Analyze the deepening financial instability in China, marked by challenges in its banking sector, a distressed real estate market, and falling commodity prices. This crisis raises concerns of global financial contagion.

China's financial stability is under scrutiny as economic indicators signal an ongoing crisis that extends beyond its borders. The impacts are evident across various sectors, including property, banking, and commodities. Recent data suggests that the measures taken by the Chinese government and the People's Bank of China (PBOC) are failing to stabilize the economy, as seen in the decline of commodity prices and the looming threat of financial contagion.

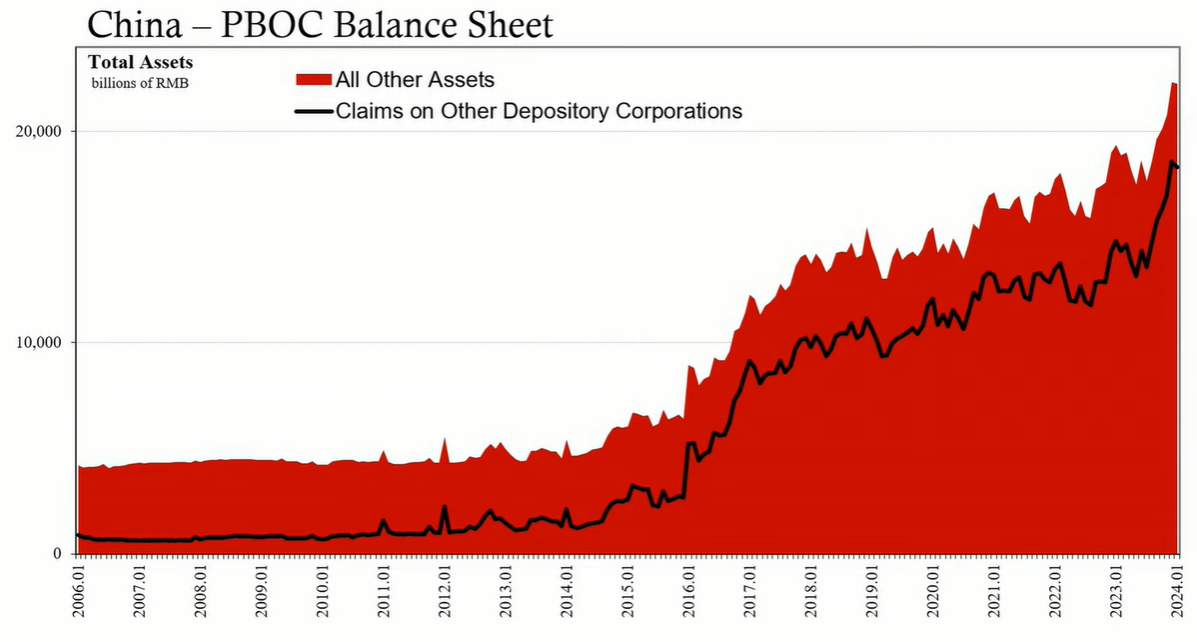

The PBOC has been compelled to implement aggressive strategies to support the banking system amidst growing concerns. Despite significant stimulus efforts and soft landing rhetoric, the Chinese banking system appears reluctant to lend, hinting at deeper underlying issues. Claims on other depository corporations surged by 23.6% year-over-year as of January, reflecting the central bank's increased lending to the banking sector. This trend suggests the PBOC is prioritizing financial stability over direct economic stimulation.

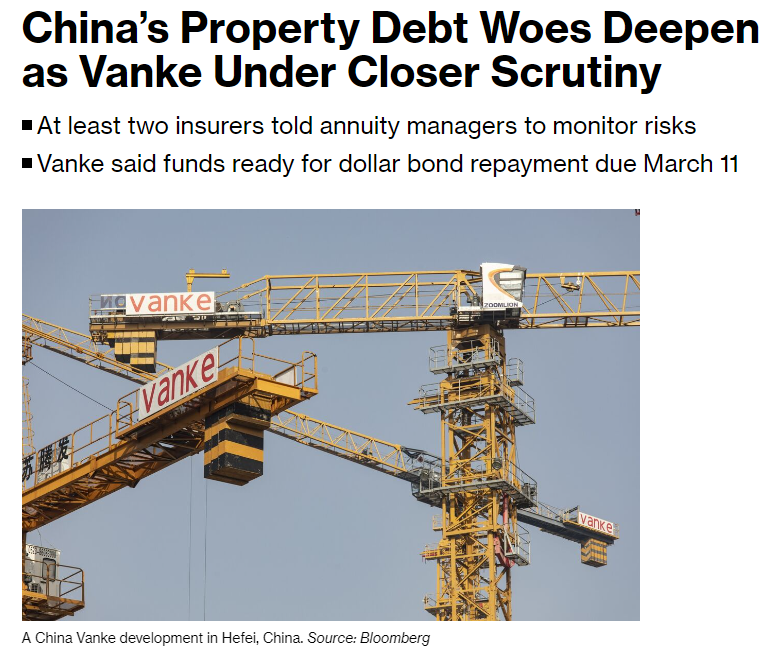

China's property sector is particularly troubling, with major developers like Evergrande, Country Garden, and now China Vanke facing severe liquidity crises. China Vanke, once an investment-grade developer, is now grappling with rumors of cash shortages, despite being the second-largest developer by sales. Moody's downgraded China Vanke to Baa3 in November, a mere notch above junk status, reflecting the sector's deteriorating health.

