Bitcoin is the Linux of monetary networks.

"Bitcoin is Digital Gold."

"It will be a reserve asset, but it won't be used as money."

"Competing cryptocurrencies will fulfill the role of payments."

"The dollar and bitcoin will exist side by side."

These are the type of statements made by small-minded individuals who are either afraid to admit that bitcoin is well on its way to becoming the next global reserve currency or completely missing what's happening right in front of them. This type of person lacks the vision and patience necessary to see that bitcoin can certainly be the foundation for the world's monetary and financial system. With people using bitcoin as a store of value and leveraging the distributed messaging protocol and the layers built on top of it to make bitcoin payments, create more complex financial arrangements with smart contracts and enable machine-to-machine payments.

It's simply going to take time to build out all of the necessary infrastructure, software libraries, companies that leverage this infrastructure and software, and to acquire the users who will ultimately use bitcoin as their day-to-day payments network and preferred store of value.

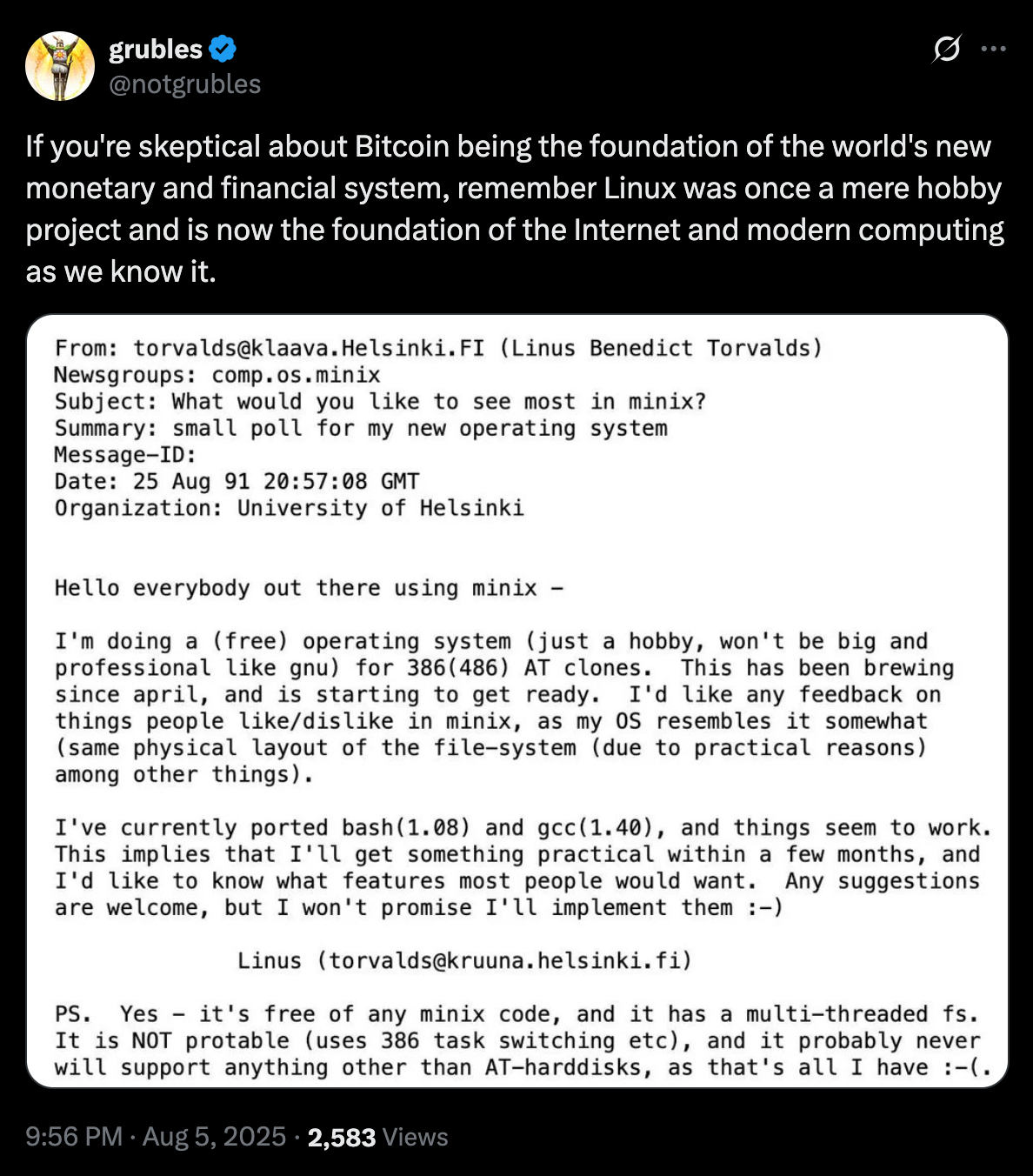

We've seen this play out in the protocol world with Linux over the last 34 years. The story of Linux is certainly not a story of an overnight success. Linux too decades to become sufficiently robust, efficient, secure and reliable before it became the Schelling point of modern computing.

Bitcoin's journey will be similar. And in my humble opinion, it is inevitable.

Robert from Infranomics presents compelling evidence that Americans are experiencing economic hardship comparable to the Great Depression, despite official statistics suggesting otherwise. He points to suicide rates matching Depression-era levels and deaths of despair—suicides plus drug overdoses—running at double the rate of the 1930s. The data reveals a 13x increase in antidepressant prescriptions since 1970, while real purchasing power has collapsed, with average hourly wages down 80% when priced in gold since 2000.

"Deaths of despair went vertical starting in 2001 when China joined the WTO." - Robert (@Infraa_)

The connection between economic policy and human suffering becomes undeniable when examining the Rust Belt's decimation following manufacturing job losses. Robert's analysis shows personal income divided by M2 money supply has fallen 30%, revealing how monetary expansion has outpaced wage growth. While these statistics paint a grim picture, recognizing the true extent of the problem is the first step toward meaningful solutions that could restore economic opportunity for everyday Americans.

Check out the full podcast here for more on dollar overvaluation, Bitcoin as a reserve asset and fiscal dominance.

Goldman Sachs Predicts Three Fed Cuts Starting September - via X

Metaplanet Purchases 463 Additional Bitcoin - via X

Trump to Impose Higher Tariffs on India - via X

Trump Calls Elizabeth Warren a Loser - via X

Trump to Announce New Fed Governor This Week - via X

Get our new STACK SATS hat - via tftcmerch.io

It’s time to build a long-term strategy and declare your financial independence. Unchained’s Financial Freedom Bundle is designed to help serious bitcoin holders secure their future by taking control of their generational wealth.

Request the bundle to get:

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ancient Aliens is my version of counting sheep.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: