This is a truly disgusting display of prosecutorial malice.

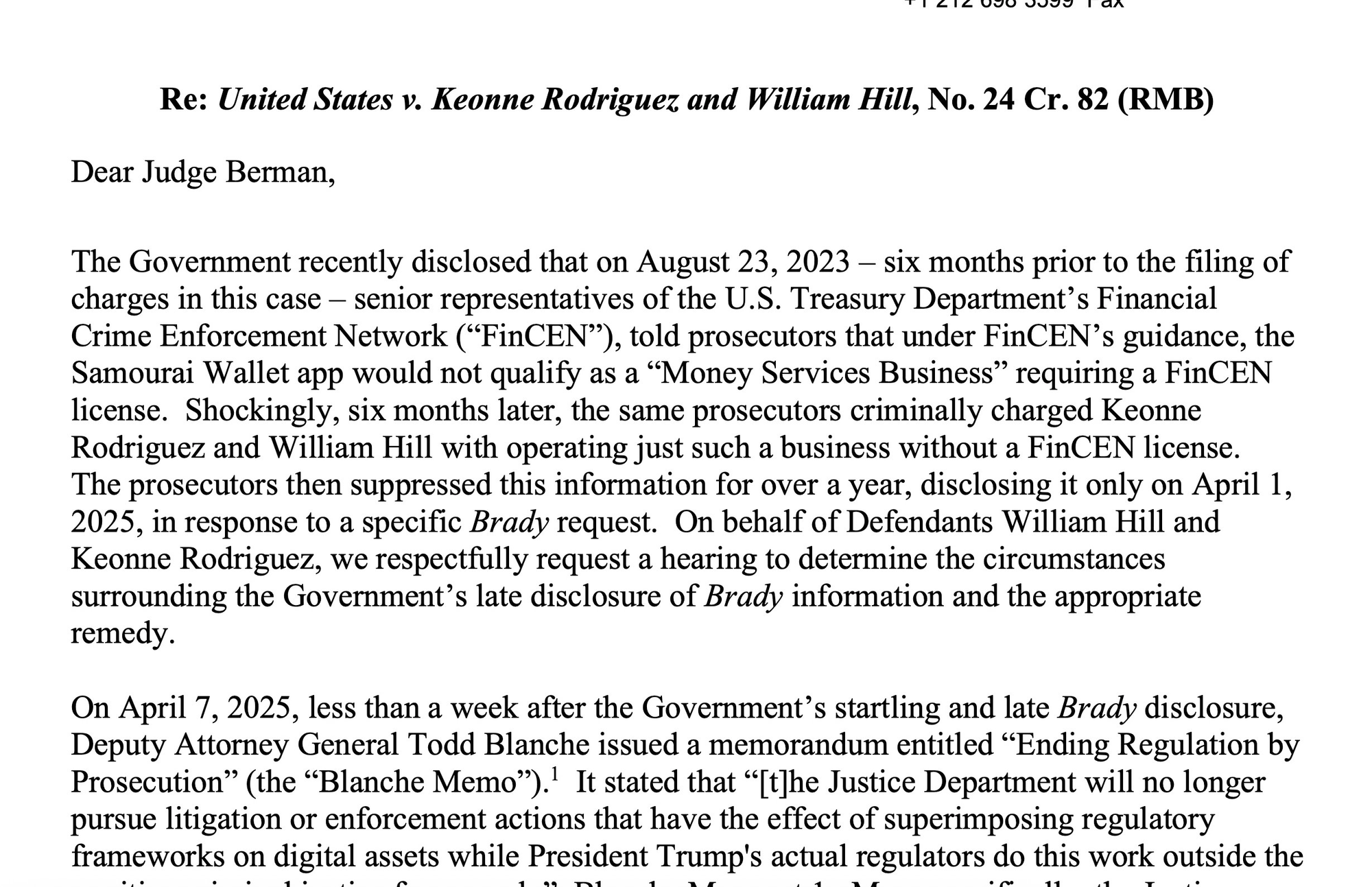

Earlier today we were made aware of a bombshell development in the case against Samourai developers Keonne Rodriguez and William Hill. For those who are unaware, the Department of Justice under the Biden administration arrested Rodriguez and Hill, co-founders of Samourai Wallet, and charged them with operating money services businesses without a proper FinCEN license. Today's bombshell revealed that that same Department of Justice reached out to FinCEN six months before filing charges in this case to ask whether or not they believe Samourai Wallet was operating as a money service business, to which FinCEN responded that they did not believe that they were because they never possessed the private keys that controlled funds in individual wallets.

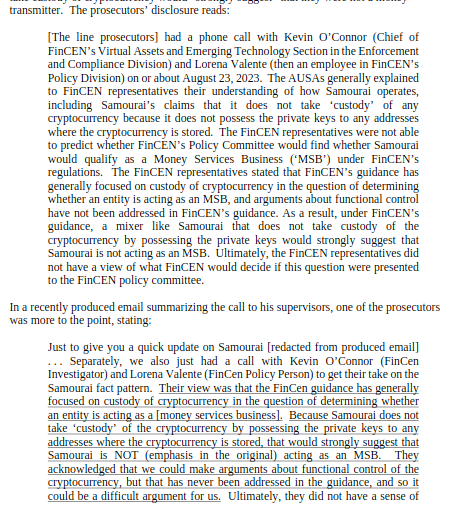

Here's the exact correspondence in the disclosure:

This is not only a bombshell, but it is truly disturbing and outright disgusting. The prosecutors in this case should be tried themselves after it is inevitably thrown out due to the obvious Political targeting that underlies this case. And it also makes one wonder just how close we came to a complete all-out frontal attack on the industry had Kamala Harris been elected president last November. The charges against Rodriguez and Hill should be dropped immediately and an investigation should be launched against the SDNY and the team of prosecutors behind this case.

Let's make one thing clear. Samourai Wallet was an incredible product that existed to ensure that bitcoin users could transact in a way that preserved their financial privacy. They designed their product in a way that ensured they never had control of funds and users always possessed the private keys used to move their UTXOs from one address to another.

Financial privacy isn't a crime. It is something that should be celebrated and protected at all costs. Especially in a world that is becoming hyper-digital, hyper-surveilled, and hyper-politicized. We need financial freedom and financial privacy now more than ever. Hopefully the termination of the case against Keonne Rodriguez and William Hill will be seen as the first step in the right direction toward a future in which these ideals are what people strive for and ultimately upheld.

Last week's conversation with Brian Morgenstern, head of policy at Riot, highlighted serious concerns about the prioritization of stablecoin legislation. I argued that the market has already found efficient solutions through products like Tether, which gained global dominance precisely because of its ease of use and unrestricted access. Circle and other US-centric issuers appear to be pursuing regulatory frameworks that could create an artificial competitive advantage over Tether's proven model.

"I don't think they should have a regulatory moat. I think it should be more of a free market." - Brian Morgenstern

This regulatory capture could backfire spectacularly, potentially driving global dollar stablecoin usage toward BRICS alternatives. Brian acknowledged these concerns, noting that while he maintains good relationships with Circle representatives, regulatory moats aren't the answer. The free market has already delivered working solutions, and the primary regulatory obstacle - SAB 121 - has been addressed through recent Fed guidance changes. If we over-regulate this space now, we risk losing America's dollar dominance in the digital realm at the exact moment when maintaining that supremacy matters most.

Check out the full podcast here for more on Bitcoin strategic reserve priorities, BitBonds, Treasury strategy, and market structure legislation.

Buffett Says All Governments Debase Currency, Fears US Fiscal Policy - via X

Buffett Receives Standing Ovation, Retires After 55-Year CEO Run - via X

Carney Targets US Social Media Free Speech - via X

Trump Tells Welker 2028 Run Was Media Troll, Plans to Turn Over Power - via X

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Excited for a Summer in the lab.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: