More to go, but a nice win.

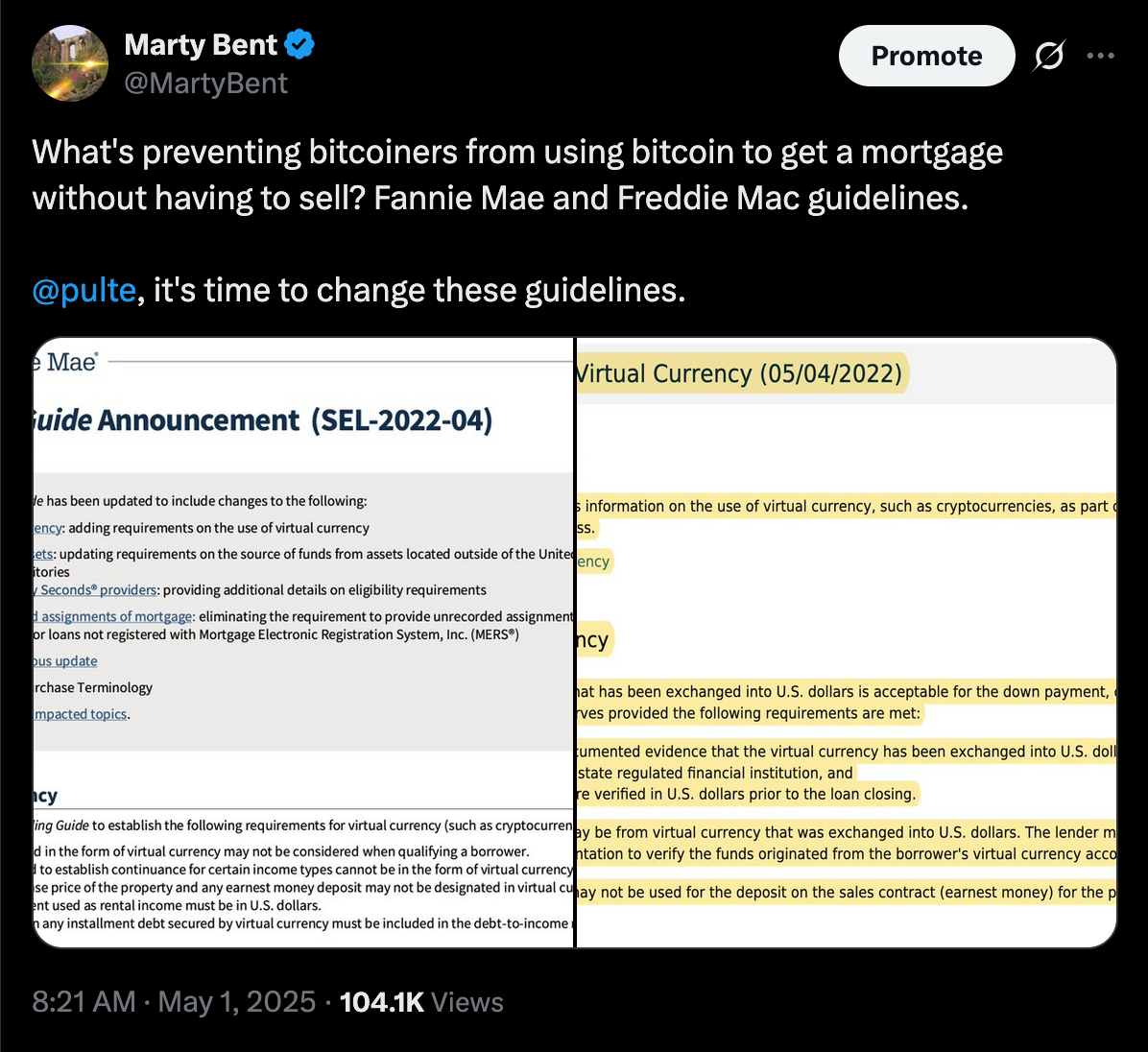

In early May, we made you freaks aware of the fact that Fannie Mae and Freddie Mac were putting up roadblocks for bitcoiners looking to get mortgages due to a rule that was written into the guidelines set forth by the FHFA during the Biden administration. Because of the rule, bitcoiners have been unable to have their bitcoin holdings recognized as assets on their personal balance sheets that contribute to their net worth when a bank underwriting a mortgage was trying to determine credit worthiness.

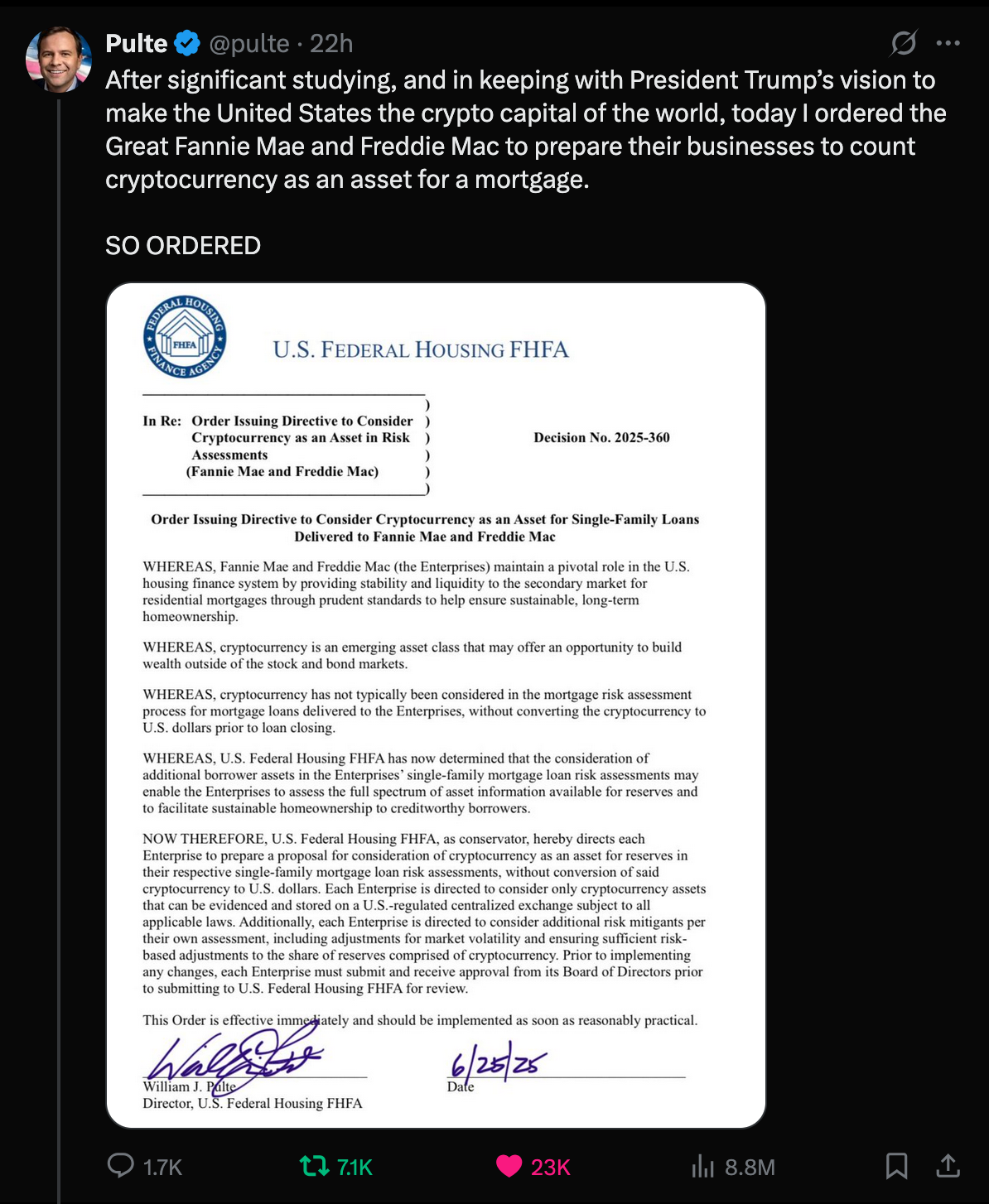

I'm happy to report that that changed yesterday, when William Pulte, the Director of FHFA, wrote a letter changing the guidelines and making it so that bitcoin holdings are now recognized as assets contributing to overall net worth and credit worthiness in the eyes of mortgage underwriters. A big step in the right direction. Though, not quite perfect yet. The guidelines state that individuals looking to have their bitcoin accounted in their net worth will have to have their bitcoin on a third-party exchange if they want them to be properly recognized.

Many are claiming that this is an attempt to centralize bitcoin on exchanges, forcing individuals to move bitcoin from cold storage to an exchange so that they can reap the benefits of these new guidelines. We can certainly see that being a possibility. However, I would also consider that this may have been hastily put together and the FHFA probably didn't have time to run through all the nuance of how one can verify that they own a certain amount of bitcoin stored in particular addresses to a mortgage underwriter. I would imagine that they thought about bitcoin in cold storage and came to the conclusion that it was too easy for an individual to show a friend's wallet or a family member's wallet that has a certain amount of bitcoin in it to dupe the underwriters, so they decided to ensure that the individual looking for a loan actually has bitcoin by associating it with an exchange account in their name.

The FHFA probably needs to get more comfortable with products like Hoseki that enable you to verify that you own bitcoin while holding it in cold storage by signing keys that Hoseki monitors. In the meantime, I imagine the best way to be within the lines of the rules set forth yesterday while still maintaining control of your bitcoin would be to do the asset verification via platforms like Unchained, which is an exchange and collaborative custody provider that allows you to have bitcoin on their platform while maintaining control by holding two of three keys in a 2-of-3 multisig quorum. I don't imagine mortgage underwriters having a problem with Unchained considering it is a licensed exchange and financial services provider. It just so happens to leverage bitcoin in a way that empowers their users more than most. Anchorwatch is another option with a similar relationship with their customer base.

