The U.S. labor market faces a severe downturn with 300,000 job openings lost in a month, highlighting a troubling trend.

In an alarming update on the state of the U.S. labor market, the Bureau of Labor Statistics (BLS) has delivered a report that signals a sharp downturn in job opportunities across the nation. According to the BLS, the country has seen a staggering loss of nearly 300,000 job openings in the last month, compounding an already concerning trend that has amounted to 750,000 lost job openings in two months and a total of 2 million in the past year.

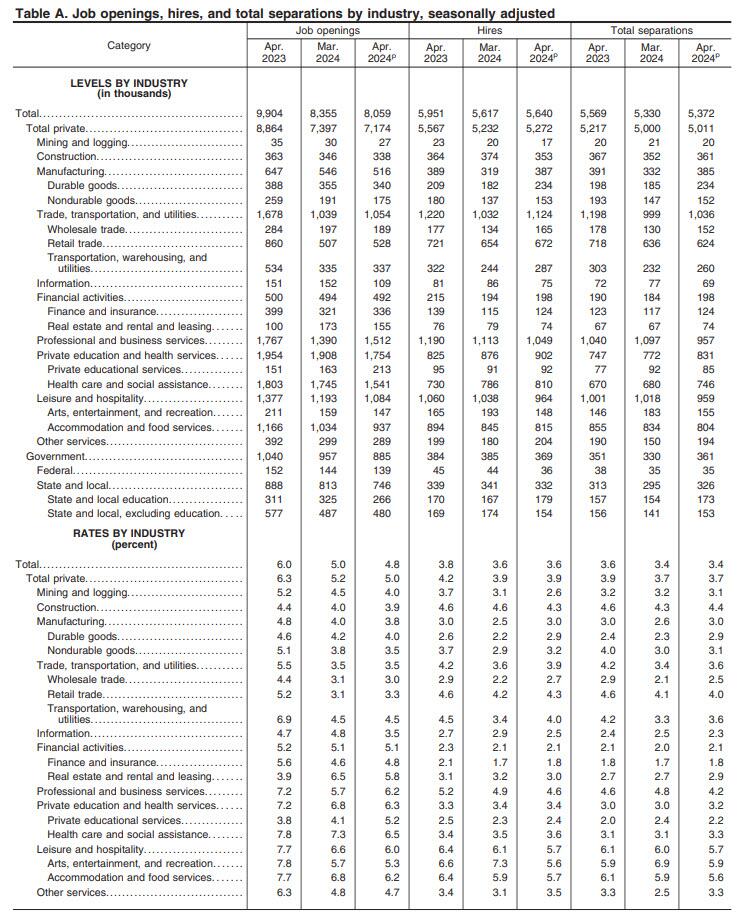

This recent data suggests a regression to the employment landscape reminiscent of pre-pandemic levels. However, this comes as a paradox given the millions of Americans who have exited the workforce during the pandemic, due to early retirement or reliance on government benefits. The depletion of job openings is most keenly felt in the private sector, with the construction industry experiencing its most significant two-month decline on record, surpassing even the 2008 housing crash.

Other sectors have also been hit hard, with manufacturing losing 30,000 openings, IT shedding 43,000, leisure and hospitality over 100,000, and the healthcare sector almost 200,000, the latter being particularly concerning in light of America's ongoing health challenges and the strain on hospitals due to uninsured patients, including undocumented immigrants.

As openings vanish, the number of hires across sectors has also seen a dramatic fall, with a 300,000 drop over the last year, and hiring rates stagnating since 2018, despite population growth. This is setting the stage for a troubling revision of the official unemployment rates, which do not account for those who have ceased actively seeking employment.

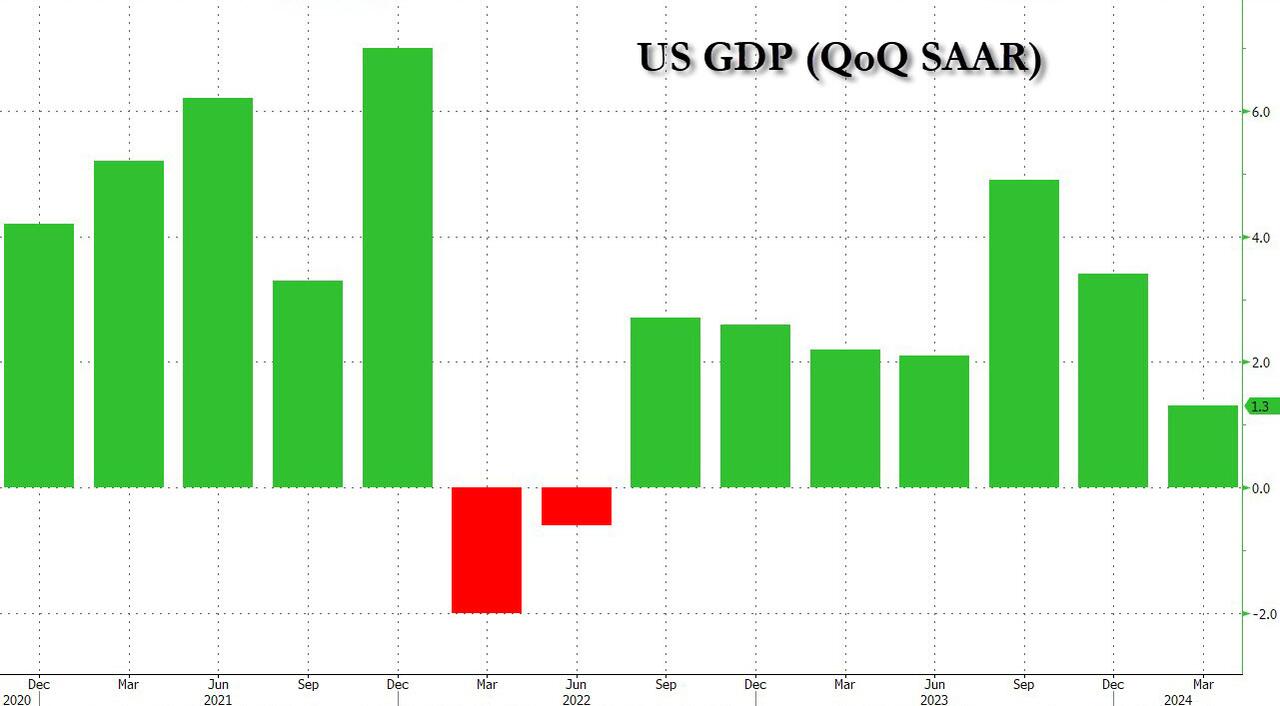

Amidst this economic backdrop, inflation has made a comeback, with consumer spending teetering precariously. The U.S. GDP growth was recently revised down to a mere 1.3%, barely keeping pace with, or potentially lagging behind, the rate of population growth.

In a glimmer of hope, the upcoming elections could signal a turning point if the market anticipates a shift in administration, particularly if Donald Trump’s electoral prospects continue to rise. The anticipation of a Trump victory could potentially act as a stabilizer, offering small businesses and the broader economy a reprieve from the ongoing downturn as they await potential policy changes that could reinvigorate growth.