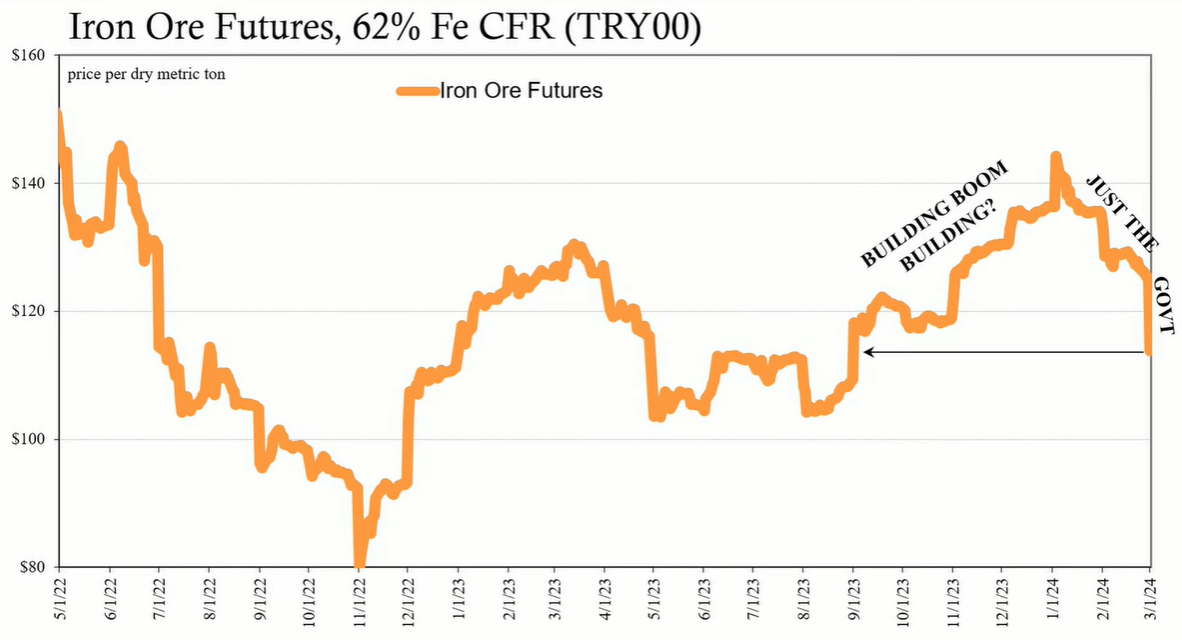

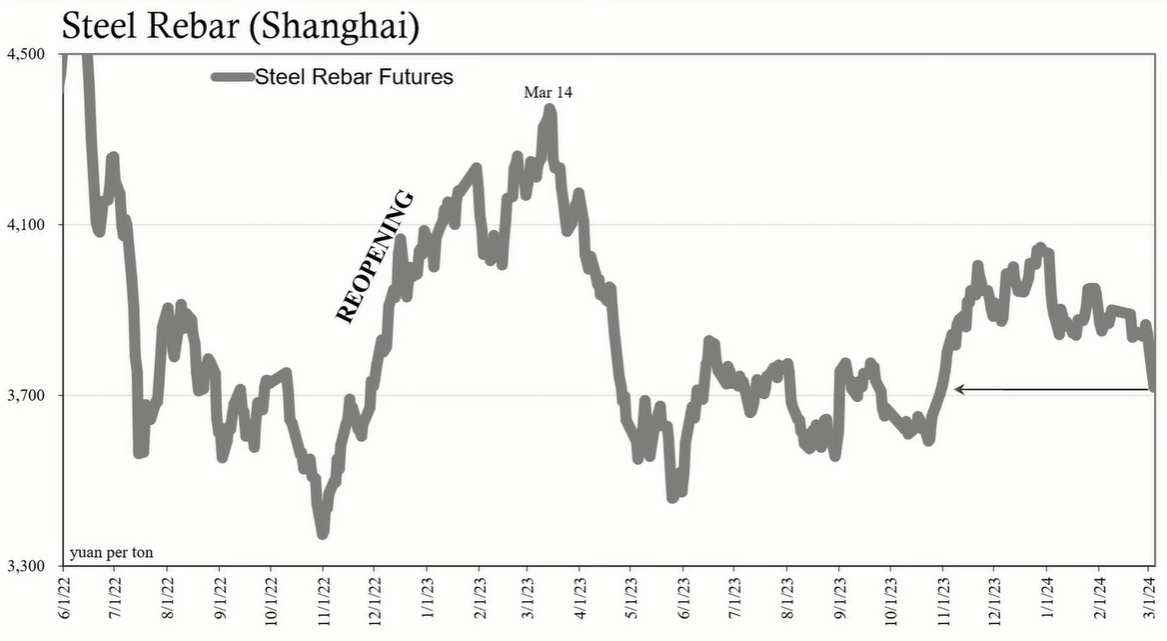

Commodity prices have taken a hit, with iron ore prices plunging to their lowest since the previous summer, and Shanghai rebar steel prices reaching their weakest point since last October. The decline in these commodities is alarming given the supposed robustness of the US economy and suggests that the Chinese government's building and stockpiling efforts have not triggered the anticipated Keynesian multiplier effect in the broader economy.

The crisis in China's property sector and banking system is not confined within its borders. The global economy faces risks from China's financial instability, with potential fire sales of assets by Chinese firms that could affect international markets. Additionally, the reduction in Chinese demand for foreign goods may further strain international trade relations.

Despite aggressive fiscal and monetary measures, China's economy shows little sign of a turnaround. The PBOC's focus on the banking system has led to a slowdown in direct economic support, in contrast to President Xi Jinping's common prosperity agenda that emphasizes consumer support. Persistent economic contraction and risk-averse banks reinforce a vicious cycle of economic stagnation.

The Chinese government's substantial efforts to counteract the economic downturn are a testament to the gravity of the situation. However, the continuously worsening data suggests that these efforts are insufficient. The real estate sector's decline, the reluctance of banks to lend, and the downward pressure on commodity prices are signs of a deepening crisis with potential repercussions across the global financial landscape. The PBOC's actions, while substantial, appear to be struggling in the face of a broader economic slowdown that is not only a domestic concern but a global one.