Five Reasons Bitcoin's 2024 Bull Cycle Is Inevitable

So you thought bitcoin was dead? At the time of this writing, one bitcoin is down -62% from its all-time high of $69,044. We’re at the point in the bitcoin cycle when you bring it up to someone, and their reaction is, “That bitcoin thing is still around?” or “That’s a scam,” or “I thought that SBF guy blew up bitcoin.”

But I have bad news for the bears. I’ve got some bull fuel today for my readers.

Bitcoin is far from dead. It’s more alive than it’s ever been.

Now is an excellent time to consider making an initial bitcoin allocation or increasing your position. The only wrong allocation to bitcoin is 0%.

Now let’s get into five reasons why I’m bullish.

Bitcoin derives its value from its scarcity. I’m not the first person to tell you that bitcoin’s supply is hard-capped at 21 million, and I won’t be the last.

A scarce digital currency outside the control of any government, central bank, or individual stands in stark contrast to fiat currencies, which are manipulated to benefit their issuers and are infinite in supply. Bitcoin’s absolute scarcity is the primary reason it is being globally adopted as a store of value. Bitcoin’s predecessor, gold, has been used for thousands of years as a premier store of value due to its scarcity.

But 21 million is not the only consideration regarding bitcoin’s scarcity.

Bitcoin exhibits increasing scarcity due to a phenomenon called the “halving.”

If you’ve been following bitcoin for a while, this is old news, but it’s a critical component of the bitcoin protocol to understand for the newer entrants to the space.

The halving is an event that takes place every four years. The reward for bitcoin miners is cut in half, or put another way, the inflation rate of bitcoin is halved.

At this time, approximately 19.5 million of the 21 million bitcoin have been mined (issued) already. Every 10 minutes, when a new block is mined, the miner who wins the block is awarded a 6.25 bitcoin block subsidy. The next halving is anticipated in April 2024 - the block subsidy will be halved from 6.25 bitcoin to 3.125 bitcoin.

The halving increases the scarcity of bitcoin through a decrease in the inflation rate.

I’d recommend Jesse Myers’ excellent article “Increasing Scarcity: Bitcoin’s Value Appreciation Engine” for a deep dive into the subject. Since bitcoin’s inception in 2009, there have been three halving events: 2012, 2016, and 2020. A halving on the horizon in 2024 is bullish for the price of bitcoin. It’s been one of the primary, if not the primary, driver of price appreciation, and the reason why bitcoin’s price follows four-year cycles.

Bitcoin’s scarcity is set to increase next year, coinciding with an anticipated increase in demand for the asset for several reasons (keep reading to find out why).

Prices for bitcoin or any good are set at the margin, where supply meets demand, and if we know supply is decreasing, and demand is increasing, the price increases.

It’s been almost 200 years since the California Gold Rush. In this monumental event, people traveled from across the United States and even from overseas in search of the shiny yellow metal. It was a rare opportunity to create generational wealth.

Unless you were alive in the 1840s (I personally don’t know anyone who was), you missed that opportunity for life-changing wealth - tough luck.

But do not fret! The good news is that the Digital Gold Rush is here.

In July, I published one of my better pieces to date, “The International Digital Gold (Bitcoin) Rush,” highlighting parallels between the CA Gold Rush and events currently transpiring in the bitcoin industry. I’d encourage you to read the full article.

But I understand if you don’t, I won’t take it personally. We are all busy people…

To summarize, the Digital Gold Rush is the institutional adoption led by Wall Street that’s coming for bitcoin very soon.

Wall Street sentiment shifted dramatically this summer, notably as BlackRock, the world's largest asset manager, filed for a spot bitcoin ETF. Several Wall Street institutions followed suit (the suits are coming!) with their own filings.

It was only in 2017 that Larry Fink said, "Bitcoin just shows you how much demand for money laundering there is in the world."

Fink really missed the mark at that time, and his mistake resulted in BlackRock clients missing the opportunity to get into bitcoin at prices much lower than today's.

2017 was when I was introduced to bitcoin, and it began to captivate my attention. And I can assure you, my readers, that I was not laundering money (or was I? No, I wasn't).

Now in 2023, Fink is all over mainstream finance media outlets such as Fox Business and CNBC, praising the merits of bitcoin as an international store of value to protect wealth against onerous government decisions and currency debasement.

While it's clear that Fink doesn't entirely understand bitcoin (he stumbles his way through interviews when talking about bitcoin), does that really matter?

The signal here is that BlackRock has pressure from clients to roll out a bitcoin product, and if they fail to deliver said product, then others will, meaning BlackRock loses out on that AUM. It's important to note that BlackRock doesn't file an ETF if they don't have a high degree of confidence in its approval. BlackRock has received 575 of 576 ETF approvals in their firm's history.

Since I published the original piece, a federal court ruled that the Securities Exchange Commission (SEC) must review its rejection of Grayscale's attempt to convert the Grayscale Bitcoin Trust (GBTC) into an ETF. The court ruled the SEC had treated Grayscale's application differently from other similar products without providing a proper explanation, making the denial "arbitrary and capricious."

The court did not direct immediate approval but required the SEC to review the application again, reports Coin Desk.

It's clear that we're getting closer to the Digital Gold Rush, and similar to the CA Gold Rush, which was initially met with skepticism, the shift in Wall Street sentiment and the coming adoption of bitcoin is the social proof needed to push the asset class into the traditional finance ecosystem.

The Federal Reserve has fought heroically against inflation since March 2022.

Wait… Please don’t unsubscribe. That was a joke. Of course, the Federal Reserve and the Government are the exact reason we are in this mess to begin with… I digress.

A significant tailwind for bitcoin’s next cycle is the return of easy money - Zero Interest Rate Policy and Quantitative Easing - a continuation of nearly a fifteen-year trend following the Great Financial Crisis.

The period of easy money culminated in 2020 and 2021, with the Fed and US Government blasting the global economy with trillions of dollars and dropping rates to 0%.

This resulted in a nearly double-digit Consumer Price Index (CPI).

Do I need to state the obvious? I’ll do it anyway. CPI is a manufactured and doctored metric that understates inflation to the benefit of the government. I heard someone call it the “Changing Propaganda Index” once, and that truly is the best descriptor.

The academic and bureaucratic classes were shocked to see inflation materialize in a big way - the highest inflation reading since the 1970s. No one seemed to understand that creating trillions of dollars would result in substantially higher prices.

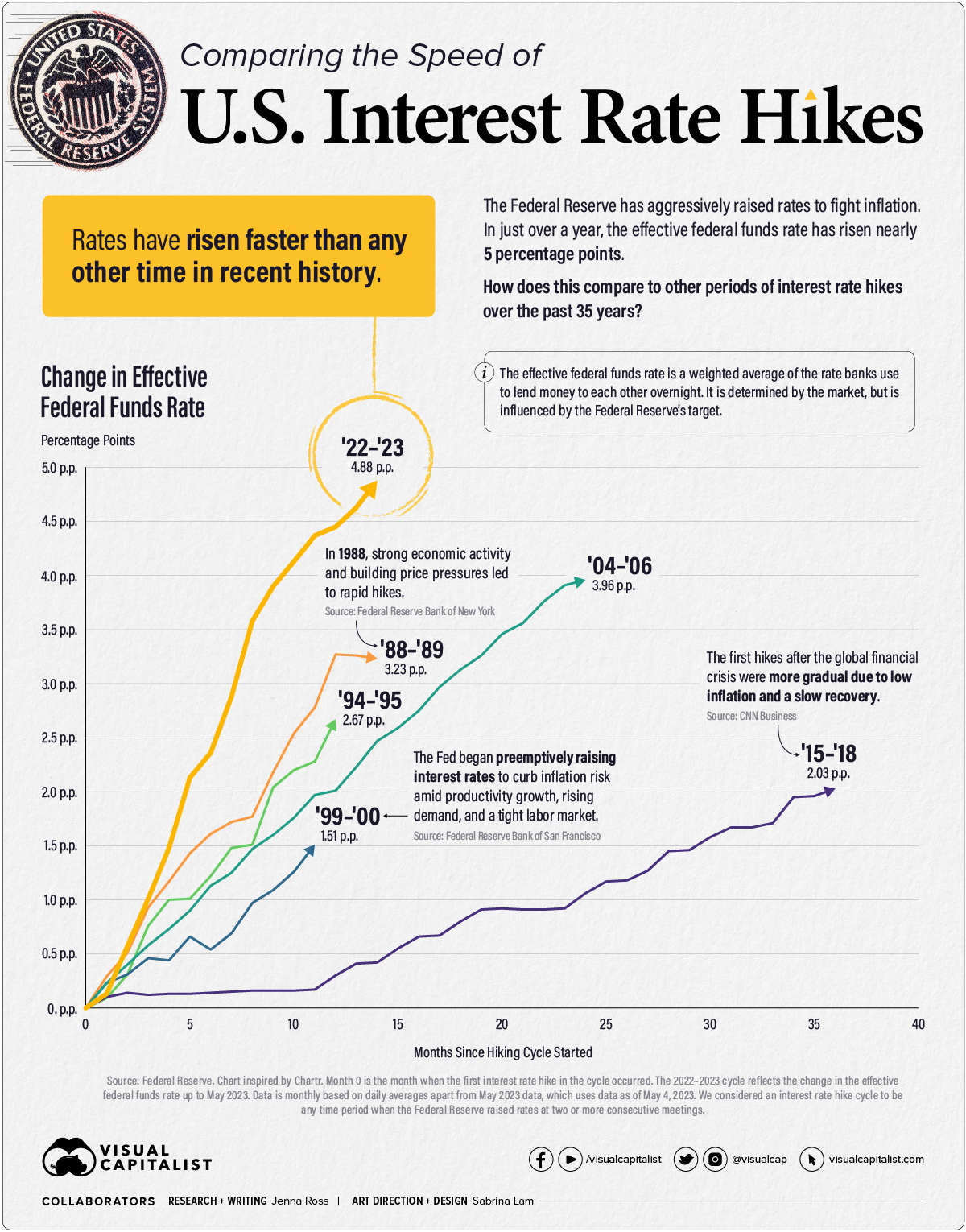

After calling inflation transitory for months, the Fed quickly changed their tune and embarked on the fastest rate hike cycle starting March 2022. Inflation was once again in the mainstream American vocabulary for the first time in decades, and the Fed had to hike rates to maintain any remaining amount of credibility.

Although the latest CPI reading of 3.7% remains above their official and arbitrary target of 2% - we are nearing the end of the tightening cycle. The propaganda machines once again commend the Fed for their brave action to hike rates and reduce the Changing Propaganda Index.

As the unproductive class and their mainstream media puppets applaud themselves for their ability to reduce inflation, the rate hikes have brought another issue into the spotlight - the US Government is insolvent.

Since the last Bitcoin cycle, the US Government’s fiscal position has deteriorated significantly. Right before the previous Bitcoin halving in May 2020, the Federal Debt was $23 trillion.

Drumroll please…. in September 2023, the Federal Debt is now at $32.9 trillion.

In three years the US Government added $10 trillion of national debt. The previous $10 trillion took a decade to add - from Q1 2010 to Q1 2020.

Government debt issuance is accelerating, and there’s no end in sight. The deterioration of the balance sheet jeopardizes the US Treasury as a global store of value and will force investors to find a new way to preserve wealth.

Unfortunately, for the unproductive class, rate hikes to quell inflation have severely damaged the health of the US balance sheet (not that it was good to begin with).

Why is that? Well, because the US Government is a Ponzi Scheme. It can only pay its obligations (debts) by issuing more obligations (debts).

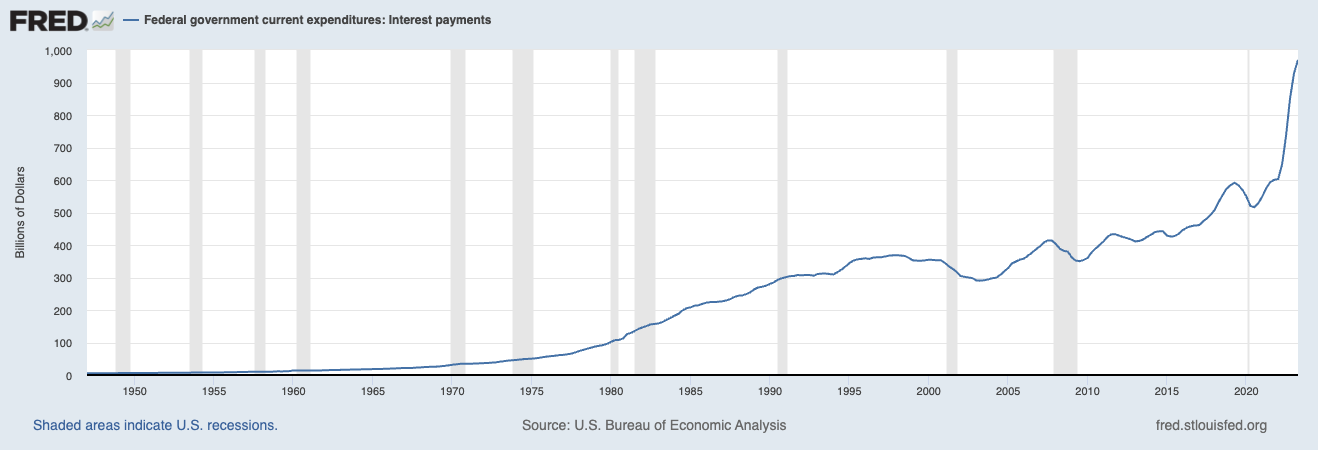

As debt matures and the US Government is obligated to pay the principal on the debt, they issue new debt, and with the Federal Funds Rate at 5.5% (compared to 0% for a decade), that results in higher interest expense on new debt issuance.

Interest payments alone are expected to rise from approximately $500 billion in FY 2022 to $1.4 trillion in FY 2032. And that’s with conservative estimates.

To further highlight the mounting interest expense, let’s look at a recent chart from Apollo Asset Management, which states that $7.6 trillion of interest-bearing public debt is coming due in the next year - so $7.6 trillion rolled over at 5.5%? Oh boy.

Remember the Debt Ceiling debate in the spring? Federal Debt was capped at $31.4 trillion at that time. In a few months, $1.5 trillion was added to the federal debt, and the US Treasury expects another ~ $1.5 trillion before the EOY.

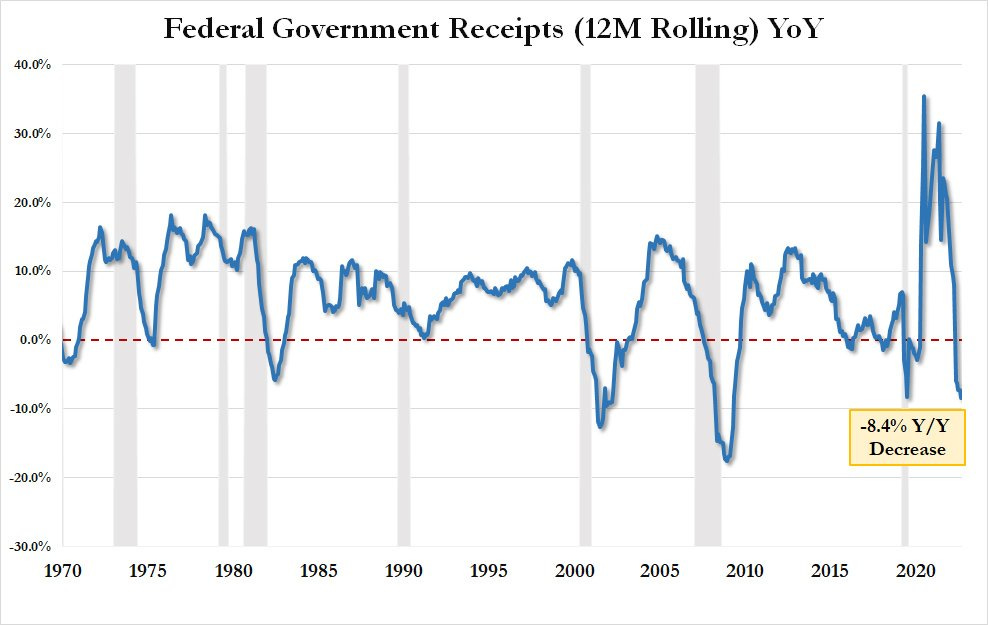

Not only are the US Government’s expenses rising dramatically, but their revenues (taxes) are declining precipitously. The result of increased expenses and decreasing revenues is a larger deficit. If the money to pay their obligations does not come from direct taxation, it will come from indirect taxation (inflation).

So how will the horrid health of the US balance sheet be resolved?

It won’t. Policymakers have backed themselves into a corner, leaving the only feasible option to be a return to easy money. The June debt ceiling deal suspended the borrowing limit until Jan 1. 2025. And we all know the “ceiling” will be raised and the limit suspended once again at that point.

My base case is that the Fed will begin to lower interest rates and resume easy money policies such as QE in 2024, coinciding with the Bitcoin halving anticipated in April 2024. Because that’s all they can do.

At least lowering interest rates will reduce the interest expense on rolled-over debt. Still, it will do nothing to fix the exponentially growing debt burden that can only be financed by money printing. The Debt Spiral is here and investors can no longer ignore the precarious situation and its implications on their portfolios.

In the coming cycle, we will see a fall from grace for the US Treasury as the preferred safe haven for individual investors and institutions. A search is underway for a new store of value that’s accessible to all - bitcoin.

The timing couldn’t be better. Bitcoin’s increasing scarcity will starkly contrast with the excess of the US Dollar, printed into oblivion to bail out the insolvent US Gov.

At this stage in the debt cycle, Government bonds are Ponzi schemes. And more people will realize this in 2024 as it becomes increasingly apparent that the only action the Fed and US Government can take is debasing the dollar.

If you’re a boomer reading this, congratulations. Your generation has amassed an unfathomable amount of money and assets, and I hope that includes you.

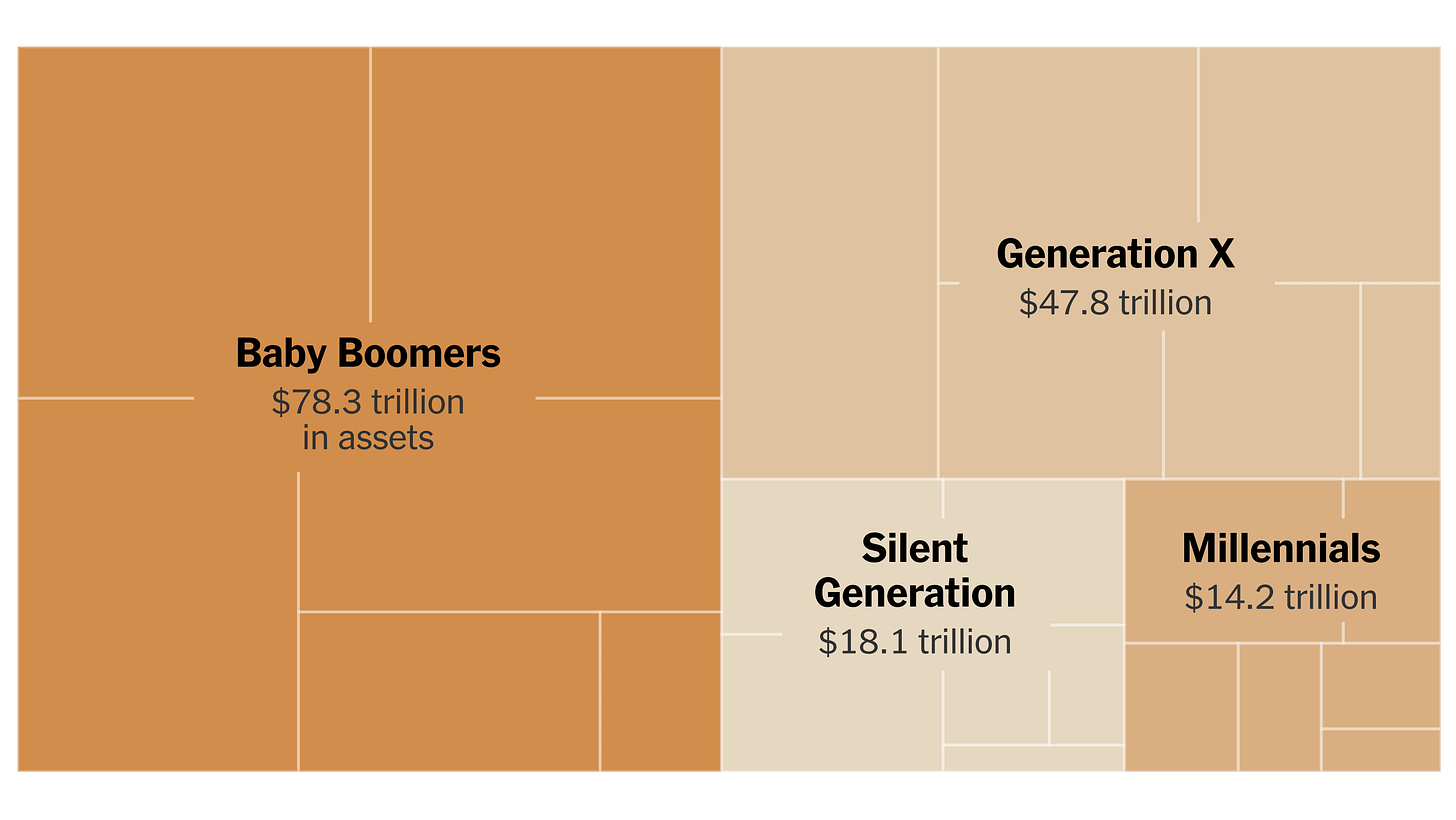

Boomers are estimated to own $78 trillion in assets, but how did they end up with this colossal amount of wealth? There are many reasons, but here are a few key ones:

The Baby Boomer generation was born between 1946 and 1964 during the birth rate spike following the end of World War II.

They came into adulthood during and after the inflation of the 1970s. To combat the roaring inflation, Federal Reserve Chairman Paul Volcker hiked rates to an unthinkable 20% in 1980. Chairman Volcker may have yet to learn that his monetary policy decision would also be the foundation from which the Boomer generation would accumulate levels of wealth never seen before.

The Federal Funds Rate was subsequently lowered by Fed Chairmans over the decades from the zenith of 20% in 1980 to 0% in 2008. From the Great Financial Crisis until 2021, Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) reigned supreme.

The secular trend of declining interest rates over forty years paired with money printing (QE) served the Boomers well. Their homes, real assets, brokerage accounts, and retirement accounts grew tremendously.

This is because most asset classes have an inverse relationship with interest rates:

There's no doubt in my mind that my Boomer subscribers are sharp people. I mean, cmon, you're reading "The Fiat Cave." How could you not be?

Subscribe

However, the generation's wealth can largely be attributed to being in the right place at the right time - if someone had a good job and put their excess cash flows into assets over the past forty years, they did well. Nothing wrong with that.

So, Boomers, I commend you. You've got a nice nest egg. $78 trillion is nothing to sneeze at; however, the youngest of you are entering your 60s, and the oldest are entering your 80s. I know that many of you are planning to pass down your share of that $78 trillion (Right Dad?) - which by the way, is the largest generational wealth transfer ever (source). This massive transfer of wealth will prove to be a secular tailwind for bitcoin.

Although Boomers largely have dismissed or ignored bitcoin, it's likely that their children have already purchased it or are at least curious. In fact, 94% of crypto buyers are Generation Z or Millennials, while only 1% are Boomers (source). According to a Bank of America study, 75% of investors between the ages of 21 and 42 are looking beyond stocks and bonds, and 47% already own cryptocurrency.

Additional findings of the report are bullish for bitcoin:

In the next decade, there will be tens of trillions passed down from Boomers to Millennials and Gen Z. And where’s a lot of that money going? You guessed it, bitcoin.

The $78 trillion of wealth passed from old to the young over the coming years will result in unfathomable demand for the world’s scarcest asset. As Millennials outnumber Boomers buyers of crypto by 63x, it’s safe to say we’ve only seen a fraction of flows into the nascent asset class.

“Fair value accounting is coming to bitcoin. This upgrade to FASB accounting rules eliminates a major impediment to corporate adoption of BTC as a treasury asset.”

- Michael Saylor, September 6th, 2023

“Three massive catalysts that cause an acceleration of bitcoin adoption - those three things don’t take us to $500,000 a coin, they take us to $5,000,000.

- Michael Saylor, November 10th, 2021

Long awaited, fair value accounting is coming to bitcoin. Bloomberg Law reports:

Under new rules expected to be published by year end, companies that hold or invest in cryptocurrency will be required to report their holdings at fair value, a measurement that aims to capture the most up-to-date value of an asset—including rebounds in value after prices dip. While the new standard will inject volatility into the earnings of companies that are heavily invested in crypto, the ability to record recoveries will be an improvement over the current practice, companies and accountants have told the Financial Accounting Standards Board for months.

So what does this mean for corporate treasuries and bitcoin adoption?

FASB guidance to date has categorized bitcoin as "indefinite-lived intangible assets." The implication for corporate treasuries is that if they acquire bitcoin on their balance sheet when bitcoin trades down, they mark the value of the bitcoin down; however, when it goes up, they cannot show a gain, which means that corporations cannot recognize the current price of bitcoin on their balance sheets.

Not only that, but the gain or loss of an intangible asset, such as bitcoin, is netted against the company's operating profits. So a company, such as MicroStrategy, could have a quarterly operating profit but, due to losses on bitcoin, would show negative operating income. A lack of segregation between a company's operating P/L and an asset such as bitcoin's performance can severely obfuscate the financial picture.

Michael Saylor has not let the" intangible" treatment of bitcoin prevent MicroStrategy from purchasing 153,800 bitcoin over the past three years. Nonetheless, he described the intangible asset treatment of bitcoin to be "toxic for the balance sheet" in an interview with The Bitcoin Layer for these aforementioned reasons.

The reality is that CEOs/CFOs have enough going on. They get paid to make sound business decisions and be conservative with the corporate treasury - they don't want to touch a "toxic" asset.

But that is soon to change. With fair value accounting, bitcoin will be treated as a financial asset on a balance sheet. This means companies will recognize unrealized losses and gains in earnings reports.

"Significance of fair value accounting coming to bitcoin is that it makes the asset non-toxic for a company that uses GAAP accounting to hold, and it also makes the performance of bitcoin transparent." - Michael Saylor, The Bitcoin Layer

What are the implications of this change for the next bitcoin cycle?

Nothing to see here, just another bullish development for bitcoin adoption coinciding with the upcoming halving in April 2024.

Fair value accounting treatment will be mandatory for all public reporting companies in December 2024. And sometime between the beginning of 2024 and December 2024, it will be optional for companies to adopt fair value.

Widespread corporate adoption of bitcoin will not happen all at once, but fair value accounting treatment paves the way for public companies to adopt bitcoin in a clean, transparent, and optimal way. Allowing companies such as MicroStrategy to report gains on their bitcoin holdings will pique the interest of other CEOs/CFOs of publicly traded companies.

Here’s a fun thought experiment from

Jesse Myers’s latest piece “Why the FASB accounting guidance is very bullish for Bitcoin"

Here’s where it gets crazy. Let’s say that the 2024 Bitcoin halving catalyzes a 2024-25 bull market, as I continue to expect will happen. If the price soars to ~$150k/Bitcoin (which I think is very possible), that would mean a ~6x in the value of MicroStrategy’s Bitcoin holdings.

With the new accounting standards, MicroStrategy would mark-up the value of their holdings accordingly each quarter. With ~$4B in Bitcoin holdings today, this could mean recording an average mark-up of $4B for five quarters in a row.

Depending on the timing of the bull market, this could mean MicroStrategy reporting an outrageous string of quarterly profits. MicroStrategy has a ~$5B market cap today. In this scenario, they could deliver ~8 quarters in a row of profits in the billions.

There’s no way around it, that becomes a big story. The financial media loves a splashy narrative, and MicroStrategy’s winning ways would be a magnet for attention. Everyone loves a winner, and everyone wants to copy winners.

Jesse, excellent and thoughtful analysis as always - thanks for the bull fuel! And I’ll add to your bullishness —

As the dollar and all fiat currencies continue to devalue at an accelerating rate, corporations must find a better way to protect their capital.

As Saylor stated in the

The Bitcoin Layer interview, corporate treasury strategies focus on liquid, fungible, low-risk assets, primarily the dollar. However, due to the 7% annualized money supply growth over the past 100 years, corporations have sought out sovereign debt, particularly US Treasuries, to offset some of the inflation.

But what better way to hedge the debasement of the dollar than bitcoin?

I suspect that as more corporate executives learn of bitcoin's absolute scarcity (21 million units) and increasing scarcity (halving), they'll be compelled to defend their balance sheets against the debasement of the dollar and sovereign debt with this digitally scarce commodity.

That concludes the “2024 Bull Fuel: Bitcoin's Next Cycle” Series. To summarize, here are the five reasons I am tremendously bullish on bitcoin:

Originally published on "The Fiat Cave".