Slowly but surely, the layered stack being built on top of bitcoin matures.

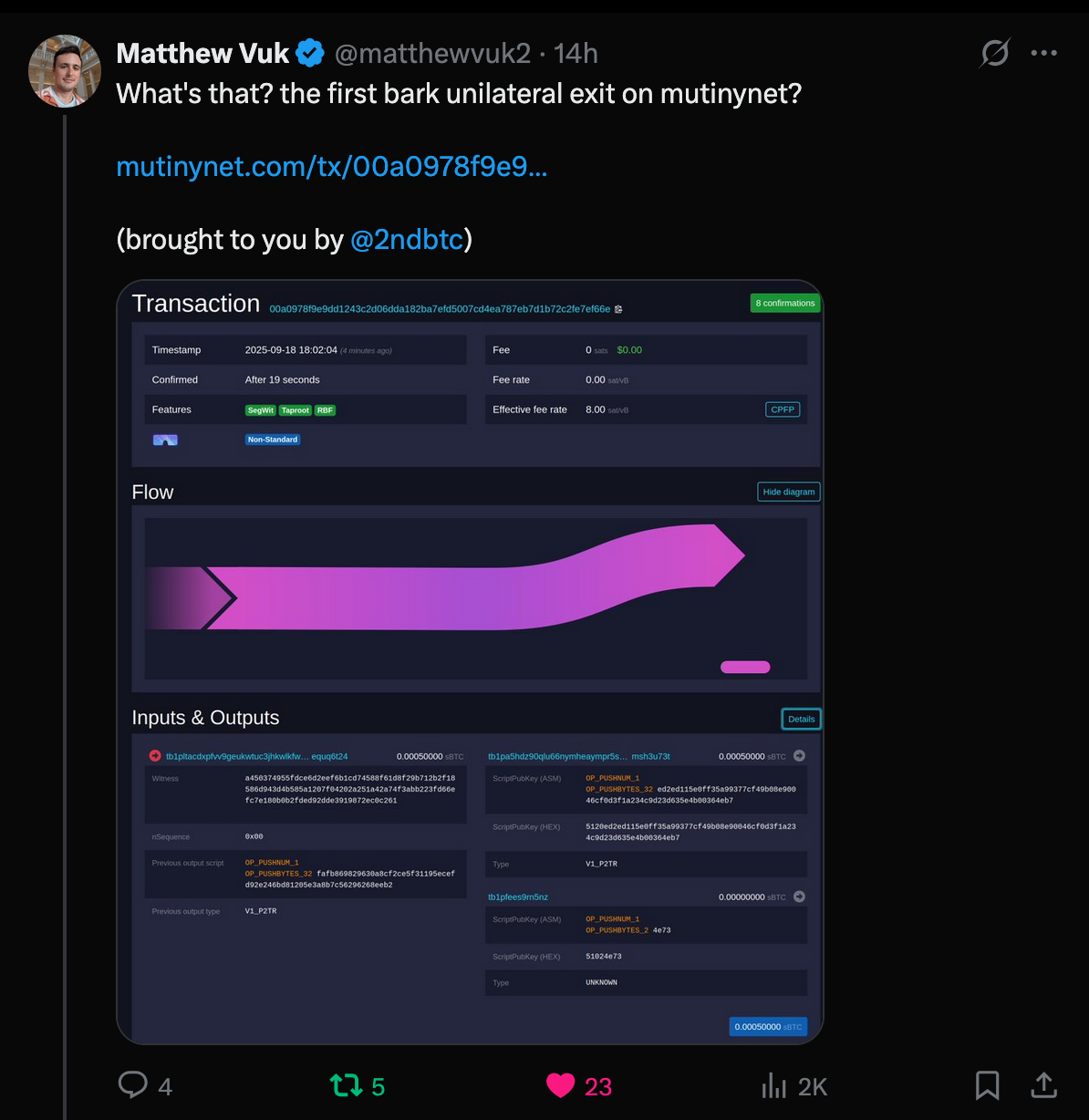

The team over at Second announced last night that they successfully completed the first unilateral exit from their Ark Protocol implementation on mutinynet, a bitcoin test network. For those who are unaware, Ark is a second layer scaling solution for bitcoin that leverages centralized servers, or Ark Service Providers (ASPs), to facilitate instant and cheap payments at scale. Currently, to my knowledge, there are two teams working to bring Ark to life; Second and Ark Labs.

Even though ASPs are centralized the Ark protocol has shown promise because it has the intent of enabling individuals to unilaterally exit ASPs. If users can unilaterally exit without permission, the centralization v. decentralization tradeoff made by Ark can be incredibly powerful. And, as we can see from the mutinynet transaction above, it seems that unilateral exits are being delivered. A beautiful thing to see.

What's even more beautiful is that, due to the very thoughtful design of the bitcoin protocol and the second layer protocols being built on top of bitcoin, every layer and protocol is interoperable with each other. Whether it's lightning, Liquid, eCash mints or Ark, users will be able to onboard to one of these protocols and interact with every other protocol. In the context of Ark and lightning, this was proven out last month at the Baltic Honey Badger conference in Riga where the Ark Labs team facilitated the vendor payments via BTCPay Servers catered to lightning users.

Not only were conference goers paying vendors from their lightning wallets with sats being settled over Ark on mainnet, some tested out ecash to Ark payments as well.

This validates a growing theme we've been excited about in this rag, on the podcast, and via our capital allocation strategy at Ten31; a layered stack of interoperable protocols that anchor into the bitcoin protocol is how we get the best use cases and user experiences in the long-run. Ark, lightning, eCash mint protocols, Liquid and others can focus on their core competencies and develop specific use cases for specific needs while being able to connect to other second layer protocols using the lightning network as a connective tissue. No need for complex bridges, validator nodes or roll up schemes. Everything just works with each other. Mainly because of the design and maturation of the lightning network.

Don't let people tell you that "bitcoin's tech" is boring and losing ground to other protocols. The base layer of bitcoin is certainly simple and "boring", but that simplicity and its boring nature is enabling more complex and robust protocols that can speak to each other to be built on top of it. The future of bitcoin tech is bright.

Melody Wright revealed how government intervention has transformed the mortgage market into a dangerous game of musical chairs. She explained that banks retreated from mortgage lending after 2008 due to Basel III requirements, leaving non-bank lenders funded by government agencies to dominate the market. These lenders now issue FHA loans to borrowers with credit scores as low as 580 and just 3.5% down payments—a share of the market that Wright notes mirrors the subprime percentage before the last crisis.

"This is insanity. And so what they did, many of us in the industry lobbied against this."- Melody Wright

Wright detailed how the Biden administration's partial claim modification program allowed borrowers to repeatedly defer payments without proving ability to pay, creating what she calls "rings of originators" coaching investors to deliberately default. Starting October 2025, new FHA guardrails will require trial payments and exclude those with delinquent student loans, which Wright predicts will trigger material foreclosures by Q2 2026.

Check out the full podcast here for more on massive oversupply, why being a landlord isn't cool anymore, and the coming auto loan crisis.

Big Mac Prices Highlight Money Deterioration - via X

$4.35B Bitcoin and Ethereum Options Expire Today - via X

Harvard Holds More Bitcoin ETFs Than Google Shares - via X

Bhutan Transfers 913 BTC Worth $107M - via X

Bitcoin Mining Difficulty Hits All-Time High - via X

China's Gold Demand Strong Despite Record Prices - via X

This extended $75k–$110k range has caused some to wonder if the bull run is exhausted. But what if the on-chain evidence tells a totally different story? Join James Check (Checkmate of Checkonchain) and Connor Dolan for a data-driven discussion on what a maturing bitcoin market means for the road ahead.

James will break down:

On-chain metrics show bitcoin has crossed the Rubicon—from a nascent store of value into a true institutional-grade asset class. This session will help you understand what that means for this bull market and beyond—and how you might position yourself appropriately.

Tuesday, September 30th at 3PM CT — online, free to attend.

Register now for early access to a new on-chain metrics report from Unchained and Checkonchain: https://unchnd.co/3Ve67mv

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The Philadelphia airport parking garages are always insanely full.

Enjoy your weekend, freaks.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: