The demand is strong.

Over the weekend, Jordi Visser put out a piece titled Bitcoin's Silent IPO: Why This Consolidation Isn’t What You Think that put forward the case that the current chopsolidation we've been experiencing is actually incredibly bullish for bitcoin because the price is holding up remarkably well despite the fact that OG bitcoin whales are selling coins by the hundreds of thousands. I highly recommend you give it a read.

If you've been listening to the podcast throughout the year, this shouldn't come as a surprise to you. Over the last three quarters, James Check has joined us to give a quarterly update on the state of the market from the perspective of onchain data. He has been consistently highlighting that long time bitcoin holders have been taking advantage of price action above $100,000 to lock in life changing profits. It is frustrating to many who wish to see the parabolic blow-off-top bull run that they have been conditioned to believe is a bitcoin rule of law. However, as Jordi notes in his piece, this is extremely bullish because the price is holding up well AND bitcoin supply is (theoretically) being distributed into a wider base of individual holders who each have different circumstances, time horizons and risk tolerances. Ensuring that the base of bitcoin holders are more isolated from each other and decreasing the chance that a few large holders can move the price materially if they want to in the future.

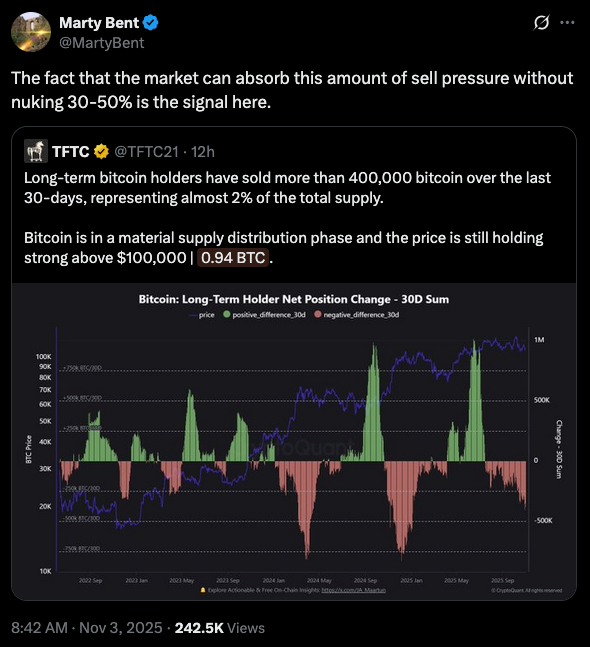

In the month of October, long-term holders off loaded more than 400,000 bitcoin, or around ~2% of the total supply. Despite that, the price has held the line at $105,000 (so far). This is an insane amount of selling pressure, the likes of which would have tanked the market 30-50% in past cycles when the market isn't on the way up. As you can see from the chart above, long-term holders sold more at two points in the last year. However, both of those points were when the price was screaming higher and the LTHs were selling into strength. It's pretty safe to say the last three months haven't been particularly "strong" for the bitcoin price.

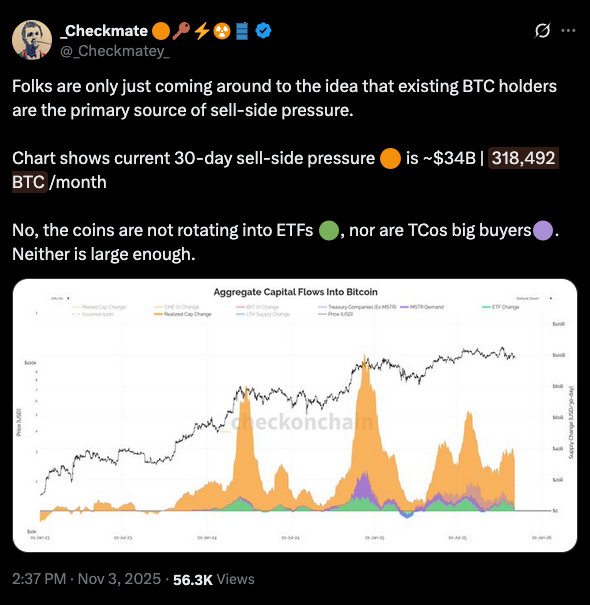

Much of the discussion around the charts like these that have been shared on X over the last week has revolved around the question, "Who is selling and why are they selling now?" I won't pretend to have an answer to either of those questions that goes beyond, "individuals or companies that have held on since bitcoin was a three or four digit asset looking to take some risk off the table." The more interesting question is, who is buying? Many are suspecting it's the ETFs and or bitcoin treasury companies, but as our friend James points out, this is not the case. At least not at the degree to which coins are coming to market.

The buy side is being driven by spot buyers who do not have to publicly disclose their buying activity. This is another question I won't be able to definitively answer, but it is fascinating to watch the consistent bid under this deluge of sell pressure. My money is on smart, patient money that knows that bitcoin represents a paradigm shift and is eager to accumulate as much at relatively discounted prices.

We'll see how long this persists.

Gary Brode delivered a vindication of tariff policy that directly challenges the economic establishment's fearmongering. When tariffs were implemented roughly six months ago, mainstream economists warned of devastating inflation and economic collapse. None of it happened. Gary pointed out that goods inflation remains stable, with no signs of the predicted disaster. The academic models these economists relied on (like Porter's theory of competitive advantage) work beautifully in classrooms but fail to capture real-world dynamics.

"We're just not seeing the kind of goods inflation that indicates any kind of disaster or any kind of massive slowdown." - Gary Brode

The explanation is straightforward: consumers substitute goods when prices rise, and more importantly, domestic manufacturing increases to meet demand. Gary noted that companies have announced trillions in new U.S. manufacturing capacity specifically to avoid tariffs. The result? American jobs return, supply chains strengthen, and the predicted economic apocalypse never materializes. The fiat economists got it wrong, and the data proves it.

Check out the full podcast here for more on rare earth supply chains, dollar weaponization and Bitcoin's path to $1M.

Trump Prioritizes US Crypto Leadership

Fed Injects $22 Billion into Banks

Central Banks Dump Treasuries for Gold

China Builds Gold Backed Dollar Escape

Sacks Calls Crypto Future Industry

Fidelity Enables Bitcoin Withdrawals

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I'm becoming a train guy again.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: