The Fed-Treasury merger unleashes unprecedented money printing.

The Bitcoin Alpha team predicts the Trump administration will effectively merge Federal Reserve and Treasury functions to maintain fiscal dominance as deficits exceed 6% of GDP. With interest expense now exceeding $1 trillion annually and representing over 100% of receipts in some months, the government faces an impossible math problem without dramatic monetary intervention.

"They're trying to merge the Fed and the Treasury to make sure that they can achieve their economic goals," I observed during our discussion. The public feuding between Trump and Powell, including the bizarre construction site confrontation, represents theater masking a deeper reality - independent monetary policy cannot survive when the sovereign faces a funding crisis. History shows no government has chosen default over debasement when pushed to the brink. The team expects this consolidation to accelerate money printing beyond anything seen previously, making Bitcoin's fixed supply increasingly attractive.

Tuur Demeester believes Bitcoin is heading toward $1 million per coin, which would represent approximately 11 kilograms of gold - the point at which Bitcoin's total market cap equals all the gold in the world. He argues this isn't just another four-year cycle but potentially an extended bull market lasting an additional year to 18 months beyond typical patterns.

"I think that's the next magnet," Tuur explained, borrowing David Bailey's term for psychological price targets that pull markets forward. The confluence of ETF adoption, treasury companies accumulating Bitcoin, and nation-state interest creates unprecedented demand drivers. With real inflation running between 10-15% annually according to his analysis, Bitcoin's role as pristine collateral is becoming undeniable. He notes that even after selling 80,000 Bitcoin recently, the market only dropped 4% - a sign of extraordinary buying strength that suggests this cycle has much further to run.

Phil Geiger predicts that Bitcoin mining will evolve from a standalone industry to become completely integrated with energy production at the source. He argues that mining ASICs will function more like demand response tools similar to batteries, but with zero energy loss in transmission and instant monetization capabilities.

"I view it more as Bitcoin mining is more of a component of the energy production industry or a tool that any energy producers can use," Phil explained on Center of Hash. He points to renewable energy operations where 20% of generated electricity goes to waste during peak production as the perfect use case. As the Bitcoin network continues to demand the cheapest possible electricity, miners will naturally migrate to these stranded energy sources. The permissionless nature of the network means any energy producer globally can immediately monetize excess capacity without negotiating contracts or building transmission infrastructure. This transformation will make Bitcoin mining less of an independent industry and more of a standard feature of energy infrastructure.

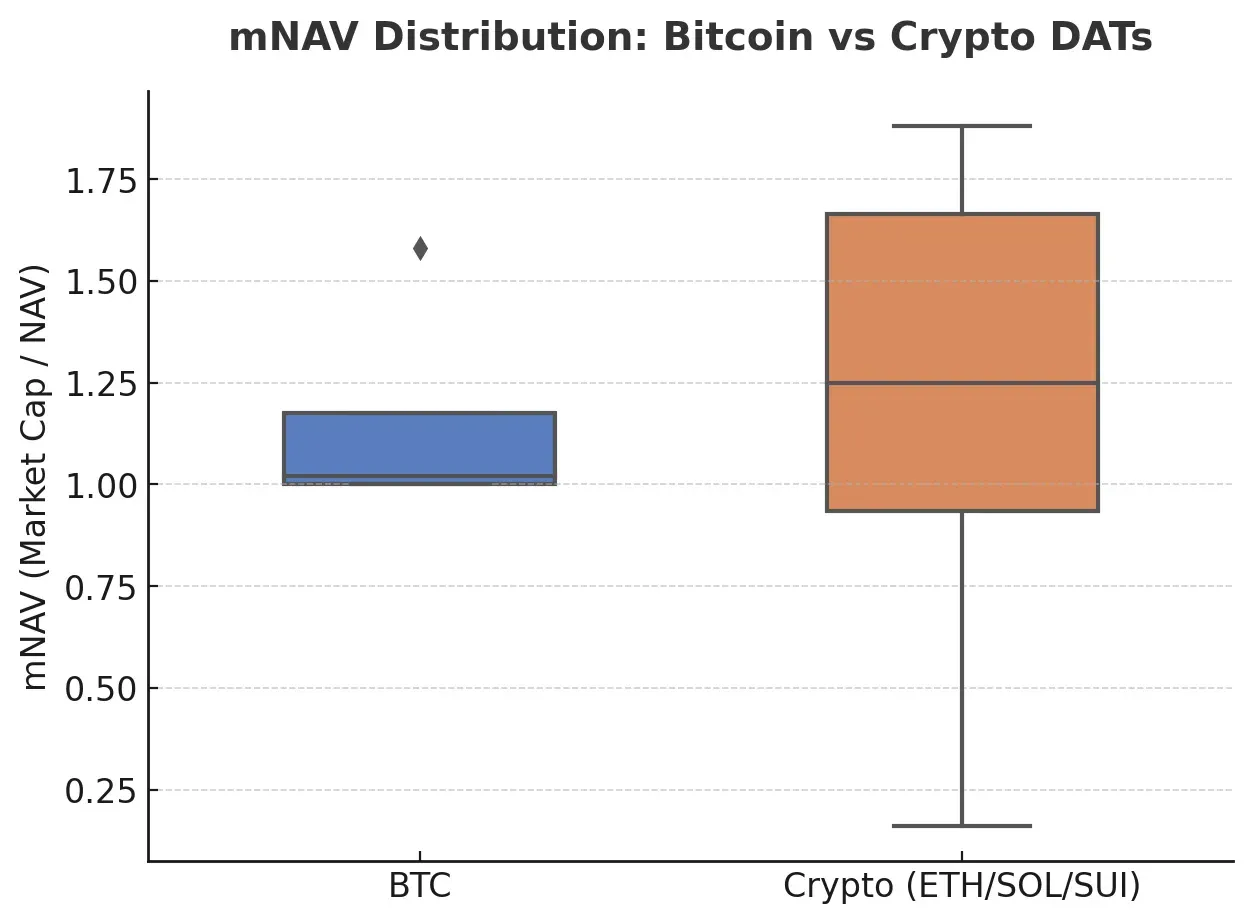

Digital Asset Treasury (DAT) companies—public firms existing solely to hold crypto on their balance sheets—are creating two distinct market structures. Bitcoin DATs show tight mNAV (market cap/treasury value) clustering around 1.3x average, while crypto DATs exhibit wild swings from 0.16x to 1.94x.

Key Bitcoin DATs:

Crypto DATs show extreme variance:

The divergence reflects fundamental differences: Bitcoin DATs benefit from institutional flows and liquidity, while crypto DATs hold more volatile assets with questionable long-term value. Management compensation tied to AUM percentages incentivizes asset accumulation, particularly problematic for less liquid cryptos prone to reflexive price action.

The trend signals market maturation—Bitcoin treasuries evolving into predictable institutional vehicles while crypto treasuries remain speculative plays. As one critic notes: "Does anyone actually want to own SOL in 10 years?"

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X: