Nothing gets the adrenaline flowing like a few consecutive $1,000+ green candles and looking back seven days at a +12.23% gain.

What a way to kick off the week. Bitcoin broke through $39,000 on Saturday and then went on a nice run early last night that continued through today with the price currently hovering around $41,700 after spending part of the day above $42,000. It's great to feel again. Nothing gets the adrenaline flowing like a few consecutive $1,000+ green candles and looking back seven days at a +12.23% gain. The bullish price action is naturally leading people to ask the question, "Why is bitcoin pumping?"

As we've said many times in the past, it is impossible to know the exact reason why the price is currently running. The simplest, most correct, answer is that there are currently more buyers than sellers in the market. And since a higher demand for bitcoin doesn't lead to more supply, the imbalance of buyers and sellers is leading the price higher. Alas, this is never a sufficient answer for people, so let's walk through some factors that may be driving more people to buy bitcoin at the current moment.

#bitcoin is surging b/c the @federalreserve is allowing the $ created out of thin air w/ the COVID stimulus/QE (which had sat "dormant" until recently, & was created 2020-22) into private hands for the first time. All risk assets go up when the Fed does QE, and they are doing… https://t.co/cTyEHxAlvs pic.twitter.com/GpuoVWPfxL

— Gordon Johnson (@GordonJohnson19) December 4, 2023

There are many pundits out there claiming that the rise in the bitcoin price is predominately being driven by the draining of the Reverse Repo market. A lot of the money that was created in 2020-2021 flowed into Reverse Repo markets in 2021 and built up over two years, topping out around $2.5 TRILLION. For some reason or another this market has been draining rapidly over the last 3-4 months to the tune of $1.2 TRILLION. I won't pretend to be well equipped enough to break down the dynamics of the Reverse Repo market as well as someone like James Lavish can, so go check out his thread on the subject.

With that being said, I won't go as far to say that this action in the Reverse Repo markets isn't causing money to flow into bitcoin, but I will say that I find it hard to believe that it is the predominant driver of the bitcoin price over the last week. Bitcoin rose by 70-80% during the first four months of this year while the Reverse Repo market was expanding by more than 10%.

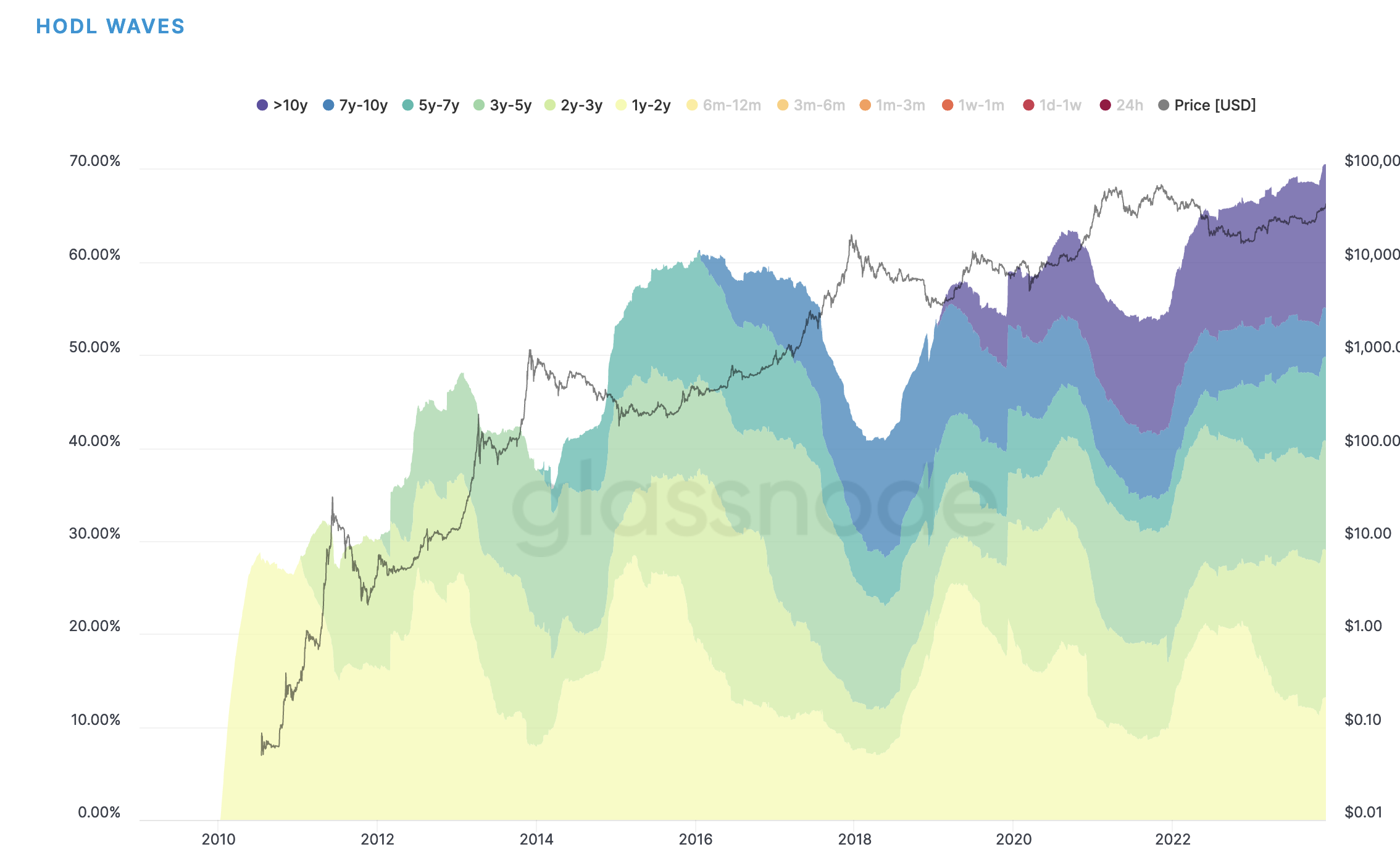

As it stands today, more than 70% of the total supply of bitcoin that has been distributed to the market hasn't moved in over a year. More than 30% hasn't moved in over five years. Put another way, 70% of bitcoin that has been accounted for is either lost forever or being held by people and companies who likely understand what they are holding and aren't going to give it up any time soon. As we approach the 15th anniversary of the Genesis block, the amount of information about bitcoin, how it works, why it exists, and what it means for the future of humanity that is available to the market is at an all time high.

As more and more people get their reps in and accumulate touch points with bitcoin, more mental light switches are turned on and more people are added to the list of individuals who will never be able to "unsee" bitcoin. As this list of individuals grows, the buying pressure rises. Increasing the price floor with it. When more people are convinced that bitcoin is something they should acquire and hold for the long-term, they do exactly that and decrease the free float of bitcoin available for everyone else to purchase, which makes it easier to push the price higher.

A couple of weeks ago we wrote about rumors of liquidity issues at UBS that signaled that all is not well in the banking sector. UBS was essentially forced to acquire Credit Suisse earlier this year, and by doing so absorbed all of the toxic assets that led to its failure. One has to wonder weather or not those toxic assets are beginning to cause problems for UBS as well.

It seems that UBS isn't the only bank in the world experiencing some liquidity issues at the moment. HSBC is apparently bracing for a £6.3 BILLION loss stemming from real estate exposure in China and the UK.

🚨WARNING: $HSBC TOLD TO “BRACE” FOR 6.3bn£ LOSS 🚨

— JustDario 🏊♂️ (@DarioCpx) November 27, 2023

I warned so much about $HSBC and how they accounting was hiding a huge hole (posts below), now the 🐓 are coming to roost… 🤷🏻♂️

Thanks for flagging @badnews4stocks https://t.co/xWBVg5lMAm pic.twitter.com/9N6ZuKWBzJ

Not ideal. I never know how to dissect the news out of China. It's very hard to discern what is going on beyond the Great Fire Wall, but it seems like building ghost cities that don't attract people to live in them was an unwise decision and the Chinese real estate market is in for some pain. Something to pay attention to, especially considering the fact that it will affect liquidity across international markets.

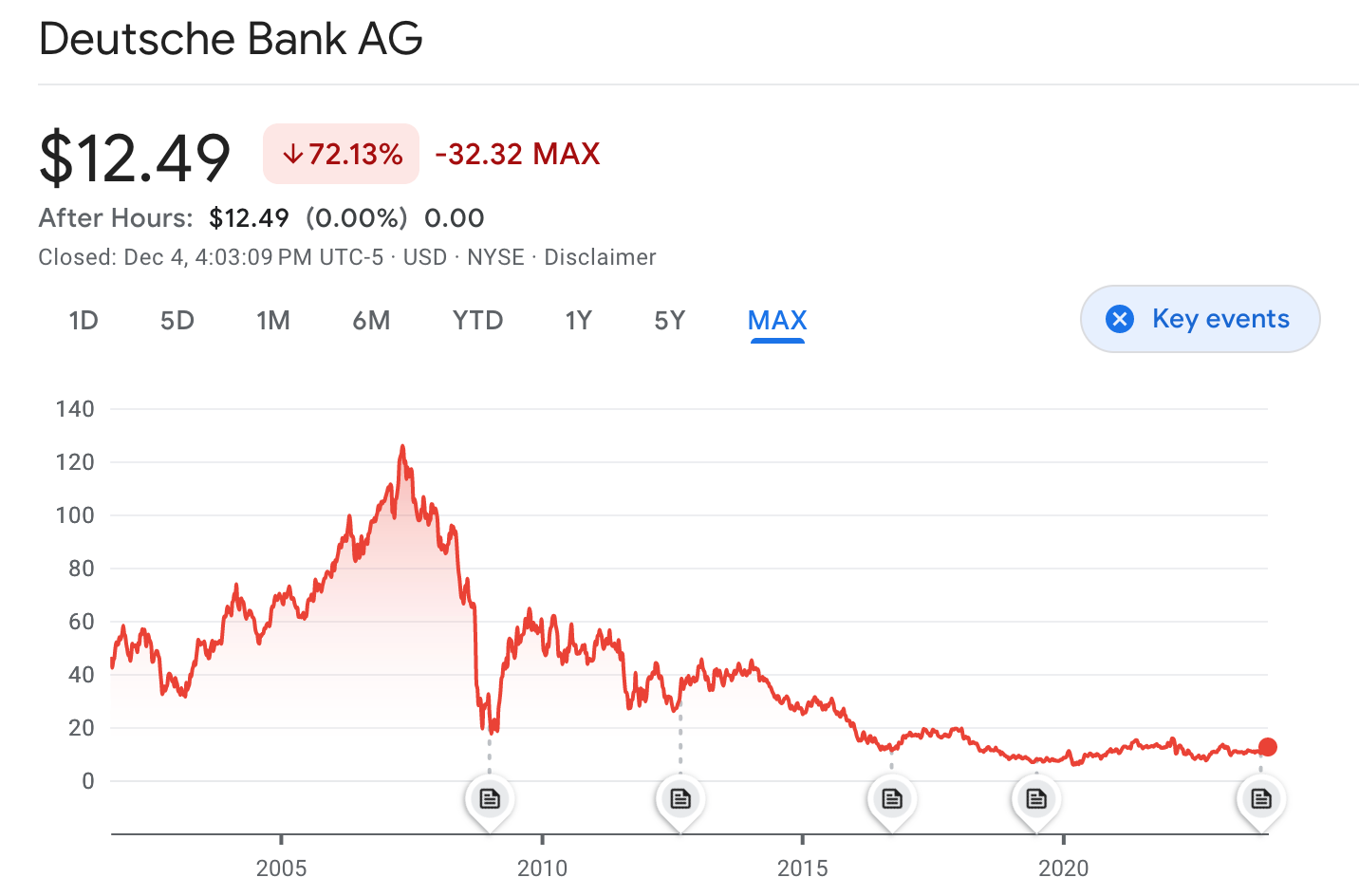

There are also rumor canaries beginning to sing a tune about Deutsche Bank's massive derivatives exposure and the fact that it could catch them off sides before the end of the year. I have no idea whether or not this is just fear mongering or whether it's legitimate, but DB's long-term stock chart looks like prototypical shitcoin chart.

Who knows what will and won't materialize, but markets are psychologically driven and if big money thinks a liquidity crisis in global markets is imminent they will react. One possible reaction to a liquidity crisis is taking your money out of the banking system and buying bitcoin, which - if secured correctly - is immune from a liquidity crisis. If you have the private key(s) that controls the addresses where your bitcoin live, you are liquid. The purchasing power of that bitcoin may be a bit volatile at times, but you will always be able to access them.

Many are convinced that the approval of a spot bitcoin ETF is imminent. They are also convinced that a spot bitcoin ETF approval means that there will be massive inflows of capital into bitcoin. With this in mind, it isn't crazy to think that there is a large number of people who are betting on both things to happen and are actively trying to front run the potential wave of capital by scooping up as much bitcoin as possible before the floodgates open.

At the end of the day, as I mentioned above, it is hard to know exactly what is driving the price of bitcoin at any given point in time. We can only make educated guesses and these are a few of my educated guesses.

Regardless of what is or isn't driving the price right now, it is important to try to remove yourself from the narratives and hone in on what is important; there will only ever be 21,000,000 bitcoin, governments and central banks will never stop printing money, and people are desperate for a solution to the inflation and censorship that is washing over the world. Bitcoin is the solution. This run in price makes sense when you simplify it to that.

Final thought...

Is there anyone more helpless than an gassy 18-month old?