The Wall Street Journal's upbeat view on recession contrasts starkly with the grim realities most Americans face, exposing a significant disconnect between Wall Street and Main Street.

The Wall Street Journal recently published an article that clearly demonstrates the divergent priorities between Wall Street and the average American family. The article, which carries a tone of optimism, heralds the arrival of an economic slowdown, suggesting that the decrease in jobs, consumer spending, and economic output could lead the Federal Reserve to cut interest rates.

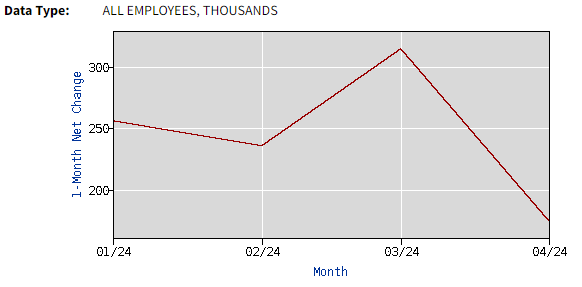

However, the raw data paints a distressing picture for the American populace. The nation's Gross Domestic Product (GDP) has seen a significant deceleration, slowing down by a third in the last quarter and barely outpacing population growth. Furthermore, job creation has experienced a drastic slump, halving in April from 315,000 to 175,000 – a number that includes a substantial portion of government and part-time positions. The ease of finding a job has also plummeted to levels not seen since 2011, in the aftermath of the 2008 financial crisis.

The services sector is at the forefront of this downturn, with consumer confidence taking a hit due to escalating concerns over inflation and unemployment. This is exemplified by the stark contrast in consumer spending patterns, where low-end expenditure is on the decline, affecting businesses from fast-food chains to food product companies. At the same time, luxury markets like Lamborghini are witnessing record sales.

In the leisure and hospitality industry, job creation has nosedived by 90% to a mere 5,000 jobs in the previous month. Wages growth, too, has been affected, falling from nearly 6% in 2022 to just over 3.5%. Despite the troubling implications for the workforce, this news has been received with enthusiasm on Wall Street, with expectations that the Federal Reserve may cut rates to bolster the current administration ahead of the elections.

The stark contrast in reactions to the economic slowdown underscores the chasm between the financial elite and the working population. While banks and the wealthy may benefit from lower yields, the rest of the country grapples with job losses and wage reductions.

As the narrative unfolds, it's clear that the Federal Reserve's policies weigh heavily on the economy. Bad economic tidings, paradoxically, translate to good news for the Fed, as it allows for further subsidization of government loans, benefitting the wealthy at the cost of increased inflation for the middle and working class.

The media's portrayal of a recession as beneficial is a reflection of a system that seems to prioritize federal spending over the welfare of millions of Americans struggling with joblessness and the rising cost of living.