China's banking sector is facing unprecedented turmoil, marked by a record low in lending growth and a struggling property sector.

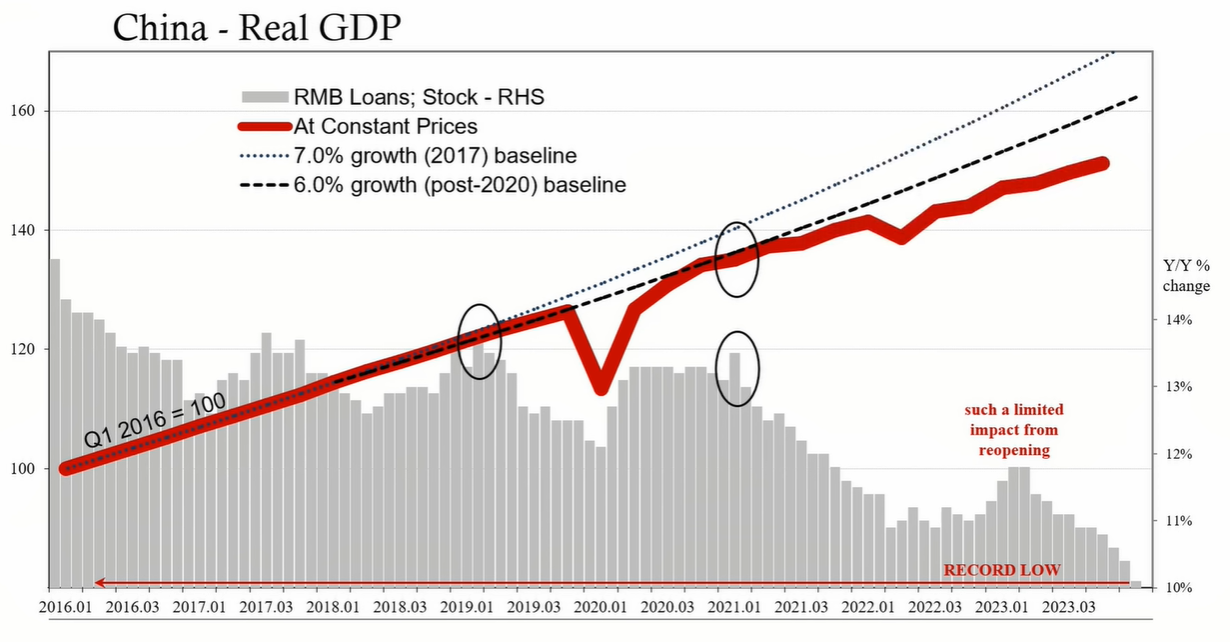

Recently released data from China reveals an increasingly precarious economic situation. The growth of Chinese bank lending has hit a record low, with a significant drop in new household loans. This decline is occurring amidst a backdrop of potential defaults by property developers, both domestically and internationally. This financial instability comes at a time when the government appears to be struggling to implement effective measures to stabilize the economy.

