The future banking stack is being built out right in front of you.

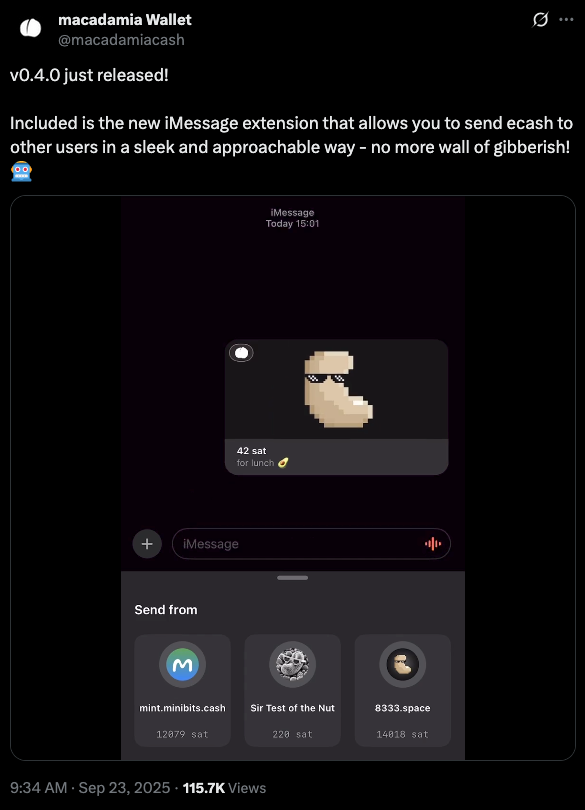

The team at macadamia, a bitcoin ecash wallet built on the Cashu protocol, launched a cool feature yesterday; the ability to send people bitcoin via ecash directly in Apple's iMessage. This is a very slick UX that makes sending bitcoin to people literally as easy as sending a text message.

I tested it out with a friend who didn't have a macadamia wallet yesterday and they were easily able to download the app and claim the ecash in their wallet within a couple of minutes. The experience makes me think that this will be a great way to onboard people to bitcoin in as straight forward a way as possible. Send them ecash via the macadamia extension, they click the link, download the app, quickly connect to a mint, and redeem the bitcoin in a couple seconds. From there, they have an ecash wallet that is interoperable with the lightning network and other second layers connected via the lightning network and can begin accepting bitcoin rather trivially.

I've said it many times in recent months, but the broader "crypto" and tradfi markets are completely missing what is happening on top of bitcoin right now. While everyone is focused on bitcoin treasury companies, stablecoins and real world asset tokenization, bitcoiners are building the future tech stack of the distributed banking system on top of bitcoin. And not only that, the products being built are reaching parity with the UX of fintech products that hundreds of millions of people have become accustomed to.

With bitcoin wallets like macadamia, there is no need to understand the concept of gas fees, whether you're bridging an asset between chains or different roll up schemes, or whether or not your stablecoin will be compatible with the wallet of the person who is looking to receive it. It all just works. You can send ecash from macadamia to pay a lightning invoice and it will just work. And the best part is that you have way more privacy using ecash than you would on most other networks due to the fact that it leverages blinded signatures within the mint. The mint operator, while acting as a centralized custodian, has no idea who is sending or receiving ecash tokens within and out of the mint. It's a beautiful thing.

Pay attention to these Chaumian mint protocols, the wallets and markets built on top of them as they continue to progress.

Jeff Walton argues we're witnessing a fundamental mispricing of risk across global markets. He points to Nvidia trading at 50x price-to-earnings while Bitcoin treasury companies trade at just 1.5x their net asset value, despite holding the world's hardest money. When Walton reprices corporate earnings in Bitcoin terms rather than fiat, he reveals that 99% of companies show declining earnings over time - a sobering reality masked by currency debasement.

"If Chevron had spent 25% of their $70 billion buyback on Bitcoin, the value today would be worth more than their market cap."- Jeff Walton

This insight crystallizes the opportunity cost of traditional capital allocation. Walton emphasizes how companies with massive valuations like Nvidia ($4 trillion market cap) hold just $54 billion in actual capital, creating enormous risk gaps. The market's failure to properly price this gap between inflated valuations and real balance sheet strength represents a ticking time bomb that Bitcoin treasury strategies are positioned to exploit.

Check out the full podcast here for more on Bitcoin treasury M&A strategies, perpetual preferreds, and S&P 500 inclusion dynamics.

BlackRock Fidelity ETFs Hit $2.27B Volume - via X

Plebstyle Launches Quiet 4.8 TH/s Bitcoin Miner - via X

100 BTC Now Needed for Top Treasury Ranking - via X

Indeed Job Postings Drop 8% Year Over Year - via X

Global M2 Money Supply Nears All-Time High - via X

This extended $75k–$110k range has caused some to wonder if the bull run is exhausted. But what if the on-chain evidence tells a totally different story? Join James Check (Checkmate of Checkonchain) and Connor Dolan for a data-driven discussion on what a maturing bitcoin market means for the road ahead.

James will break down:

On-chain metrics show bitcoin has crossed the Rubicon—from a nascent store of value into a true institutional-grade asset class. This session will help you understand what that means for this bull market and beyond—and how you might position yourself appropriately.

Tuesday, September 30th at 3PM CT — online, free to attend.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.xyz.

Final thought...

Getting better at writing when I really don't want to.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: