The stakes are rising.

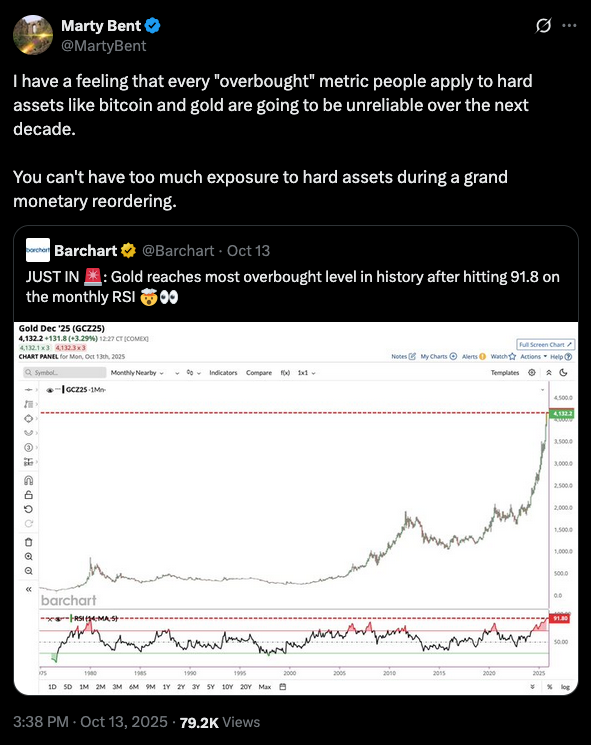

With gold soaring this week, many people are pointing to the charts and proclaiming that its run is about to end because it is entering "overbought" territory according to some metrics like RSI. Bitcoin is currently sitting on the sidelines while the precious metal rallies, but I'm not worried about this. It's pretty typical price action. Gold leads, bitcoin follows. However, we're not here to discuss this particular correlation analysis today.

What I want to posit is exactly what I expressed in the tweet above; I think people who are looking at these "overbought" metrics are going to be in for a surprise over the next decade because they're using metrics that were suited for a particular market regime. That market regime lasted for many decades, but it is becoming clear that something is different in this market. We touched on this last month when we covered the rapid increase in China's gold held on warrant at the Shanghai Gold Exchange.

On Friday of last week I sat down with Vince Lanci, who runs vblgoldfix.com, to discuss this topic (among many others) and what it signals to him, and he expanded on what we said in last month's letter on the subject beautifully. Long story short, China has been building up a war chest of gold for the last fifteen years because in the aftermath of the 2008 crisis they were bothered by the bailouts and fiscal spending. As one of the largest holders of US treasuries, China was uneasy about the growing debt in the US and decided to begin the process of diversifying away from treasuries as a reserve asset. They built up a very large base of gold reserves between 2010 and today, got buy in from other countries who realized the risk of holding US treasuries was higher than they previously thought after Russia's assets were frozen in 2022, and have opened up their parallel settlement network to use as an alternative.

By putting their gold on warrant and creating a gold vault network across BRICS countries, China can do trade with counterparties using the yuan and those counterparties can immediately take their yuan and convert it to gold. For a more in-depth explanation, I recommend you take the six minutes to watch this clip from our episode when you're finished reading.

If this is what is happening right now, and I am inclined to believe that it is, I think we're at the beginning stages of this rush to hard assets. Even if you're a country not in the tight-knit BRICS network, if you realize that this is going on you're only move is to begin loading up on gold in an act of self preservation.

The BRICS countries are currently calling the bluff of the dollar reserve system. The debasement trade has entered the popular lexicon. And the efficacy of the US's perceived leverage is being called into question. This was made abundantly clear over the weekend with Trump's flip flopping on the rare earth metals negotiations.

Using traditional metrics and heuristics to navigate these waters will be a futile exercise. Fiat is being called into question and many global superpowers are retreating to neutral hard assets.

The bitcoin price isn't moving much now, but it will most definitely benefit handsomely from this transition. Especially when you consider the fact that it is a strong counter-move to BRICS countries moving to a gold settlement network.

Vince Lanci delivered a sobering assessment of Bitcoin's current trajectory in our latest conversation. Drawing from his decades of experience watching similar dynamics play out in precious metals markets, Vince argued that the US government is attempting to co-opt Bitcoin through the ETF structure. He explained that by creating spot Bitcoin ETFs, approximately 70% of Bitcoin's liquidity shifted from international markets into US-controlled venues. This wasn't accidental—it's the same playbook used with gold futures in 1974. The government doesn't need to own Bitcoin to control it; controlling the liquidity pool is sufficient. Through margin requirements, settlement rules, and regulatory mechanisms, the US now dominates Bitcoin's price discovery.

"If you can't kill it, you demonize it. If you can't demonize it, you co-opt it." - Vince Lanci

Vince emphasized that this control doesn't mean Bitcoin will fail, but rather that its path forward has fundamentally changed. The US liquidity network is so powerful that even without malicious intent, it naturally becomes the dominant force in any market it touches. For Bitcoin, this means the derivative price now matters more than spot, enabling the same rehypothecation schemes that suppressed gold for thirty years.

Check out the full podcast here for more on gold market manipulation, China's BRICS strategy, and Trump's monetary policy.

US Government Transfers 667.6 Bitcoin to New Wallet

Elon Musk Calls Bitcoin Based on Energy

Bitcoin Adoption Accelerates in Underserved Areas

Hyperliquid Whale Shorting Linked to Insider Leak

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

You know the story of bitcoin’s market cycles... euphoric blow-offs, brutal crashes. Maybe not anymore. The Bitcoin Checkpoint takes a deep look at how the 2023–2025 cycle has rewritten market structure and why these changes could be permanent.

Inside, you’ll find analysis of record-low volatility, ETF flows absorbing billions monthly, and why long-term holders remain in control with $1.3T in unrealized profit. Plus, download now for automatic access to the event where James Check took a deep dive into the report himself.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Off to soccer practice.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: