China's economy is grappling with a severe credit contraction prompting government measures and raising global economic concerns.

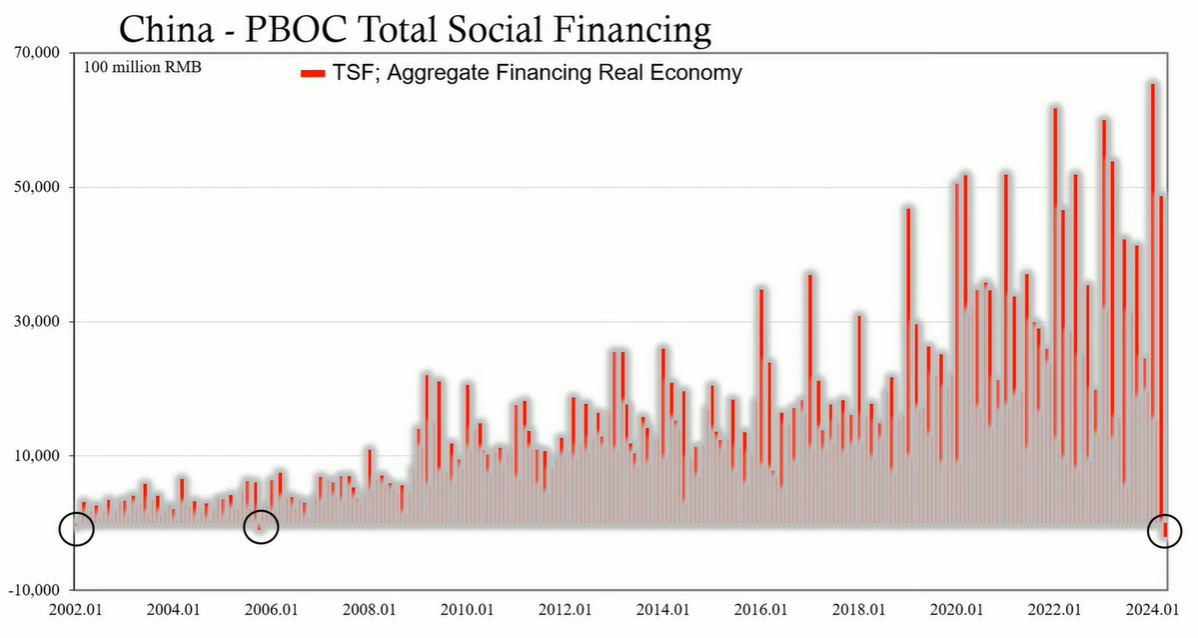

China has experienced a notable contraction in total credit for the first time since 2005, marking the largest decline on record. This unexpected event has been accompanied by a slump in bank loan growth and falling producer prices, signaling deep-rooted issues within the Chinese financial system. The Chinese government, at its highest level, has acknowledged the severity of the situation, which has potential global ramifications.

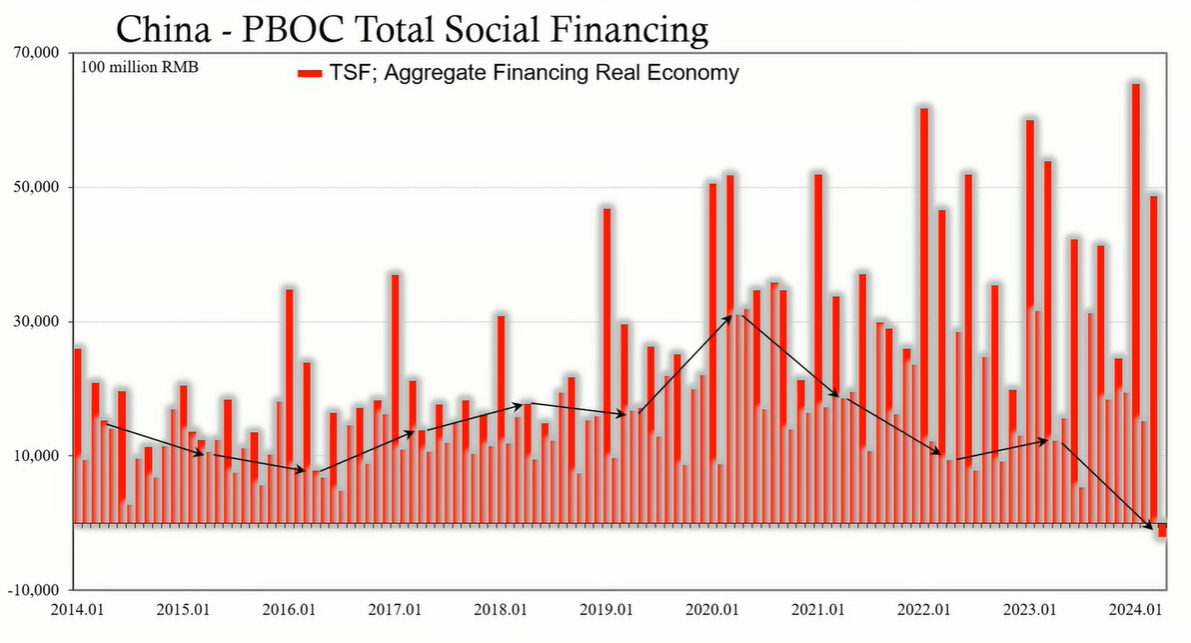

Total social financing (TSF) is a broad measure of credit growth in China, encompassing various financial activities such as bank loans, bond issues, and equity financing. In April 2024, the TSF to the real economy reported a negative flow of 200 billion RMB, a stark contrast to the 4.87 trillion RMB positive flow in March. This represents a 20% year-over-year decrease from April of the previous year and a 19.3% reduction from the first four months of 2023.

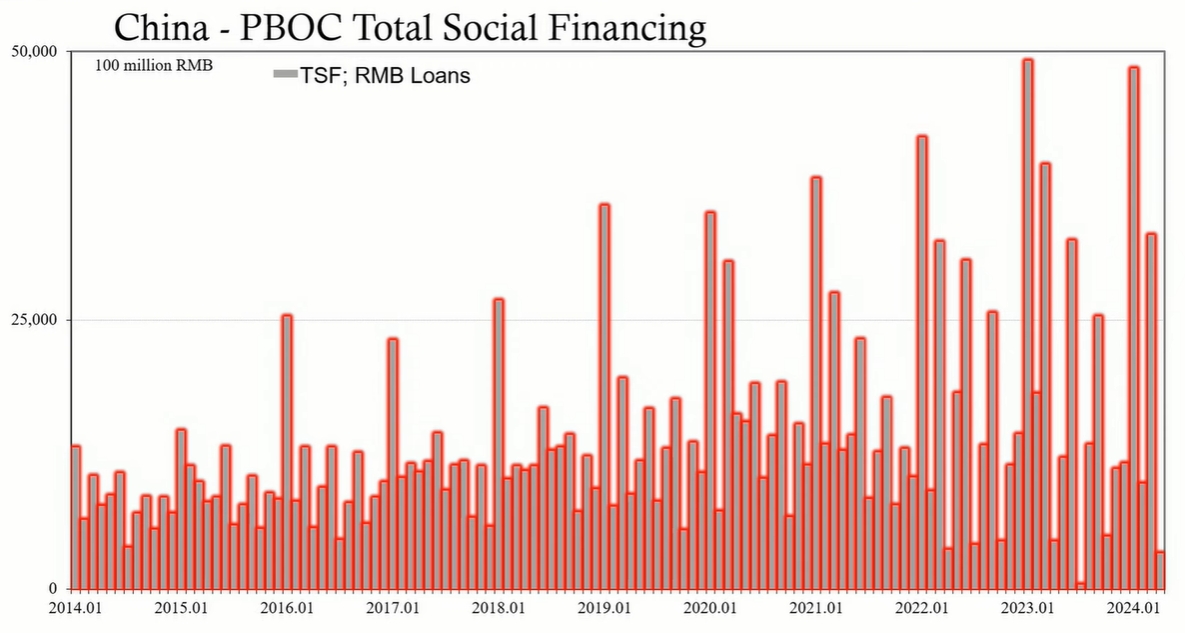

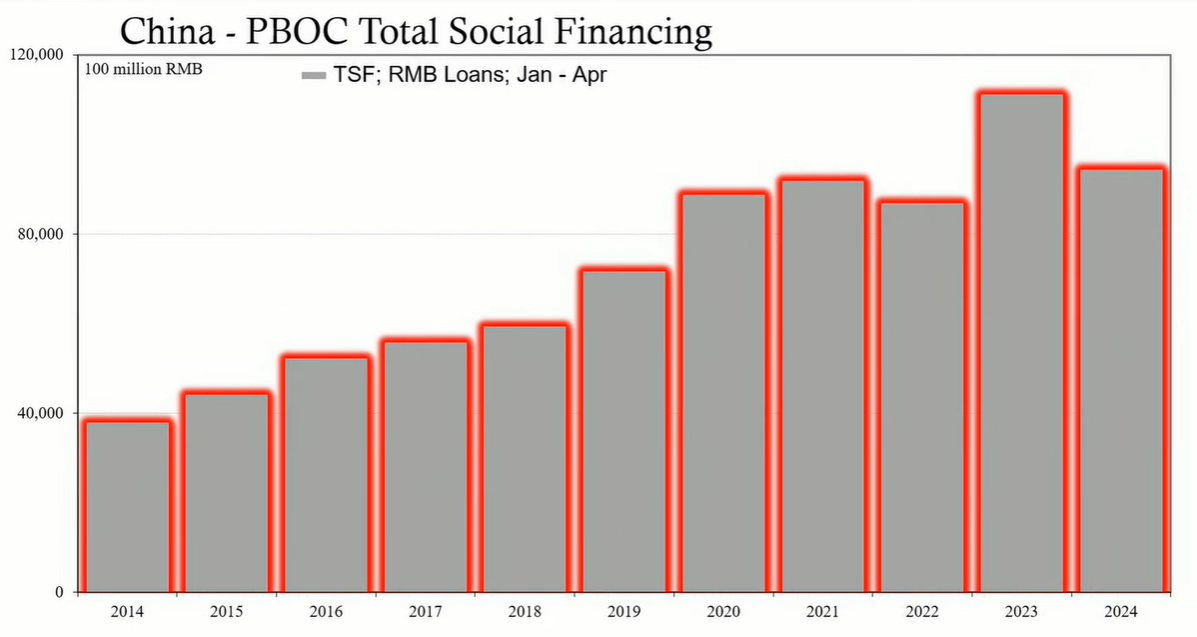

The bank loan growth into the real economy was significantly below expectations, with only 730 billion RMB in new loans. The total RMB bank loans from January through April 2024 reached 9.4 trillion RMB, down 15% from the previous year. The reluctance of Chinese banks to extend loans is attributed to increased risk aversion and balance sheet constraints.

Government bonds have been the predominant source of credit in the system. However, the Chinese government has scaled back on debt issuance compared to the final months of the previous year, exacerbating credit scarcity within the market.

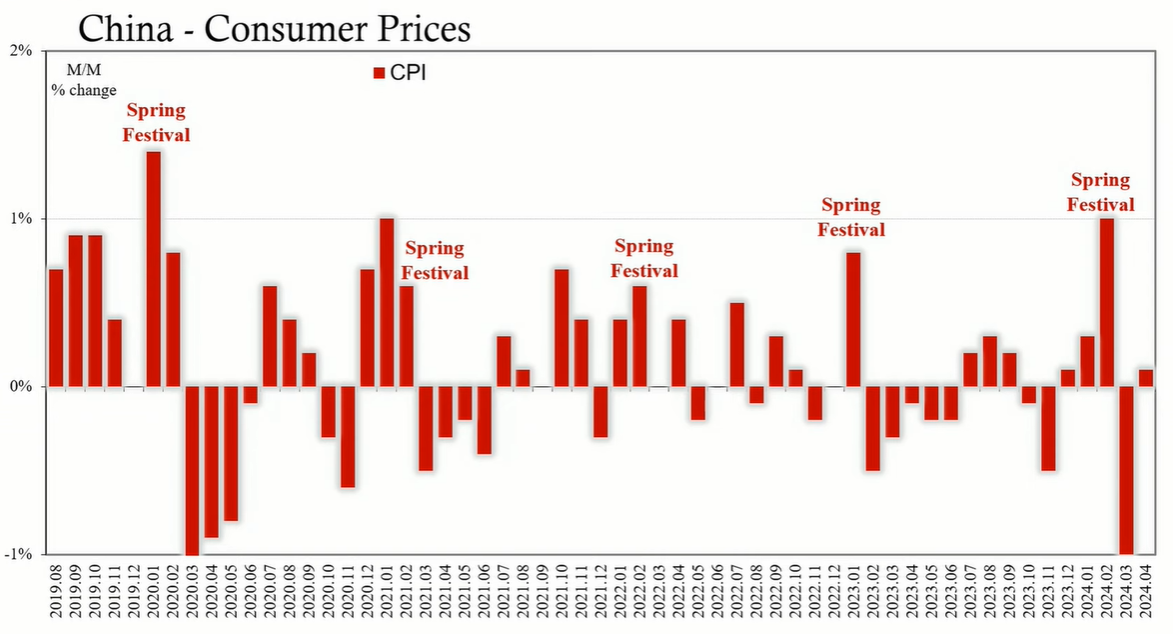

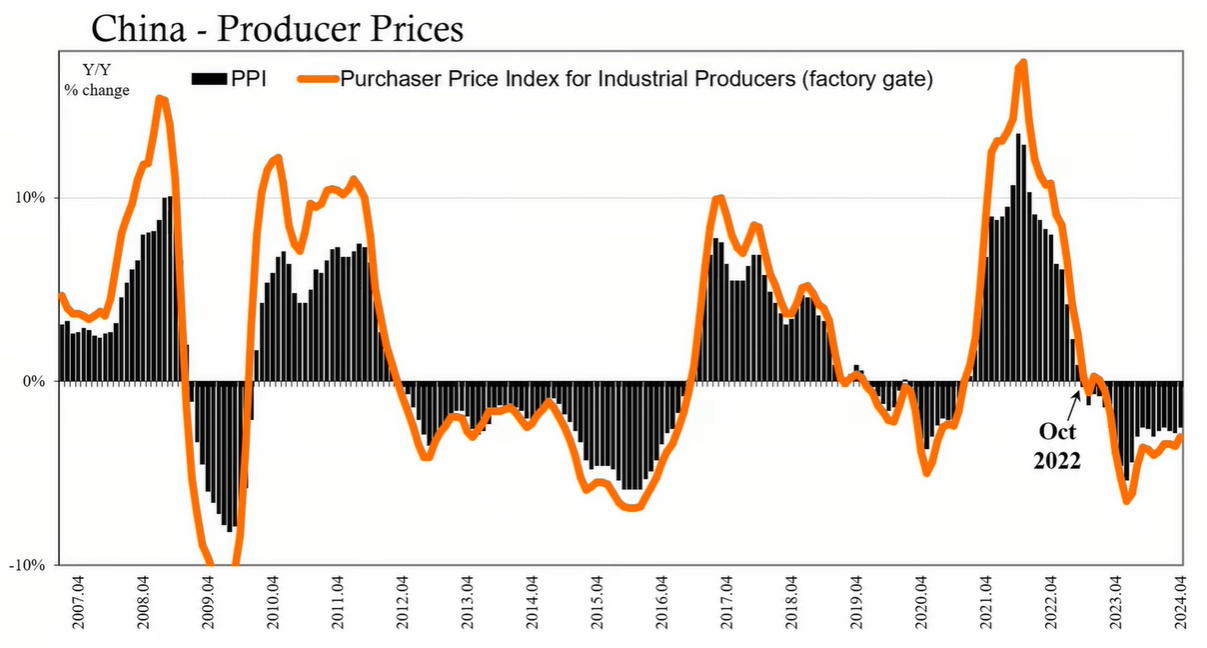

China's Producer Price Index (PPI) increased by only 0.1% while the Consumer Price Index (CPI) rose by 0.3%, indicating minimal inflationary pressures due to weak demand. The PPI has seen a six-month consecutive decline, with a 2.5% year-over-year decrease, signaling a downturn in industrial production and export demand.

The deflation in China's producer prices contributes to global price deflation, affecting economies worldwide. European officials have raised concerns about the influx of heavily subsidized Chinese exports, which could disrupt local markets and lead to a deflationary spiral. The Chinese government's response indicates a difficult internal economic climate that leaves little room for external accommodation.

In response to these challenges, China's Politburo has signaled a new campaign to rekindle growth, acknowledging the need for more aggressive measures. They have proposed using policy tools such as interest rate cuts and reserve requirement reductions, suggesting a grave economic outlook.

The Chinese stock markets have initially reacted positively to government statements, with significant gains in major indices. However, the currency and bond markets have shown only brief optimism before reverting to previous trends, indicating skepticism about the effectiveness of government interventions.

The contraction in China's credit system and the associated economic indicators suggest a continuing struggle within the Chinese economy. The attempt to offload excess production globally is a clear sign of domestic overcapacity and weak demand. This situation has far-reaching implications, contributing to global economic challenges and potentially exacerbating issues such as stagflation. The Chinese government's willingness to implement more drastic measures reflects the gravity of the current economic situation.