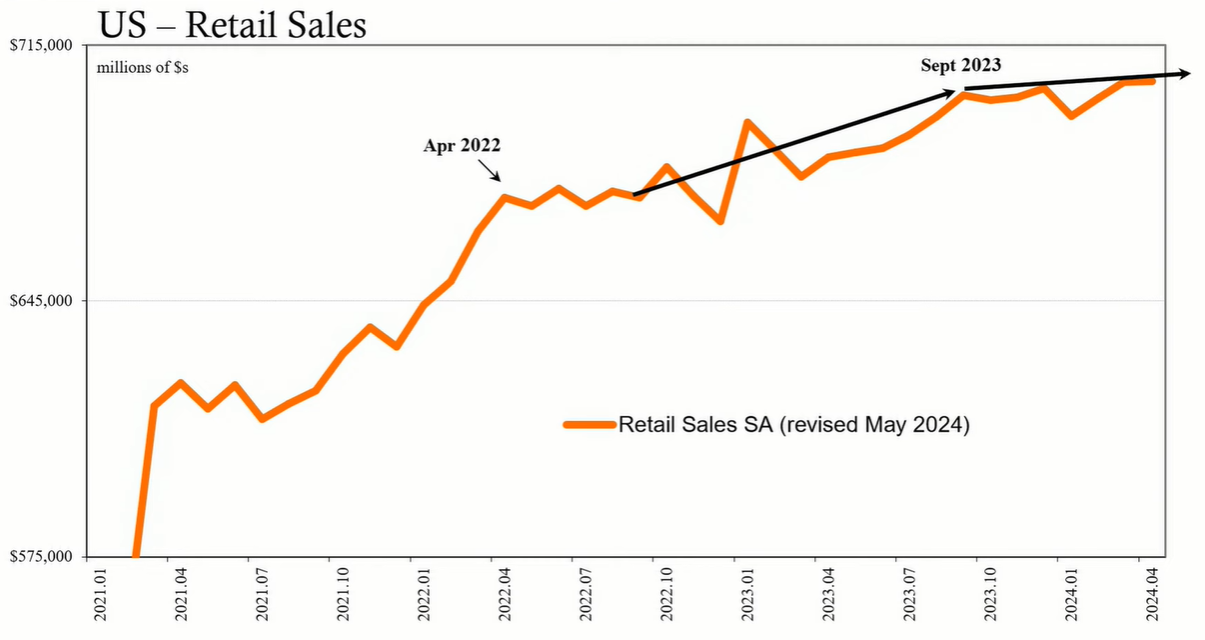

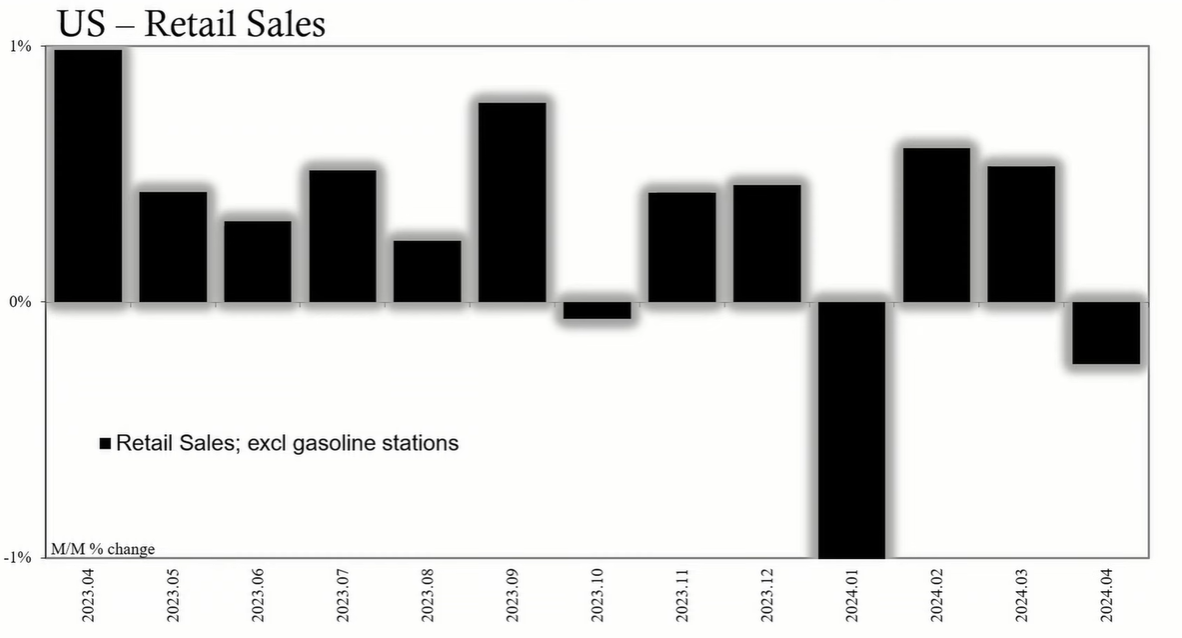

Retail sales for April were flat on a nominal basis, indicating a loss of momentum in consumer spending. Excluding gasoline stations, retail sales fell by 0.25% in April, suggesting that consumer spending is weaker than previously believed. This weakness is supported by other economic indicators, such as consumer sentiment and employment statistics.

The CPI data and concurrent economic indicators suggest that the US economy may not be as strong as previously perceived, with the potential for further disinflation rather than inflation. The decrease in energy prices and the disconnect between shelter costs and the real economy are indicative of this trend. The recent CPI data, while not conclusive, points toward continuing economic weakness and raises questions about the potential for stagflation or a more serious economic downturn. As the narrative shifts, policymakers and market participants will need to reassess their positions in light of the evolving economic landscape.