This analysis by Tuur Demeester ventures beyond Bitcoin's surface-level price trends to uncover the multifaceted forces shaping its recent rally.

Bitcoin's recent performance has been remarkable, with a 67% increase compared to the previous year. In August, the price was at $26,000, and it currently stands at $43,000. This report will delve into the factors behind this surge and also examine the broader global macroeconomic landscape. Additionally, we will explore the claim made by a Belgian newspaper about Bitcoin's halving and ETFs being excessively priced in.

Bitcoin's growth is not only attributed to its intrinsic properties but also to global economic conditions. The Belgian newspaper's assertion that Bitcoin's halving and the anticipation of ETFs are already priced in lacks substantial evidence, especially when considering the low search interest for Bitcoin and the lack of selling from long-term holders. Bitcoin's upcoming halving is expected to significantly reduce the daily supply from 900 to 450 Bitcoin, leading to a tightening in annual inflation from 1.6% to 0.8%, making it harder than gold.

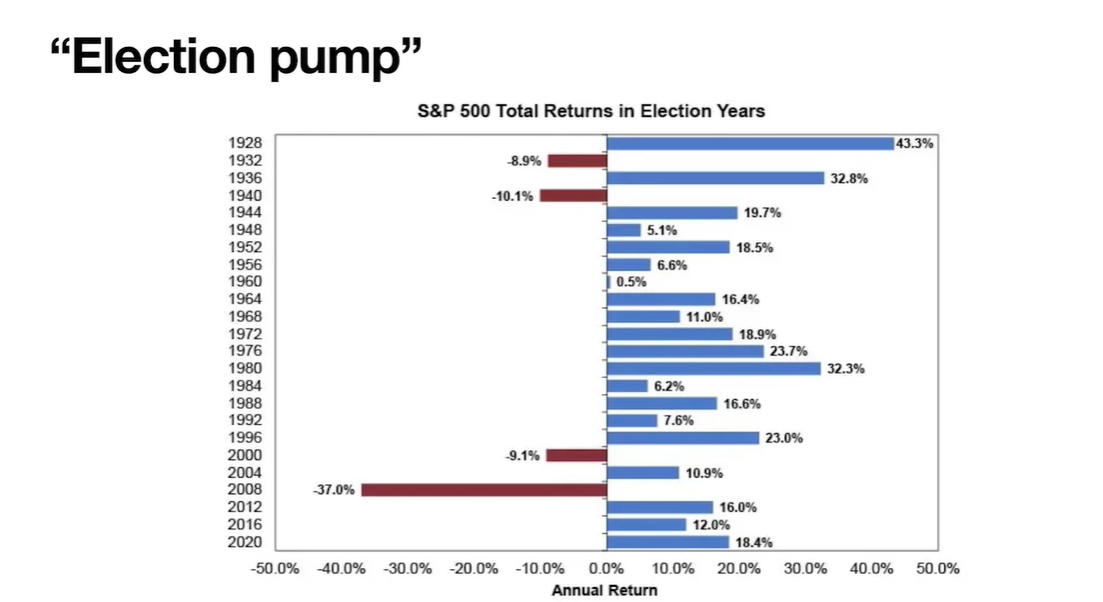

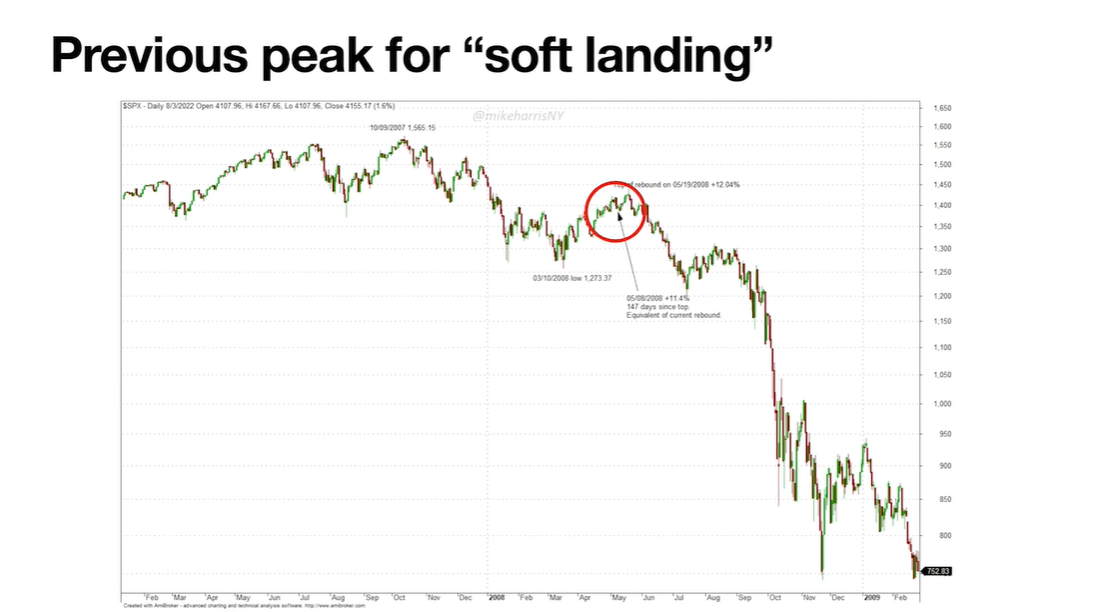

The global economic condition has mixed signals. On the one hand, there are expectations of a soft landing in the economy, potentially influenced by political factors such as the upcoming elections. Stock markets appear to be in a parabolic uptrend, and there is a perception of disinflation. However, this could be wishful thinking, as historical data show that such optimism does not necessarily prevent economic downturns.

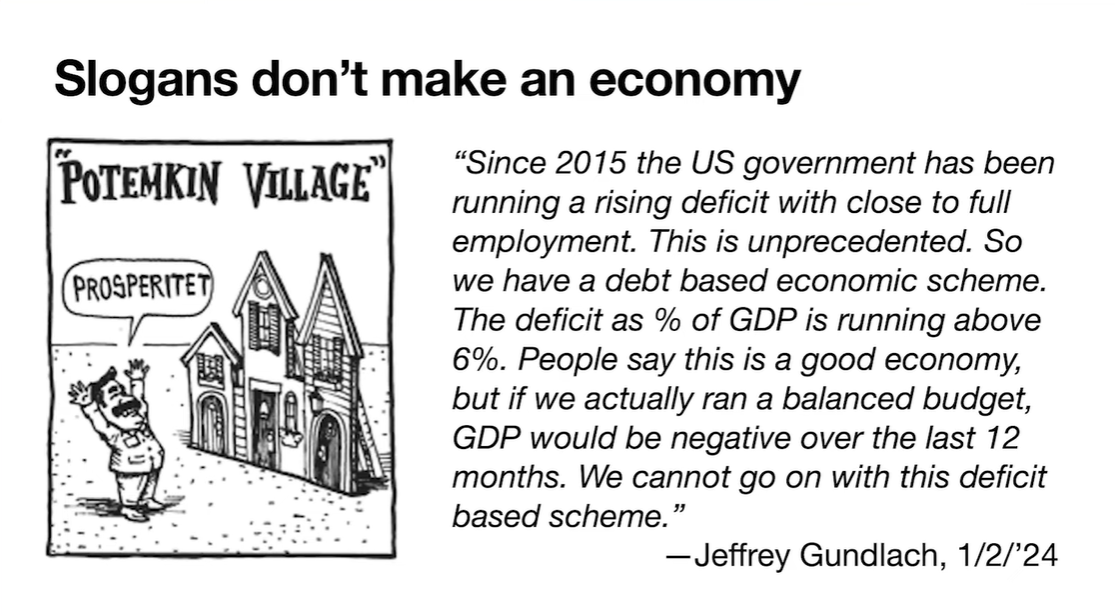

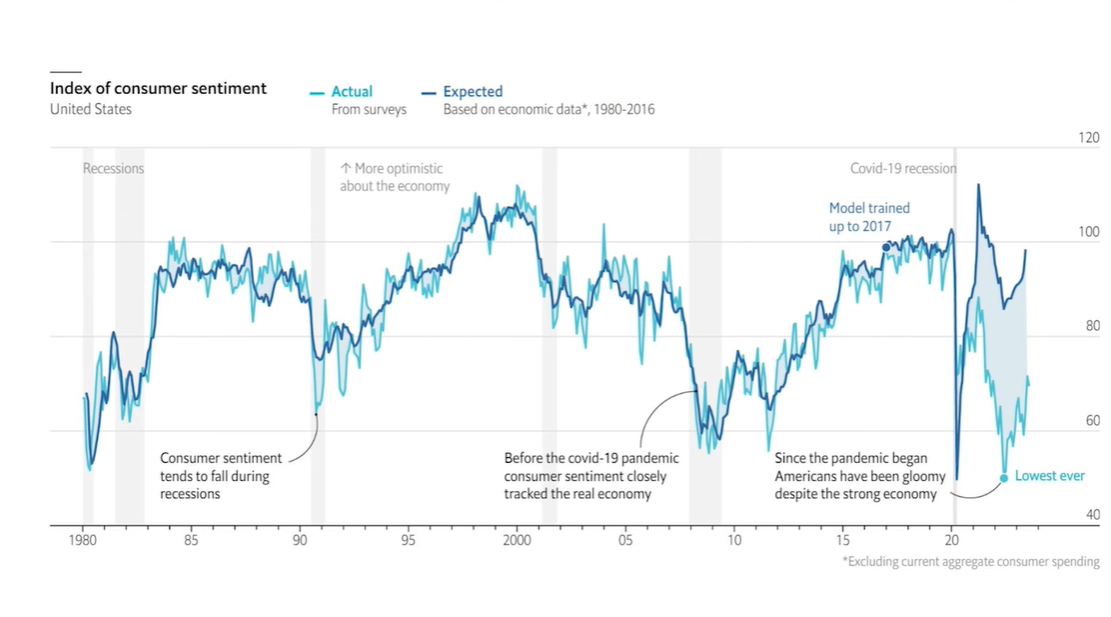

Despite full employment, the U.S. economy runs on a rising deficit, which is unsustainable. The deficit as a percentage of GDP is above 6%, and a balanced budget would lead to negative GDP growth. Public confidence in the economy is low, and the data used to assess economic health may not fully capture the current dynamics.

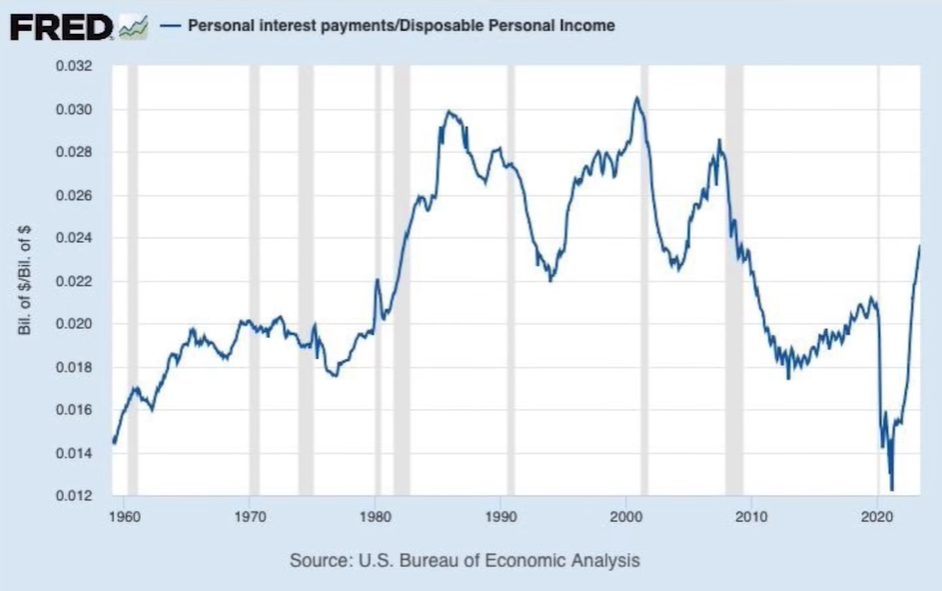

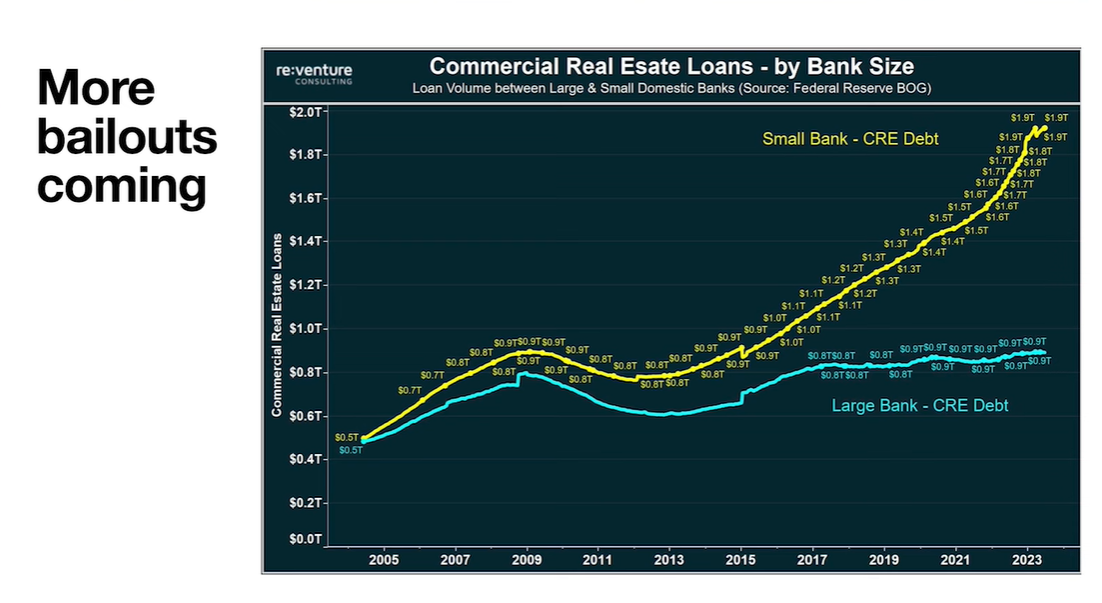

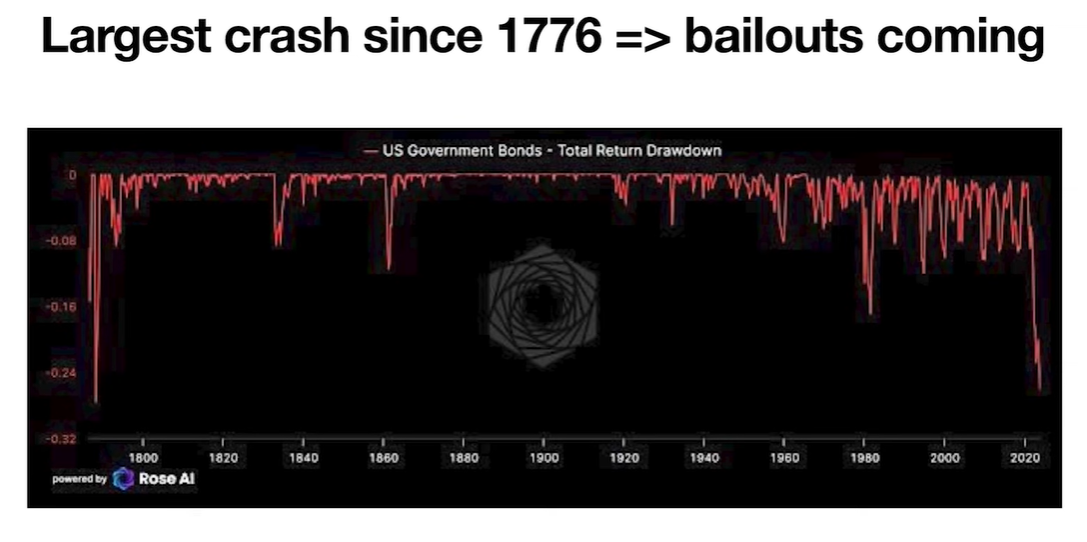

Interest rates are at their highest in decades, and the cost of servicing debt is increasing. The real economy is struggling as people allocate more of their disposable income to interest payments. Bond markets are in a bear market, signaling potential bailouts in the future.

The real estate market, often seen as a store of value, shows signs of weakness when assessed in terms of hard assets like commodities. Mortgage-backed securities indicate a potential downturn, and banks holding these securities may require bailouts.

The bond market crash is historic, with parallels to the French Revolution and Weimar Germany. This underscores the precariousness of current times and suggests the possibility of significant economic shifts.

Bitcoin's relationship with the financial markets is complex. The approval of Bitcoin ETFs could act as a catalyst for growth, allowing for easier investment in Bitcoin. The speculative attack strategy, where companies use their stock to buy Bitcoin, could lead to a revaluation of PE ratios and drive Bitcoin adoption.

Several factors point to a bullish outlook for Bitcoin. The U.S. election pump, central banks' inclination to print money, Bitcoin ETFs, and the upcoming halving suggest a strong future for Bitcoin. Additionally, Bitcoin's decoupling from other risk assets and its response to money printing indicate its growth potential. Despite challenges and uncertainties, Bitcoin is poised for significant gains by the end of 2024.