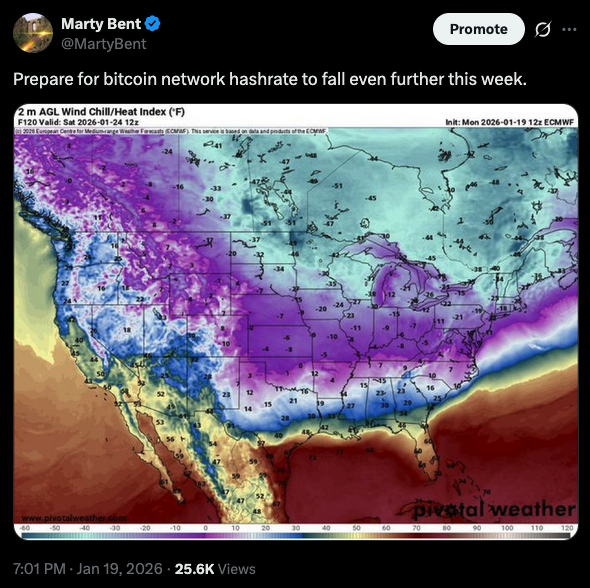

Make sure your long johns are clean.

As I'm sure most of you, particularly the Americans, are aware of by now, there is an epic Winter storm preparing to hit a large swath of the United States. If current projections hold, it should sink deep into Texas and the Tennessee Valley, which are both bitcoin mining hubs with large demand response programs. I believe that across the two power markets there are anywhere from 2.5-4.5 GW of bitcoin mining capacity engaged in ERCOT's large flexible load program and the TVA's "interruptible power" program. There is some nuance within ERCOT. Not all miners are officially enrolled in the LFL program, but they will shed load any way when power prices reach certain levels.

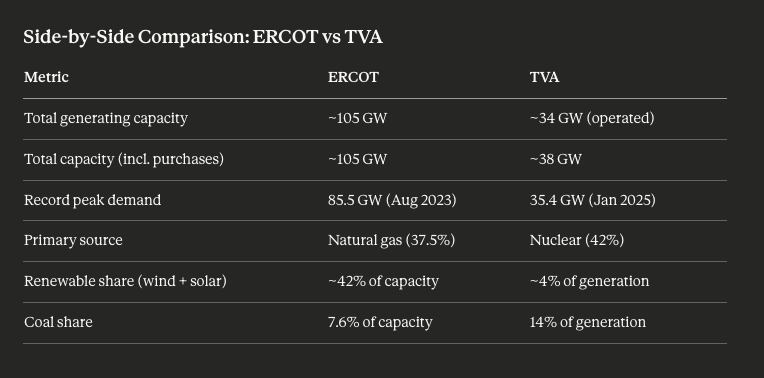

With AI data center infrastructure having flooded these areas over the last three years and no major storm having affected the area since 2021, this week is set to be the first major test of these grid systems in five years. A lot has changed on both the supply and demand side of the equation for power since the beginning of 2021. ERCOT has expanded generation capacity dramatically, with a heavy focus on wind and solar. The TVA has expanded capacity modestly with a focus on natural gas power plants, which have been spun up to replace generation from decommissioned coal plants. Here's a comparison of each power market's generation capacity and peak demand estimates.

While it may seem like ERCOT is in a better position, that's because it is... when generation conditions for wind and solar are moderate to ideal. However, with the over-indexing on wind and solar in recent years, the Winter storm could pose a bigger threat to ERCOT. As you can see from the chart above, record peak demand was hit in August of 2023 at 85.5GW being drawn by the grid during a very hot day. Luckily, the sun was shining and the wind was blowing then.

If Texas experiences conditions as bad or worse than it did during the Winter storm of 2021, things could get ugly rather quickly. Especially if they get hit with the part of the storm that brings ice with it. That will freeze wind turbines and block solar panels from receiving sunlight (if enough breaks through the clouds in the first place), rendering those generation resources useless as demand spikes. I'm not saying this is going to happen, but it's certainly something to pay attention to as we approach Friday night. If Texas reaches peak demand levels and half of the generation from wind and solar drops to zero, that would create a very hairy situation that could lead to blackouts.

Luckily for individuals living within ERCOT and TVA, there are sizable bitcoin mining operations that will be there to shed their load so that supply can be directed to residential consumers in need of heating to escape the cold front.

If you're a bitcoiner, expect slower block times as the storm rolls across the country and miners who are participating in demand response programs or are simply extremely price sensitive turn off their machines.

As it stands right now, we are due for yet another downward difficulty adjustment on Thursday afternoon.

If you're a miner who can stay plugged in over the weekend and through the beginning of next week, it should be a rather good time to be hashing. This will mark the fifth downward difficulty adjustment over the last six difficulty re-targets and it should be quickly followed by yet more hashrate coming off the network.

The much-anticipated intergenerational wealth transfer from Baby Boomers may not deliver the windfall many expect. Dave Collum argues that this massive transfer will trigger significant asset repricing that undermines its own value proposition. The core issue lies in affordability - younger generations simply cannot shoulder the tax burdens, maintenance costs, and lifestyle expenses associated with high-value boomer assets like oversized homes and investment properties.

"The process of liquidating these assets to pass wealth down will itself trigger the market corrections that reduce the wealth being transferred." - Dave Collum

This creates a self-defeating cycle where the very act of wealth transfer necessitates asset liquidation, flooding markets and driving prices down. Collum's analysis suggests that what appears to be a generational wealth bonanza on paper may prove to be significantly diminished in practice, as the mechanics of transfer collide with economic reality and generational spending power disparities.

Check out the full podcast here for more on housing market dynamics, tax policy implications, and generational spending patterns.

S&P 500 Erases all of its 2026 Gains

Lutnick Says Globalization has Failed the West

US 10Y Treasury Yield Jumps to 4.28%

Coinbase CEO Says Bitcoin Could Hit $1 Million by 2030

Greenland PM Tells Residents to Prepare for Possible Invasion

Treasury Secretary Says Seized Bitcoin Goes to Digital Reserve

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. On January 28 at 1PM CST, James Lavish joins Unchained for a live presentation and Q&A on currency debasement, why traditional portfolio assumptions are being tested, and how gold and bitcoin fit into a changing monetary landscape.

The event will cover:

● Why debasement is structural, not cyclical

● How inflation and financial repression challenge familiar portfolios

● Why gold tends to move first—and bitcoin often moves further

Wednesday, January 28 at 1PM CST — online, free to attend. Register now and get early access to the report: https://unchnd.co/49H3Eb7

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I'm back, baby.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|