Rising "Buy Now, Pay Later" usage and declining credit balances signal increasing financial pressures and a potential economic downturn.

A noticeable decline in revolving credit balances coupled with an increase in alternative financing methods, such as "Buy Now, Pay Later" (BNPL), indicate growing economic vulnerabilities and suggest an impending slowdown.

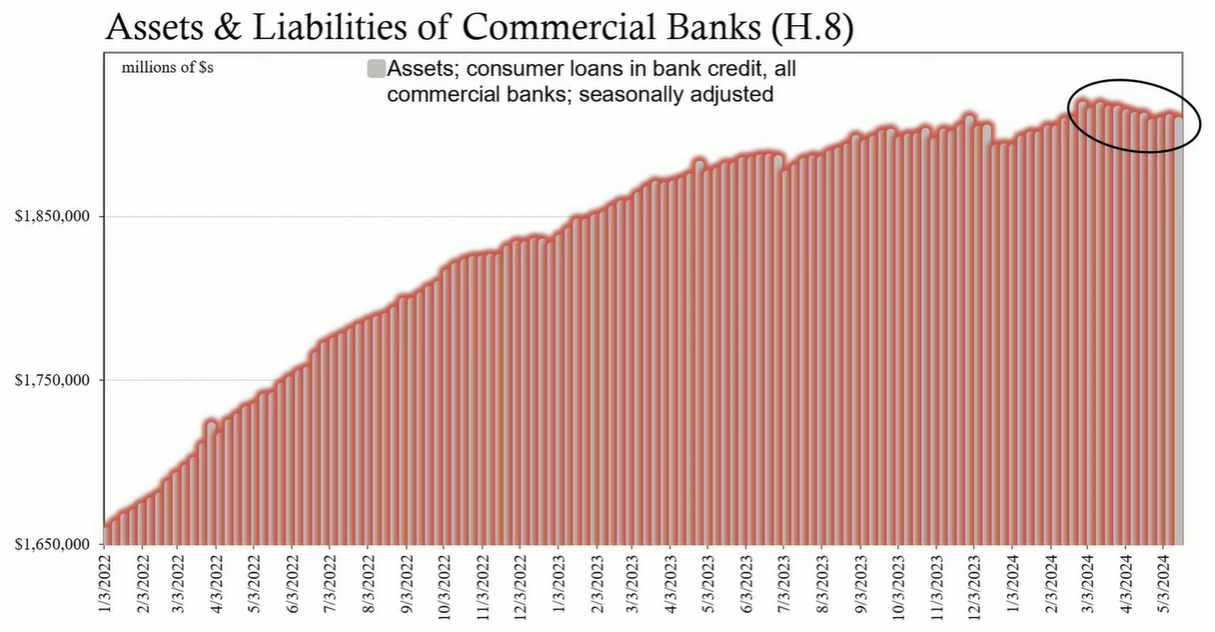

Over the past two months, there has been a notable decline in revolving credit balances lent by commercial banks. Revolving credit, primarily consisting of credit card loans, is a reliable cyclical indicator of financial health. A decrease in such balances can point to a lack of confidence among consumers and financial institutions.

Simultaneously, banks have demonstrated a penchant for safety and liquidity by significantly increasing their holdings of U.S. Treasury and agency debt. This shift toward more secure assets further underscores the cautious stance of financial institutions in the current economic climate.

A NerdWallet survey conducted by The Harris Poll, involving 2,061 adults in April, revealed that 25% of Americans have used buy now, pay later (BNPL) services, and 10% used cash advance apps. Significantly, one-third of Americans turned to credit cards to pay for necessities, not for rewards, but out of financial necessity, with 16% doing so because they lacked the money for these expenses.

The NerdWallet survey also found that 12% of respondents expect to use credit cards for necessary expenses in the next twelve months due to inadequate funds. Additionally, 37% have incurred late fees over the past year, indicating a trend of increasing financial duress among consumers.

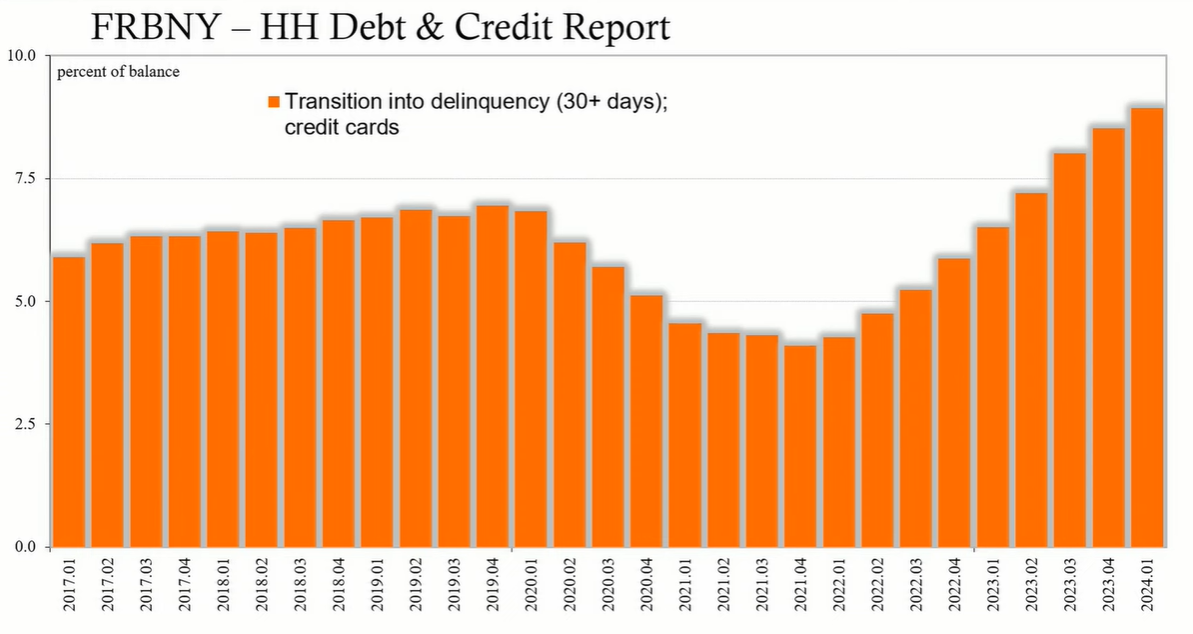

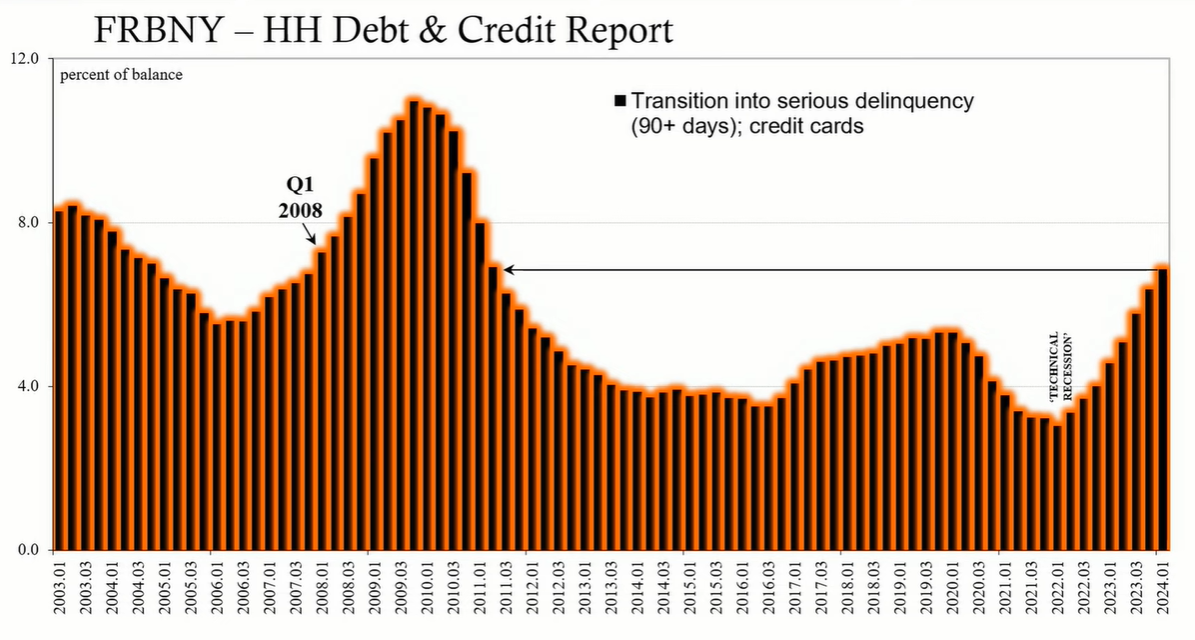

Credit card delinquencies have reached new highs not seen since late 2011. According to Bankrate.com, 44% of credit card holders carry balances month-to-month, and delinquency rates have surpassed pre-pandemic levels, suggesting that the issue is not merely a return to normal but an escalation.

Banks are responding to these risk factors by limiting credit extensions. Federal Reserve data shows a significant downturn in consumer revolving credit beginning in March 2024. This trend, coupled with increased delinquency rates, may signal banks' anticipation of a worsening economic situation.

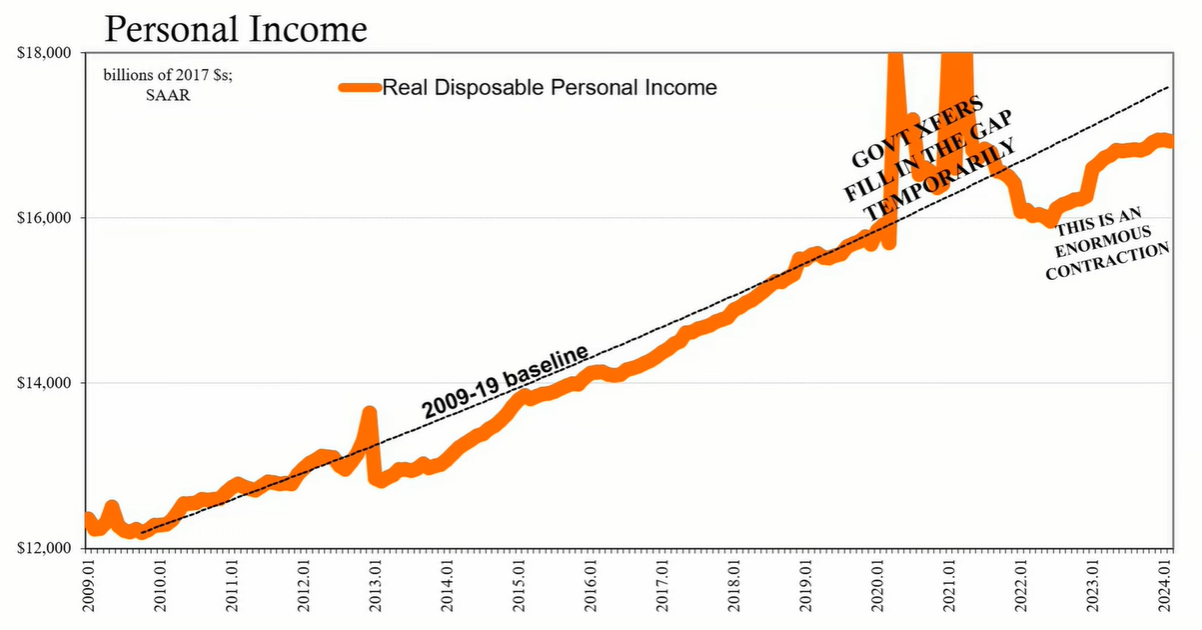

Despite claims of a strong labor market, income statistics suggest otherwise. Consumers' incomes have not kept pace with their financial obligations, forcing them to rely heavily on credit and alternative payment methods. This economic strain is reflected in the declining use of discretionary funds and increased patronage of discount retailers such as Walmart.

The convergence of declining revolving credit, growth in alternative financing, and rising delinquency rates paints a concerning picture of the current economic health. With banks exhibiting risk-averse behavior and consumers increasingly turning to credit for basic needs, the data points to a weakening economy with limited options for financial relief.