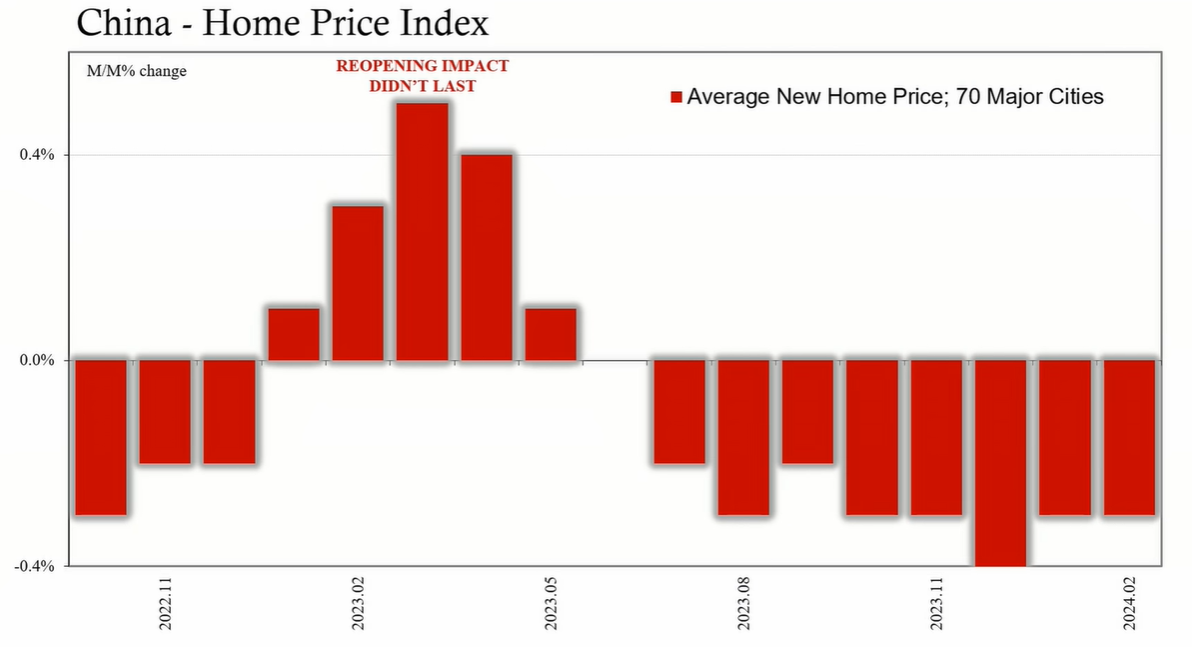

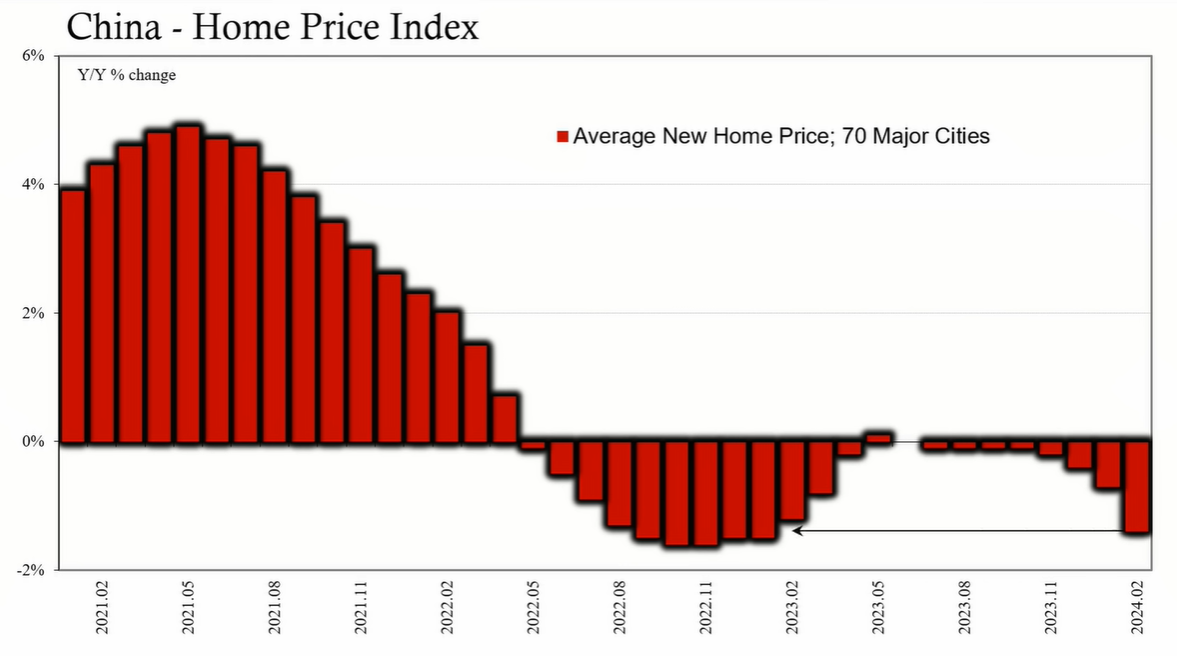

The property sector in China, which is closely tied to household spending and savings, is exhibiting signs of distress. According to the National Bureau of Statistics, home prices have decelerated, with the 70-city price index dropping by 0.3% month over month, paralleling the decline seen in January. Year over year, prices have fallen by 1.4%, marking the worst performance since the post-lockdown period.

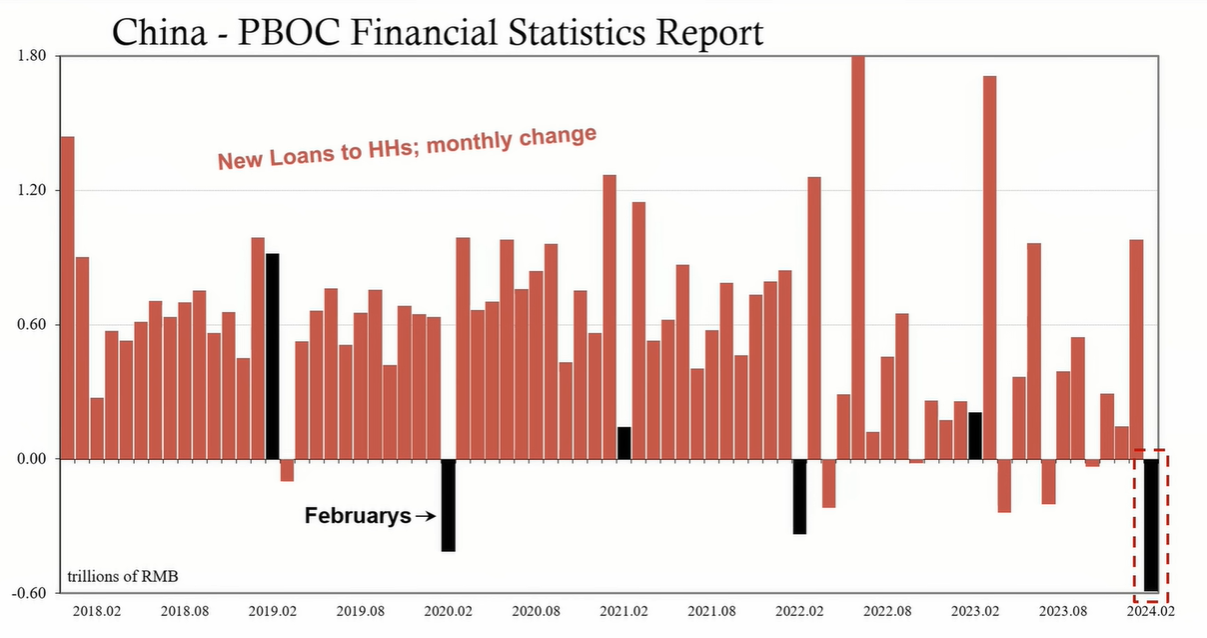

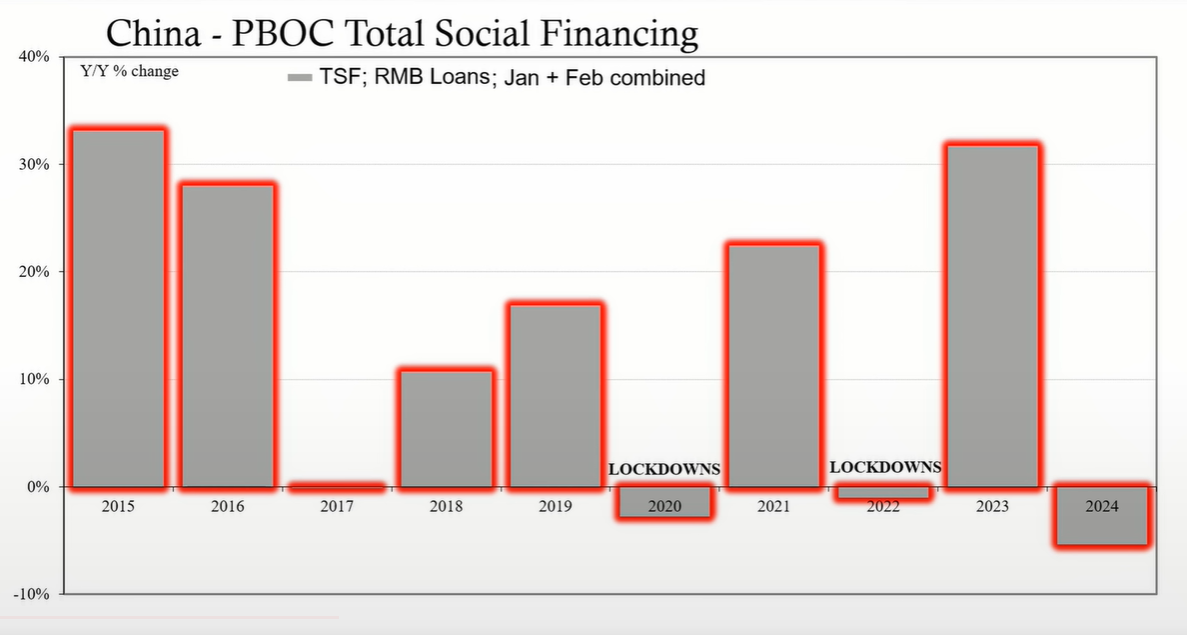

The People's Bank of China (PBOC) delayed the release of financial statistics, which when finally published, highlighted concerning trends. The growth rate of RMB loan stock has decelerated to 10.1%, another record low. Household loans, critical for the property sector, saw a record monthly decline of 590.7 billion RMB in February, erasing a previous increase in January. This trend suggests a lack of confidence in the property market and a reluctance to engage in new mortgage lending.

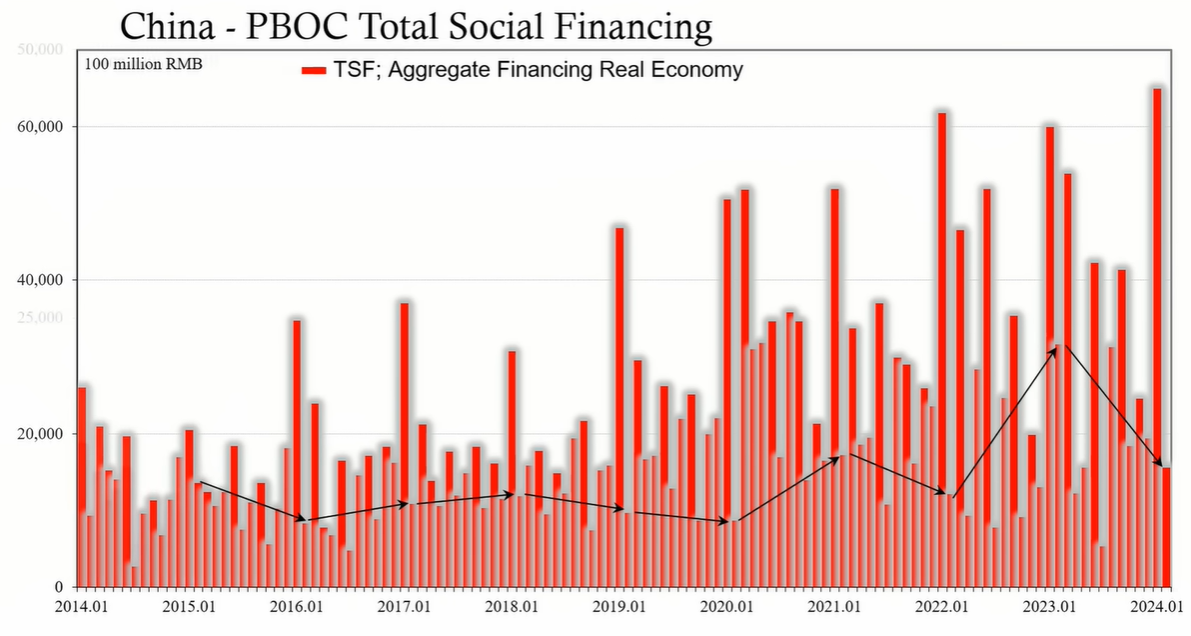

Total social financing, which includes all credit flows in the system, was only 1.56 trillion RMB for February, a 51% decrease compared to the previous year. The banking sector's reluctance to lend, despite government stimulus efforts, questions the efficacy of the PBOC's transmission mechanisms.

Major real estate developers in China continue to struggle. China Vanke, once an investment-grade developer, has seen its bond values plummet, indicating market skepticism about its debt repayment capabilities. Moody's downgraded the company to junk status, with S&P and Fitch likely to follow suit. Chinese banks are becoming increasingly defensive, potentially facing a surge of bad loans and the prospect of becoming property owners, a situation reminiscent of the financial crises experienced by Western banks in the past.

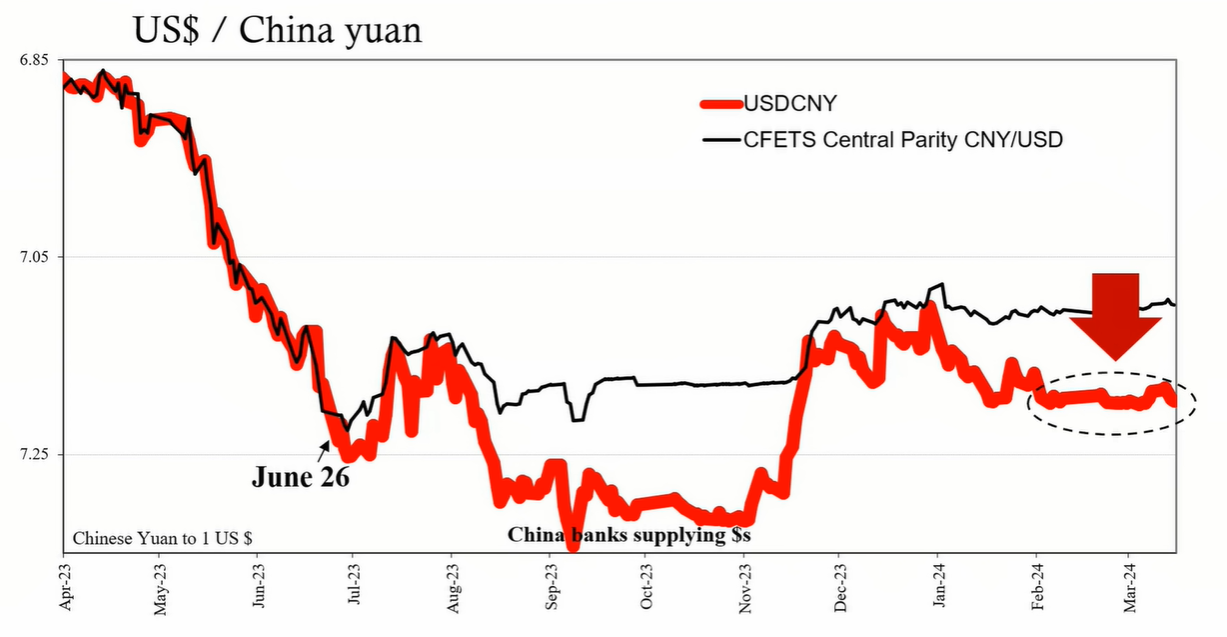

The Chinese yuan has remained suspiciously stable at around 7.20 to the US dollar, suggesting possible currency manipulation by the central bank. The bond market is also reflecting investor demand for safety, with low yields on government bonds.

The National People's Congress set a modest economic growth target of around 5% for the year, acknowledging the difficulty of achieving this goal. The government has pledged to issue ultra-long bonds worth 1 trillion RMB but continues to rely on familiar strategies that have yet to yield positive results.

Amidst the economic turmoil, Xi Jinping has further consolidated his power, breaking with party traditions and norms. The absence of a third plenum to discuss long-range economic reforms and the cancellation of a traditional press conference signal a departure from transparency and collective leadership.

The confluence of reticent banks, a faltering real estate sector, and a lack of effective government strategies points to China as a significant risk to the global economy. The risk of a disorderly economic unwind in China has become non-trivial. With the government's current approach yielding little success, the future remains uncertain, and the possibility of a deepening crisis cannot be ruled out.