Hopefully the FHFA dives deeper into the nuance of how individuals can verify that they own bitcoin so that people aren't forced to move bitcoin to an exchange if they don't want to, or never move it off in the first place because they want to use it to prove credit worthiness.

As I said in May, I ran into this exact problem and decided not to buy a house earlier this year because I did not want to sell bitcoin. That proved to be a wise decision considering the fact that bitcoin ripped 15% the week after we decided to rent instead of buy. When we're ready to buy a house at some point next year, it will come with much less stress now that these guidelines are in place.

Shout out to Bill Pulte and the FHFA for taking action after seeing my tweet last month. The type of speed you like to see government move at when it comes to common sense issues.

Tom Luongo argues that beneath every major global conflict—from Ukraine to the Middle East—lies a singular objective: destroying the US Treasury market. He contends that preventing capital from flowing into America is the real endgame, not the surface-level territorial or ideological disputes we see in headlines. This financial warfare aims to undermine dollar dominance and America's ability to attract global investment.

"Can they destroy the US Treasury market and keep capital from flowing into the US? It's always the same thing over and over and over again." - Tom Luongo

Luongo's analysis suggests that whether it's sanctions on Russia, tensions with Iran, or trade disputes with China, each serves as a mechanism to destabilize US Treasuries and create alternative financial systems. The stakes keep escalating, but the target remains constant: break America's financial magnetism and redistribute global capital flows to benefit competing power centers.

Check out the full podcast here for more on Iranian nuclear negotiations, City of London betrayals and Federal Reserve strategies.

It’s time to build a long-term strategy and declare your financial independence. Unchained’s Financial Freedom Bundle is designed to help serious bitcoin holders secure their future by taking control of their generational wealth.

Request the bundle to get:

First 100 to request a bundle receive a physical copy of Foundations.

Request your bundle here.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Nothing better than enjoying a cold Guiness with friends as delightful live Irish music plays in the background.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: