Hold on to your butts.

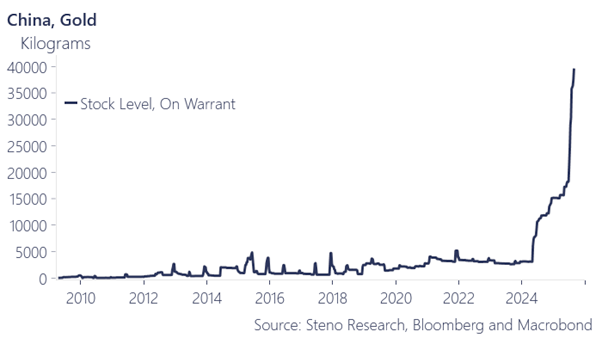

Here's a pretty startling chart out of China that I haven't seen talked about much; the amount of gold held "on warrant". As you can see, it has risen dramatically since the beginning of last year. What does it mean? It could mean a number of things, so let's walk through the possibilities and I'll take a stab at what I think is happening.

First, let's understand what it means for gold to be "on warrant". When gold is on warrant it means that the owner of that gold has been issued a document of title by an exchange approved vault and is formally registered as available for delivery against futures contracts or other exchange transactions.

Said another way, it is "visible and tradeable" inventory in the official system. In the case of China, it is possible that the PBOC, state owned banks or other CCP-connected financial institutions have sent gold to the Shanghai Gold Exchange, asked for it to be formally registered and it now sits in SGE vaults to be used as collateral for something. It's also possible that the gold was already sitting in vaults controlled by the SGE and one or more of these entities requested for it to be formally registered at the behest of the CCP.

Why would China want to rapidly increase the amount of gold held on warrant? There are a number of reasons why they would. There could be a lack of liquidity in the system that is relieved by registering gold on warrant because it can then be used as collateral, leased, or more easily traded.

Another reason could be to simply flex. We've all seen the charts of China's dumping of US Treasury bonds while accumulating bullion since the 2010s. We've cited them in this newsletter many times. Putting a massive slug of those gold buys on warrant in a relatively short amount of time could simply be China sending a signal that says, "We're verifying to the world that we have still have the gold and are willing to use it."

Increasing the gold on warrant could also be a move that aims to ease tightness in spot and futures markets, impact pricing spreads and make China a more dominant player when it comes to gold price discovery.

Hell, China could have done this to accomplish all of the above.

One thing seems pretty clear to me, we aren't going back to the days of the US being able to leverage the dollar system to bully the world. We've had many discussions on the TFTC podcast over the last few years where my guests have surmised that China is planning to create a gold-backed currency so that they can detach from the dollar system. I think the chart of Chinese gold on warrant is a glaring validation of that theory. China is clearly prepping for this, or something very much in the same vein.

The only question that remains is when do they decide to rip off the band aid and make the world aware of their intentions? I would not be surprised if it's very soon, especially considering the meeting of the minds that occurred yesterday during China's military parade. Putin, Modi, Erdogan, Kim Jung Un, Lukashenko, and many other leaders from the "misfit countries" of the world gathered to meet with Xi and his cabinet. I doubt the only thing they discussed was how impressive the synchronized marching and the weapons were.

Do not be shocked if the oft talked about theory of a gold-backed BRICS currency becomes a reality this Fall. My bet is on the BRICS contingent keeping it simple and coalescing around a gold-back yuan instead of the basket of goods that was being discussed years ago.

How will the US respond? An event like this would likely crater the market for US Treasuries, and the global financial system by extension.

If you've been reading this rag for long enough you know where I stand. Desperate times call for bold, calculated and creative moves. And if the scenario described above does come to fruition the bold, calculated and creative counter-move would be to lean into bitcoin as hard and as quickly as humanly possible. Deregulate the market, eliminate taxes associated with bitcoin usage, encourage American individuals and businesses to adopt bitcoin as a treasury asset and medium of exchange. Ride the asymmetric wave of bitcoin's monetization and benefit massively.

That takes balls, though. Does America have the balls to be bold anymore? Time will tell.

Many bitcoiners are convinced that Wall Street is suppressing Bitcoin's price through paper bitcoin and rehypothecation schemes, but Matthew Mežinskis presented compelling evidence against this narrative. He showed that on-chain data reveals plenty of long-term holders actively selling real bitcoin, with 50-70% of profit-taking coming from coins held over one year. The price ending August just 2.5% below the power curve trend is completely normal - we actually ended July 6.2% above trend, demonstrating typical market fluctuations.

"Nobody ever sells their Bitcoin, they said. It was all paper bitcoins, they said." - Matthew Mežinskis

Mežinskis emphasized that the market is functioning with genuine bitcoin changing hands, not derivative manipulation. I've observed this paranoia growing on Bitcoin Twitter, but the data clearly shows we're tracking right where we should be. Sometimes the simplest explanation is the correct one: natural market dynamics, not conspiracy.

Check out the full podcast here for more on the power law model, four-year cycle validity, and Bitcoin vs traditional finance convergence theory.

American Bitcoin Reserves Surge to 2,443 BTC - via X

Cypherpunk Future Relies on Bitcoin Innovation - via X

CFTC Approves Polymarket for US Crypto Markets - via X

Analyst Confident in Bitcoin's Long-Term Victory - via X

Crypto Market Bill Vote Expected Soon - via X

Tom Honzik has helped 1,000+ people secure more than 5,000 BTC. Now, TFTC and Unchained are teaming up for a live online session on bitcoin custody.What you’ll learn:

Stick around for the AMA to ask Tom Honzik and Marty Bent anything—from privacy considerations to the tradeoffs of different multisig quorums.

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Go Birds.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: